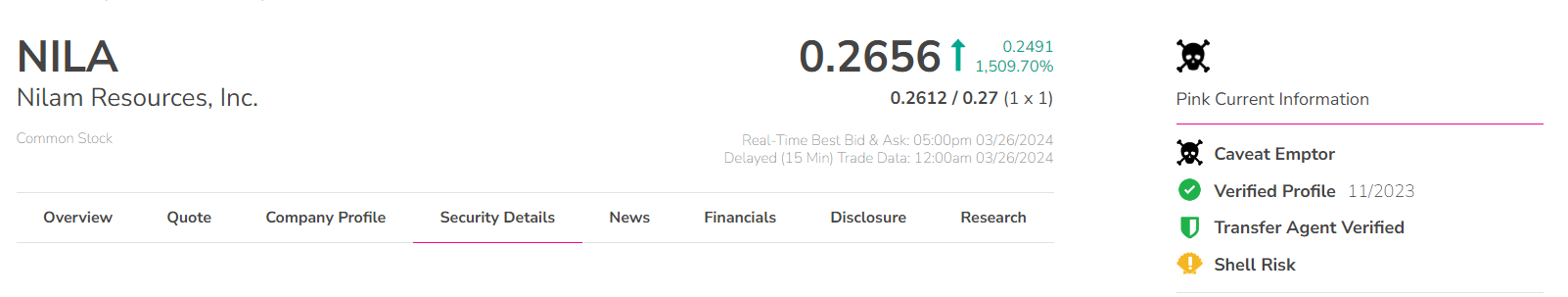

This week, a micro-scale company called Nilam Resources, which announced plans to purchase $1.7 billion worth of Bitcoin, was marked as a public concern amidst a serious 1500% increase in share prices on March 26. The OTC Markets Group, which operates the OTC Pink trading platform, currently tags Nilam Resources (NILA) with Caveat Emptor, a name it gives to companies worthy of buyer attention.

What’s Happening at Nilam Resources?

On a glossary page explaining the labels, OTC Markets clarifies that this public concern could stem from a spam campaign, dubious stock promotion, any known investigation about the company, regulatory suspension, or other disruptive corporate actions.

NILA’s OTC listing also indicates it is considered a Shell Risk, a label given to companies that may be shell companies based on annual financial data and other revenue-related criteria. On March 25, Nilam Resources, an investment holding company, announced the signing of a Letter of Intent to acquire a company planning to hold 24,800 Bitcoins.

Nilam Resources claimed the deal had been in preparation for months. It plans to issue new authorized preferred stock in exchange for Bitcoin, which will be at a discounted rate according to current market prices. The day after, share prices soared, reaching an all-time high of 33 cents, a 1700% increase from the previous week’s 1.8 cents. According to OTCMarkets, the company’s current market value is now $280 million. However, many are skeptical that the crypto firm can implement its ambitious plan, with some suggesting the announcement is a type of marketing stunt.

Industry Figures Respond Promptly

Bitcoin analyst and editor of Adamant Research, Tuur Demeester, said he removed his first tweet sharing Nilam’s announcement after a commentator pointed out it could indeed be a stunt of a dying penny stock.

A crypto YouTuber and co-founder of Web3 company WhereAt Social, Quinten Francois, also accused the application of being a common marketing stunt among failed small-cap stocks. Dylan LeClair, market intelligence director at crypto asset fund UTXO Management, shared his doubts, stating that the plan would only work if there were legitimate demand for the stock sale:

“A Letter of Intent is one thing, actually implementing it is another. It’s likely to fail and is for PR purposes.”

If Nilam is successful, it will hold more Bitcoin than any other publicly traded company in the US, aside from MicroStrategy. This includes surpassing Elon Musk’s Tesla and major Bitcoin miners like Riot Blockchain, Hut 8 Corp, and Marathon Digital Holdings, according to BitcoinTreasuries data.

Türkçe

Türkçe Español

Español