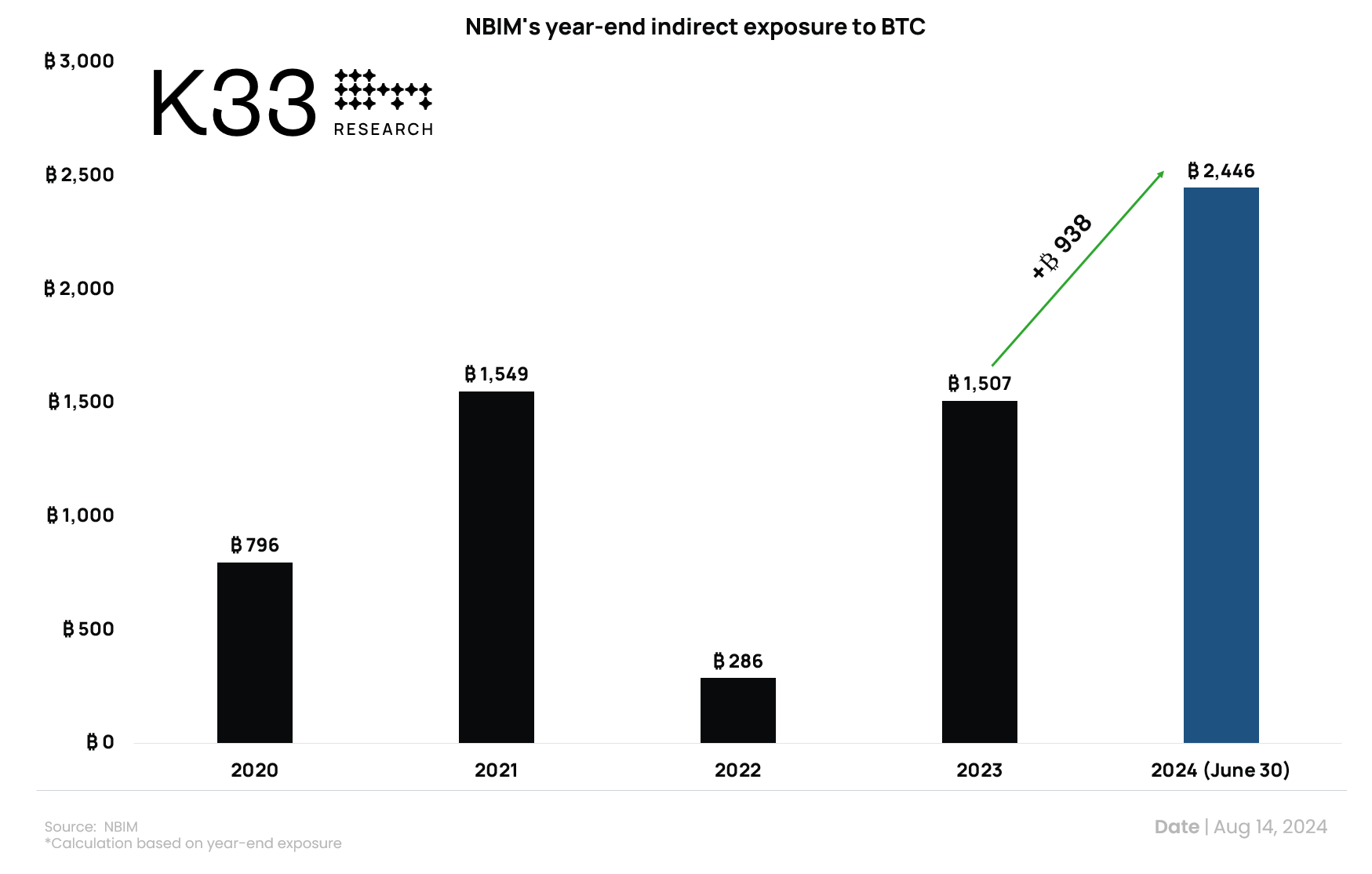

The Norwegian Wealth Fund (NBIM) has garnered attention by indirectly increasing its Bitcoin holdings from 1,508 BTC to 2,446 BTC by the end of 2023. This increase is seen as an indicator of the fund’s interest in Bitcoin. Behind the scenes, algorithmic sector weighting and risk diversification strategies are at play.

Corporate Bitcoin Strategies Begin to Emerge

This strategic move is influenced by large companies that do not aim to invest directly in Bitcoin but integrate cryptocurrency into their portfolios. Figures such as MicroStrategy CEO Michael Saylor, Twitter founder Jack Dorsey, and Peter Thiel are among the key figures shaping Bitcoin treasury strategies.

Norway’s indirect Bitcoin investment has reached 44,476 sats (27 dollars) per capita, highlighting the depth of this interest. NBIM’s increase in indirect Bitcoin investment is not limited to MicroStrategy investments alone. Investments in companies like Marathon Digital Holdings, Coinbase, and Block Inc. also supported this growth.

For example, the investment in Marathon Digital Holdings increased from 0% to 0.82%. The Coinbase investment rose from 0.49% to 0.83%. This diversified investment strategy shows that Bitcoin is becoming more than just a cryptocurrency, establishing a significant place in the financial system.

Norwegian Wealth Fund Will Contribute to Bitcoin’s Growth

The Norwegian Wealth Fund‘s moves highlight the growing acceptance of Bitcoin in the institutional investment world. This indicates that Bitcoin is occupying an increasingly larger space in the fund’s overall portfolio and its future potential is being recognized. Bitcoin’s evolution in the financial world is leading to broader acceptance of cryptocurrencies and making them more common among investors.

The Norwegian Wealth Fund’s indirect investments in Bitcoin show that institutional investors are increasingly recognizing the future potential of cryptocurrencies. These moves not only solidify Bitcoin’s place in the financial world but also increase the impact of cryptocurrencies on the global economy. The maturation process of cryptocurrencies heralds a new era.

Türkçe

Türkçe Español

Español