XRP dropped approximately 3% in the last 24 hours, reaching around $0.56 on August 28, reflecting downward movements in other parts of the crypto market amid the Nvidia earnings countdown. All eyes are on the $3.2 trillion chip manufacturer Nvidia, which is set to release its earnings report after the US market closes on August 28.

What’s Happening on the XRP Front?

Analysts predict a 70% revenue growth for Nvidia in the current quarter due to increased demand for artificial intelligence. In 2024, Nvidia’s 160% stock rise contributed to approximately 30% of the overall gains of the Nasdaq 100, a US stock index with increasing 30-day average correlation with the broader crypto market in August.

As a result of this correlation, cryptocurrencies generally reflect the volatile trend of the Nasdaq led by the Nvidia earnings countdown. This includes XRP and other top ten cryptocurrencies like Bitcoin and Ethereum.

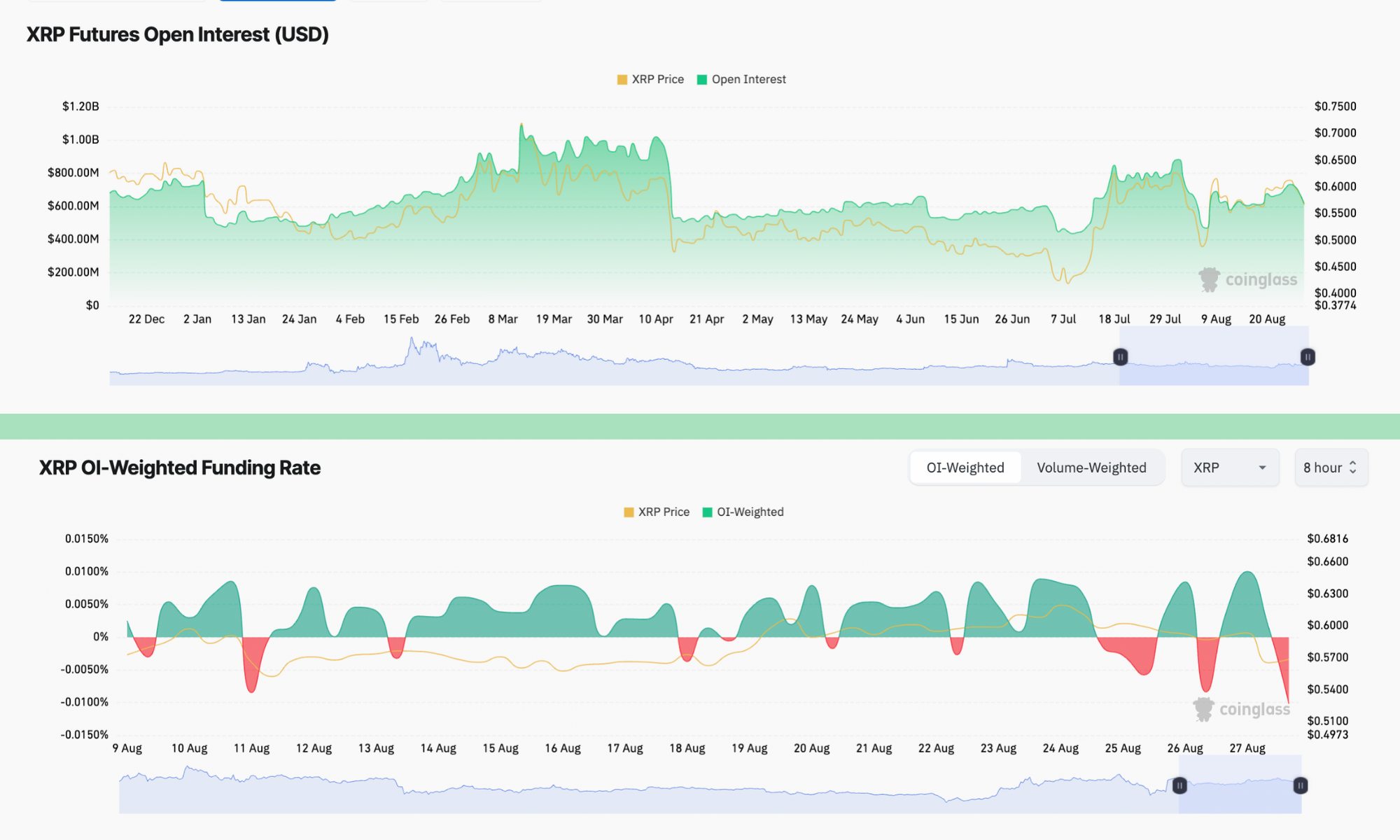

According to Coinglass data, XRP’s losses today coincide with sharp declines in open interest (OI) and funding rates in the futures market. As of August 28, XRP Futures OI data was approximately $616.88 million compared to $679.81 million the previous day. During the same period, XRP futures funding rates, calculated every eight hours, fell from 0.0101% to -0.0102%.

XRP OI data shows a lack of confidence in the market direction or a pullback in bullish predictions. It may also imply that some investors are taking profits or reducing losses in response to the recent price drop. Meanwhile, negative funding rates indicate that short positions are now dominant. When funding rates are negative in future markets, shorts will pay longs to keep their positions open, reflecting bearish sentiment among investors.

XRP Chart Analysis

XRP‘s decline is part of a correction trend occurring within the prevailing ascending triangle pattern. Specifically, the cryptocurrency recently pulled back by about 10% after testing the upper trendline of the triangle as resistance, similar to previous corrections.

As of August 28, XRP is testing the lower trendline of the triangle as support and aims to return to the upper trendline level at around $0.63. XRP’s daily relative strength index (RSI) also supports a recovery scenario, making higher lows while moving within the neutral reading range of 30-70.

Türkçe

Türkçe Español

Español