Bitcoin investors often find September to be a challenging month. This trend is not exclusive to cryptocurrencies but applies to all asset classes. Historically, September tends to show a downward trend. Bonds have lost value in eight of the last ten Septembers. Gold has also declined every September since 2017. Given this data, it’s no surprise that Bitcoin struggles in September.

October Could Be a New Beginning for Bitcoin

However, the scenario changes completely in October. In eight of the last nine Octobers, Bitcoin has gained an average of 22.9%. The increases in October suggest that this month has a strong seasonal effect on the market. Consequently, traders have already started to mobilize. In Asian markets, there has been a 150-fold increase in contracts predicting Bitcoin will reach $80,000.

Bitcoin has shown a lackluster performance over the past six months, resulting in limited price fluctuations and a narrow trading range. This stagnation might be due to trading shifting from exchanges to over-the-counter (OTC) markets. The reduced activity on exchanges also limits price volatility, making the market appear quieter.

Will New Investors Play a Role?

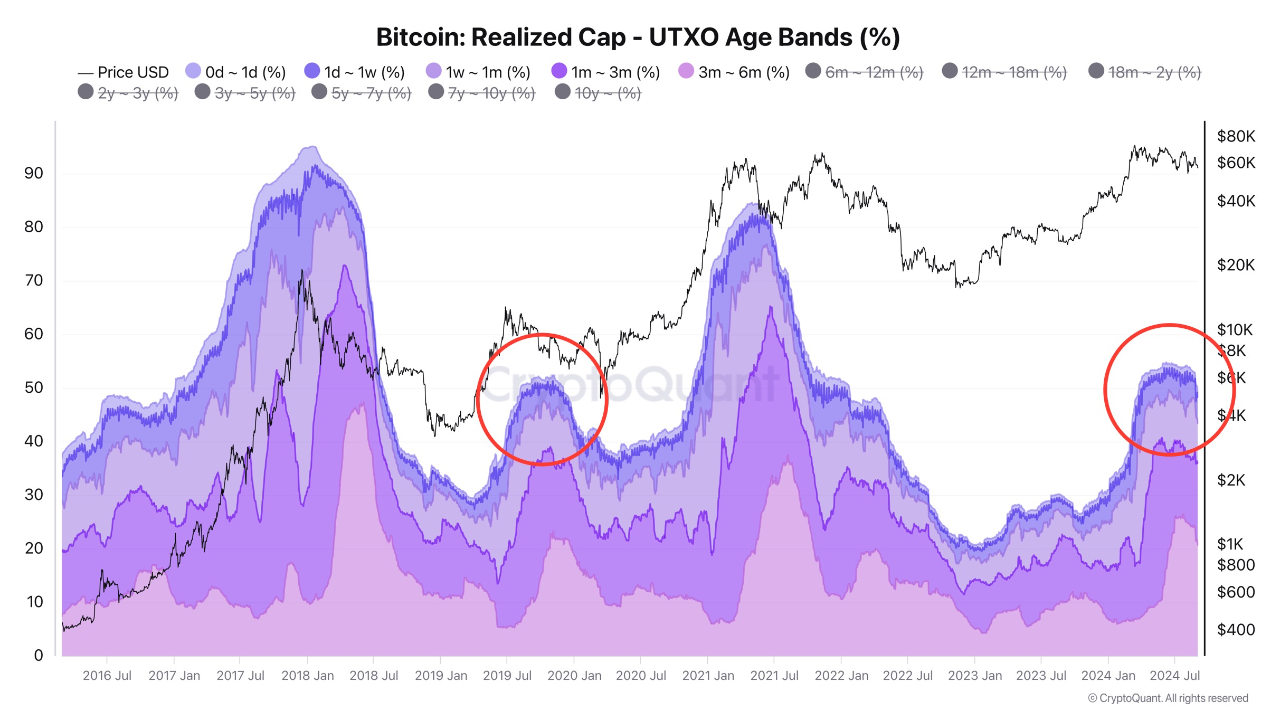

For a deeper analysis, technical details like unspent transaction outputs (UTXOs) need to be examined. The data shows how long investors have been in the game. If an investor has held Bitcoin for less than six months, they are likely new to the market. New investors typically enter when Bitcoin’s value rises and exit when the markets quiet down.

Recently, there has been a slight increase in these new UTXOs. This rise began in March when Bitcoin’s price peaked. However, many new investors may have exited the market since then. Alternatively, they might have stayed and transitioned into the long-term investor group by surpassing the six-month mark.

This situation resembles the halving period in 2019. During that time, it took approximately 490 days for Bitcoin to reach a new peak. Despite the market turmoil caused by COVID-19, a similar pattern was observed.

If history repeats itself, we might be going through a similar process. However, it’s wise not to keep expectations too high. No one has a crystal ball. Still, the possibility that the major movement for Bitcoin could start in October should not be overlooked.

Türkçe

Türkçe Español

Español