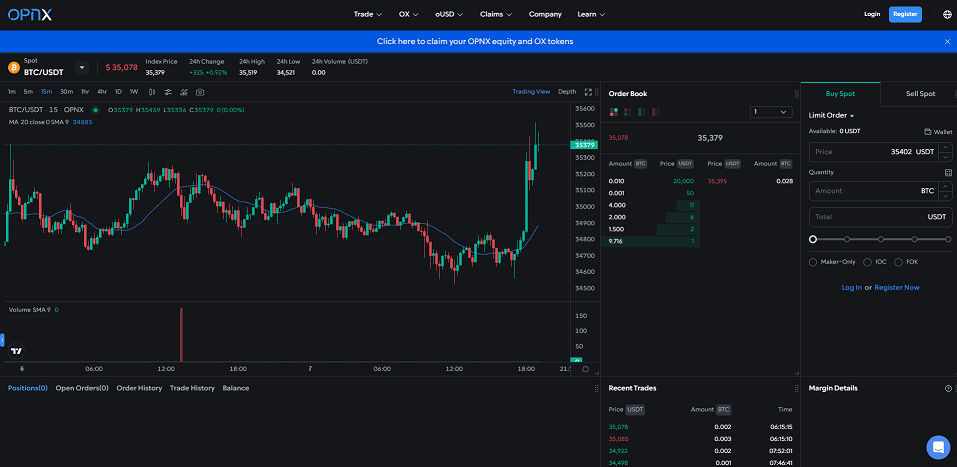

Legal regulations, one of the most talked-about agenda items recently, require many companies to closely monitor legal processes. Accordingly, crypto exchange OPNX announced on November 8 that it has obtained a Virtual Asset Service Provider (VASP) license in Lithuania, allowing it to offer spot crypto services throughout the European Union.

A New Addition to VASP License Holders

In a statement made by exchange officials, it was emphasized that this license will require the exchange to comply with the highest standards of compliance and security in the region. The team claims to already have a robust Know Your Customer (KYC) and Anti-Money Laundering system in place to ensure compliance with European Union legal regulations. OPNX CEO Leslie Lamb commented on the matter:

“Obtaining the VASP license from Lithuanian authorities is a significant milestone in OPNX’s global expansion and our mission to serve crypto users around the world.”

Lamb stated that certain services offered on the OPNX platform will not be available in certain jurisdictions within the European Union due to measures taken in those jurisdictions.

“This license enables us to serve the European region, but there are also specific jurisdictions within the EU that require specific licenses to operate certain services.”

OPNX Will Continue License Applications

Lamb also added that OPNX exchange is currently working to obtain these licenses. However, the existing license will allow the OPNX exchange to provide spot trade services across the European Union, and as additional licenses are obtained in the future, other services will also be made available.

OPNX has attracted attention as a controversial exchange since its establishment. The famous crypto exchange was founded by Kyle Davies and Su Zhu, who also founded the bankrupt crypto hedge fund Three Arrows Capital (3AC), as well as Mark Lamb and Sudhu Arumugam, who founded the bankrupt crypto exchange CoinFLEX.

Critics of OPNX continue to claim that the exchange is not secure due to its previous bankruptcies. However, the exchange creates a different topic of discussion as it allows bankruptcy claimants to sell their bankruptcy claims and receive faster payments.