In the world of cryptocurrencies, recent developments in the Layer-2 scaling solution Optimism have given investors hope. Accordingly, Optimism reported a series of strong network metrics in the first quarter (Q1) of 2024. As a result of this surge, the network’s cryptocurrency OP token gained 9% in value.

Optimism Gains Attention with Increased Activity and Rising Transaction Fees

According to a recent Messari report, Optimism’s circulating market cap increased by 11% from the previous quarter, reaching $3.7 billion. The fully diluted market cap also rose by 1%, reaching $15.7 billion.

Despite the broader crypto market rally where Bitcoin (BTC) and Ethereum (ETH) gained 69% and 53% respectively from the previous quarter, OP’s market cap ranking fell from 26th to 39th among all Blockchain networks. However, within the Ethereum ecosystem, OP remains one of the four largest projects by market cap.

This growth is driven by a significant increase in activities on the Optimism network. Daily active addresses rose by 23% to 89,000 in the first quarter of 2024 compared to the previous quarter, while daily transactions increased by 39% to 470,000 during the same period. These metrics are approaching the all-time highs recorded in the third quarter of 2023.

The network’s revenue increased by 78% from the previous quarter to $16 million, thanks to increased activities and a 48% rise in the average transaction fee to $0.42. However, this average fee significantly dropped due to the implementation of Ethereum Improvement Proposal (EIP) 4844 in the second half of March, which reduced L1 transmission costs by 99%.

Total Locked Value Increased by 18% in the First Quarter

Despite the fee reduction, Optimism’s on-chain profit in the first quarter of 2024 increased by 14% from the previous quarter, reaching $2 million. The network’s Total Locked Value (TVL) rose by 18% to $1.2 billion. However, despite this increase, it fell to 11th place in the TVL ranking. The DeFi sector, which constitutes 86% of active addresses, led Optimism’s TVL. According to Messari, NFT applications and games accounted for 6.9% and 6.7% respectively.

Among the leading protocols, Synthetix showed a 4% increase in TVL quarter-on-quarter, reaching $307 million. Aave recorded significant growth with a 52% increase in TVL to $270 million, and Velodrome saw a 10% rise in TVL to $171 million.

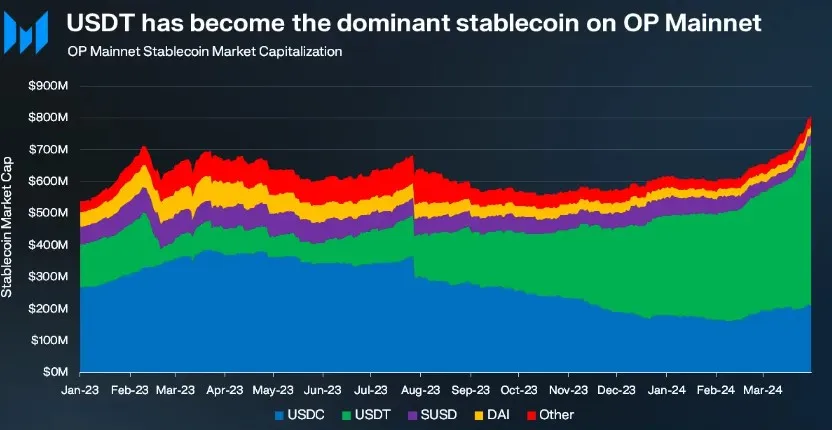

Optimism’s stablecoin market cap also showed a notable increase in the first quarter of 2024, reaching $809 million, representing a 32% rise from the previous quarter. Circle’s USDC stablecoin and Tether’s USDT played a significant role in this increase. Notably, USDT rose by 64% to $512 million, making up 63% of the total stablecoin market cap on Optimism.

OP Coin Rises Again with the Crypto Market Revival

Despite Optimism’s strong performance in the first quarter of 2024, its cryptocurrency OP did not achieve the expected price increase by the end of this period. In March, OP reached an all-time high of $4.84, but just a month later, it fell to a yearly low of $1.80, aligning with the market’s downward trend.

However, the recent upward momentum in the general cryptocurrency market has positively impacted OP coin. OP recorded a 9% price increase in the past 24 hours and a 3% rise in the past week, currently trading at $2.56. Additionally, according to CoinGecko data, OP’s trading volume increased by 19% in the last 48 hours, reaching $290 million.

Türkçe

Türkçe Español

Español