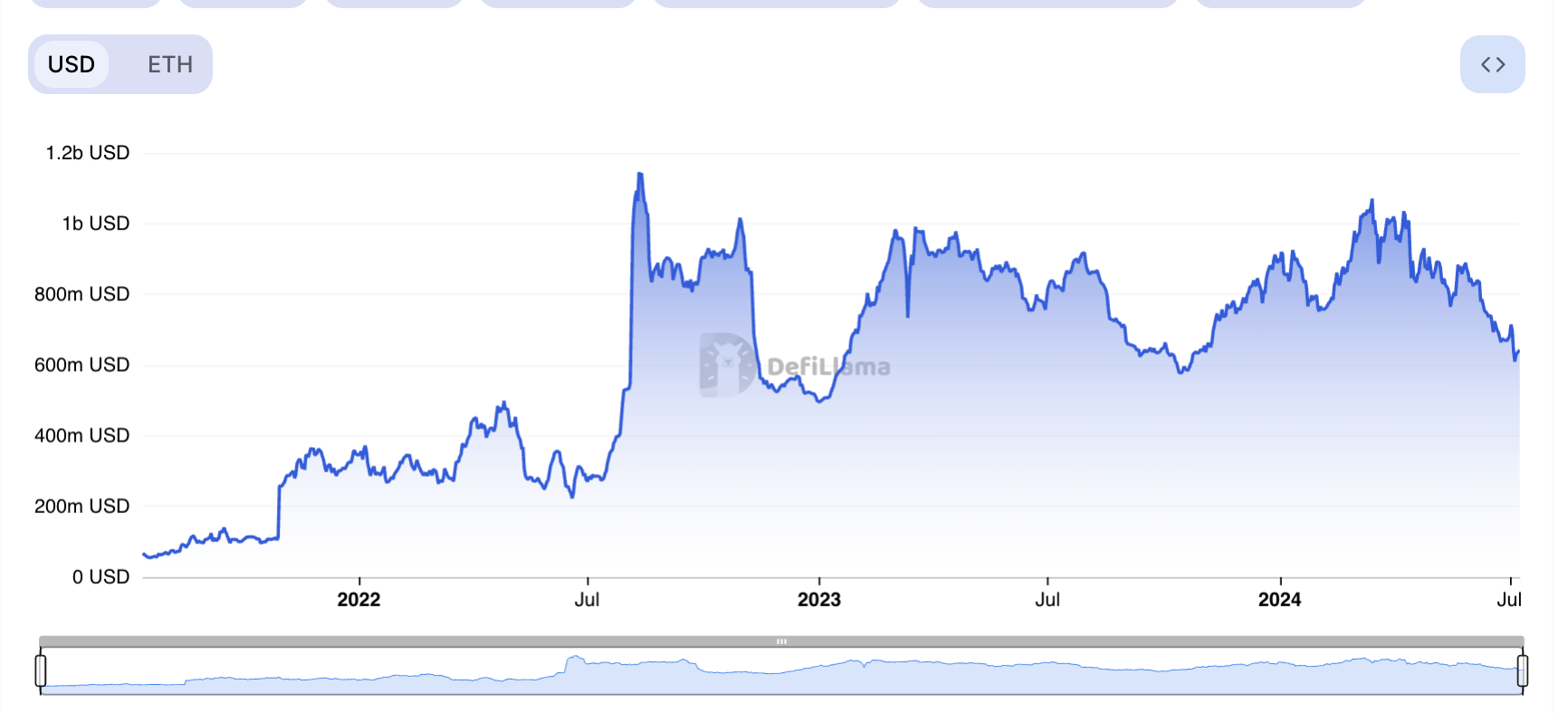

Ethereum network-based popular Layer-2 network Optimism witnessed a significant drop in its total value locked (TVL). At the time of writing, the TVL value stands at $643 million, the lowest since October 2023. Optimism’s TVL measures the total value of all cryptocurrencies locked within decentralized finance (DeFi) protocols on the network.

What’s Happening with Optimism?

TVL drops indicate that users of these protocols are withdrawing their assets due to general market decline or high volatility. Optimism’s TVL has been on a downward trend since reaching a peak of $1.05 billion on March 17.

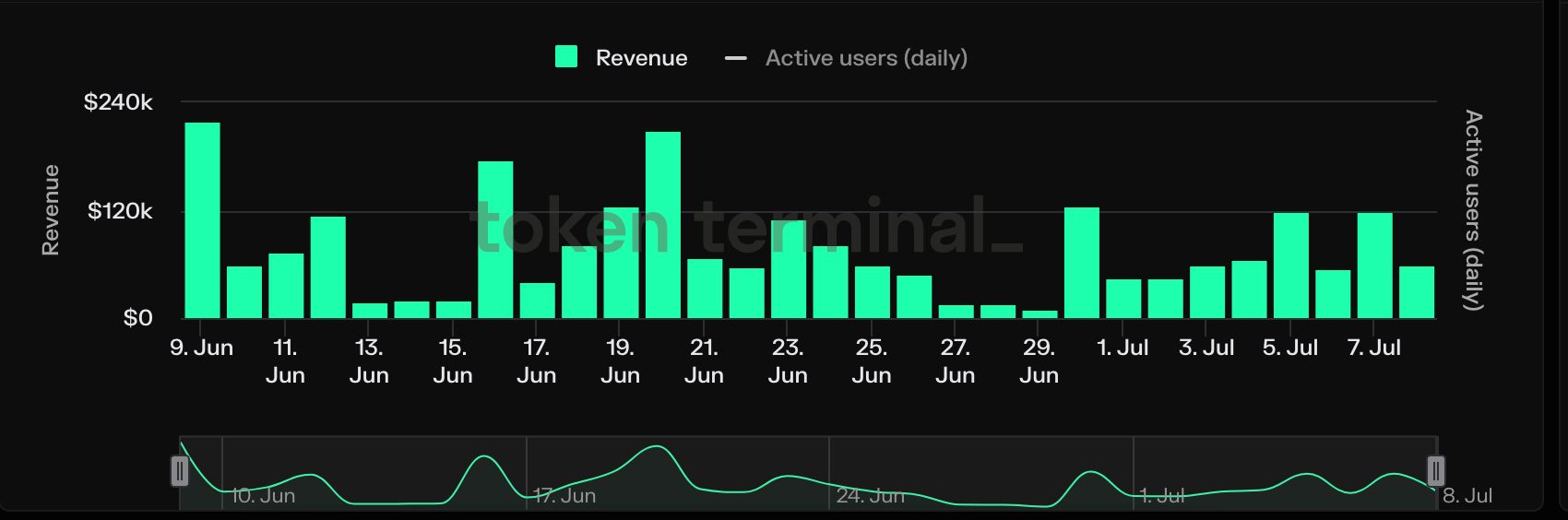

It dropped by 18% just last month, reflecting the overall decline in the cryptocurrency market during that period. The decline in crypto market activities, standing at $2.23 trillion at the time of writing, led to a 12% drop in the global cryptocurrency market value over the last 30 days. Due to increased liquidity outflows from Layer-2 networks, Optimism’s monthly revenue also declined. Although the network’s revenue was $2.33 million last month, it showed a 9% decrease over the last 30 days.

OP Chart Analysis

At the time of writing, OP was trading at $1.51, and the altcoin’s value dropped by 32% over the past month due to the general market decline. According to data from the one-day price chart, the altcoin continues to be tracked with a significant downward trend.

The altcoin may experience a rise and achieve record gains with the expected approval of Ethereum ETF this month. On July 8, asset managers VanEck, Grayscale, Fidelity, BlackRock, 21Shares, Franklin Templeton, and Bitwise submitted amended spot ETH ETF S-1 registration statements to the U.S. Securities and Exchange Commission.

Sharing a statistically positive correlation with Ethereum could also increase OP’s value. When these new funds go live and demand for the Layer-2 network rises again, OP’s next price point could exceed the $1.7 level.

Türkçe

Türkçe Español

Español