The leading layer-2 (L2) network Optimism (OP) has experienced a noticeable decline in transaction volume over the past few weeks. The number of daily active addresses has visibly decreased, negatively impacting network revenues. However, the current broader market rally has led to an increase in the total value locked (TVL) in the decentralized finance (DeFi) sector.

Comments on Optimism

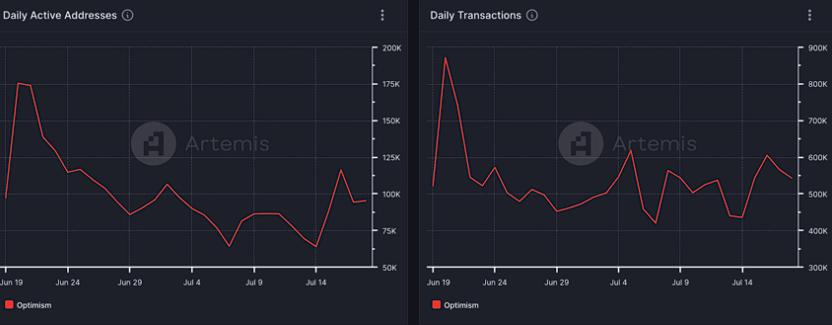

Data provided by Artemis revealed a consistent decline in user demand for Optimism over the past 30 days. During this period, the number of unique addresses that performed at least one transaction on the network decreased by 45%.

Due to the low number of users on the network, daily transactions also saw a decline. Considering Artemis’s data, the mentioned rate dropped by 31% during the review period.

The noticeable decline in user activity on the Optimism network and the 6% decrease in OP’s value triggered a reduction in network fees and revenue. To understand, on July 17, Optimism’s network fees totaled $61,600. Compared to the previous month, the value was $208,000.

On-chain data showed that the revenue obtained from the Optimism network dropped by 65%.

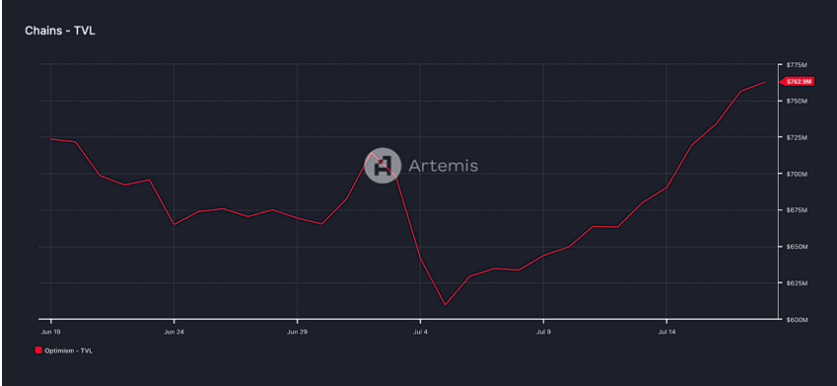

However, the recent rise in the overall crypto market has prevented the decline in user activity on Optimism from causing more significant damage to the network.

As of the time of writing, Optimism’s DeFi TVL had reached $766.55 million, representing a 15% increase. Looking at the last month, the value was at its periodic peak.

Future of OP Price

OP’s price has been trading within a specific range over the past few days. This situation revealed that a new channel was entered after trading within a rising channel between July 5-15.

OP price is hovering just above the established resistance. This situation seems to be significantly influenced by the rise in Bitcoin. BTC price surpassed $67,000, and OP price rose along with it.

OP recently surpassed the resistance at $1.88 and now seems to be moving away from the support level at $1.84. After surpassing the resistance, OP reached $1.93.

However, if the trend reverses and the price declines, it could drop back to $1.60.

Türkçe

Türkçe Español

Español