The Matrixport report that shook the market last week led to massive sell-offs. Today, the price that was at $47,000 has dropped to $40,400. Bitcoin, which experienced a nearly $7,000 increase in a very short time, is now enveloped in the excitement of a spot BTC ETF, and the K33 team has made observations that will reassure investors.

K33 Research Crypto Report

The latest cryptocurrency report published by K33 Research looks promising after the downturn experienced last week. According to analysts, over half a billion dollars in positions were liquidated within an hour last week, and the froth in the futures side has been cleared, so we may not see a “sell the news” event in the coming hours.

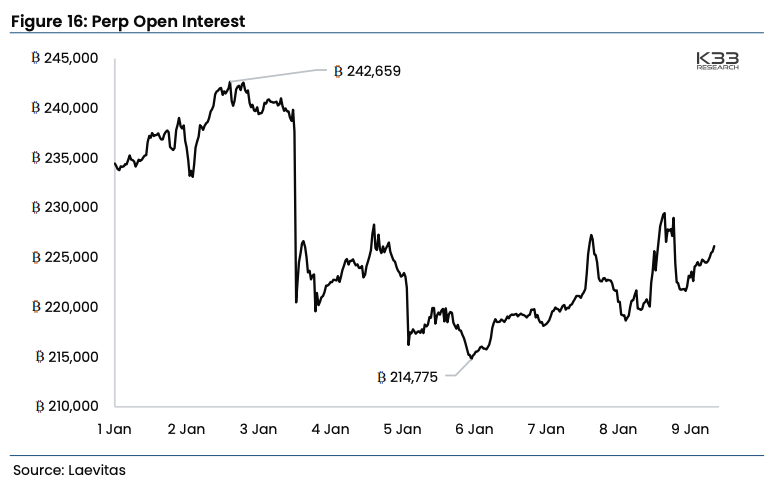

K33 Senior Analyst Vetle Lunde and Vice President Anders Helseth had previously warned that rapid losses could occur due to long liquidations. However, since these positions have been significantly cleared, there is no longer any need to fear. Open interest on the futures side experienced a 12% decrease between January 2 and January 6, and funding rates have returned to a neutral state. Lunde and Helseth emphasize that things have returned to normal since that date.

What Are Institutional Investors Expecting?

Experts also interpret the record high of over $6.1 billion in open positions at the Chicago Mercantile Exchange as favorable for the bulls. Lunde and Helseth commented on this;

“CME premiums continue to remain high at nearly 20%, but are trading in a much healthier uptrend than what we witnessed at the annual opening. After ETFs are approved, both premiums and OI are likely to decrease significantly. The shift from futures-based ETFs, which make up 43% of CME’s OI, to spot ETFs will affect the closed CME long positions.”

Here, OI refers to “open interest”. In line with the general market sentiment, K33 experts also say that the approval is expected to come on Wednesday.

“We expect volumes to rise over the next week and at the same time, investors to make quick adjustments in their risk profiles. If there’s one week in 2024 you should particularly pay attention to, it’s this week.”

On the other hand, ETF issuers are consecutively updating their annual management fees. Thanks to downward revisions, the fees have dropped to very low levels.

“There are two positive effects of ETFs having low fees. First and foremost, investing is more attractive with low management fees. Secondly, issuers liquidate less BTC to cover the fees, so lower fees reduce BTC selling pressure.”

Türkçe

Türkçe Español

Español