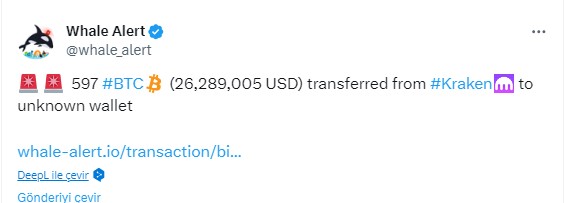

A surprising development occurred within the crypto community as over 1 billion dollars worth of Bitcoin (BTC) was withdrawn from the Kraken exchange, starting yesterday and continuing today. The withdrawal transactions, varying between 400 to approximately 1,000 BTC per transaction, attracted the attention of industry observers due to their large scale. In total, according to Whale Alert data, more than 40 such transactions took place, leading to speculation and discussions in the crypto space.

Massive Transfer of BTC

The timing of these significant withdrawal transactions, occurring just three days before the SEC’s decision on Bitcoin ETFs, is particularly noteworthy. The official announcement is scheduled for January 10th, and the crypto community is eagerly awaiting the outcome with various speculations. Kraken, a US-based exchange, is known for its regulatory compliance, being registered as a money services business with FinCEN, and being supervised by the Wyoming Banking Division.

The sudden movement of Bitcoin from such a well-regulated platform has raised questions about the reasons behind these large-scale withdrawal transactions. In addition to the current uncertainties, Bitcoin’s third halving is also expected in about 100 days. This event, considered short-term in financial markets, could significantly impact the valuation of cryptocurrencies.

Critical Juncture for BTC

As pressure mounts and the industry undergoes these developments, the community may face events that even experienced participants find difficult to interpret. The massive Bitcoin outflow from Kraken comes at a critical juncture, and expectations related to both the ETF decision and the upcoming BTC halving could rise. Consequently, the more than 40 transactions that took place in recent days from the Kraken exchange, involving over 1 billion dollars in Bitcoin outflow, stand out as a significant event in the crypto community. These large-scale withdrawal transactions took place three days before the SEC’s announcement of the Bitcoin ETF decision, leading to speculation and expectations in the industry. Kraken is known as a regulated exchange, and this sudden Bitcoin outflow, along with the upcoming BTC halving and general uncertainties, marks a significant turning point.

Türkçe

Türkçe Español

Español