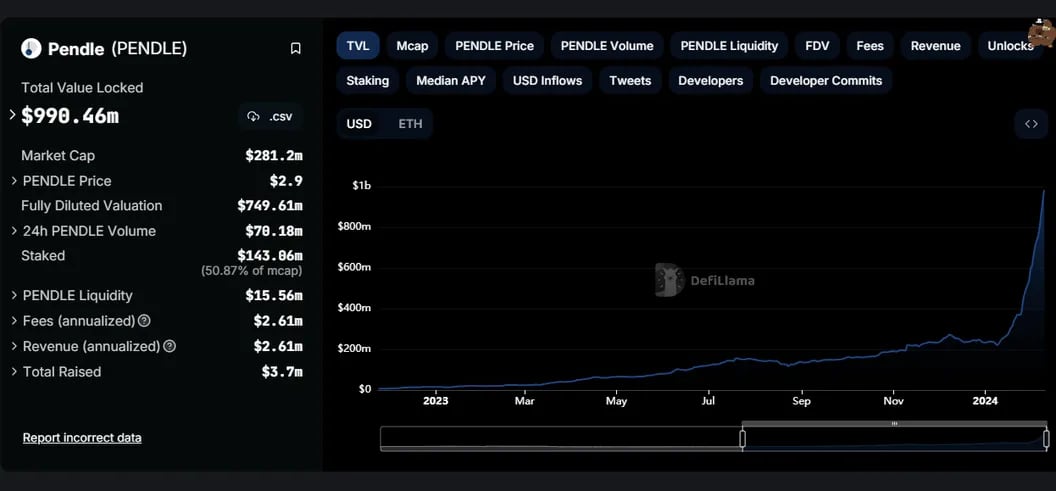

The total value locked (TVL) in the decentralized finance (DeFi) protocol Pendle has reached approximately $1 billion. Interestingly, the majority of these assets were locked into the protocol within the last six months. The surge in interest towards the protocol has emerged as the market seeks more opportunities for liquid re-stakable tokens. Notably, Pendle had recently announced its support for BNB Chain and Real World Assets (RWA).

Pendle Rises with Growing Interest in Liquid Re-stakable Tokens

According to data from DeFiLlama, the TVL of Pendle, a DeFi protocol that offers yield in the form of tradable digital tokens, has recently reached $990 million. Pendle operates as a price discovery tool by separating DeFi investments into principal tokens (PTs) and yield tokens (YTs), allowing the trade of future yields and principal in the open market, thus enabling investors to speculate on future yield rates and lock them into the protocol.

In an interview on Telegram, Pendle developer RightSide explained that the interest in liquid re-stakable tokens has been the main driving force behind Pendle’s recent growth, accounting for the increase in the protocol’s TVL.

A Pioneer in Liquid Re-stakable Token Finance

Liquid re-stakable token finance (LRTFi) is a new DeFi sector that allows for the issuance of liquid re-stakable tokens (LRTs), enabling liquidity for staked assets and allowing users to earn rewards while their original assets remain locked to secure network services.

It is important to highlight that Pendle is among the pioneers in LRTFi, offering a unique proposition for users to speculate on yields and scores within EigenLayer.

Previously, Pendle had expanded to the BNB Chain and started offering products that allow users to benefit from RWA.