The frog-themed meme coin PEPE experienced a decline of approximately 15% due to concerns over recent changes in the multisig wallet and potential developer manipulation, after which a significant PEPE holder spent 320 Ethereum, equivalent to $529,000, to purchase 640 billion PEPE tokens.

Whale Continues to Make Purchases

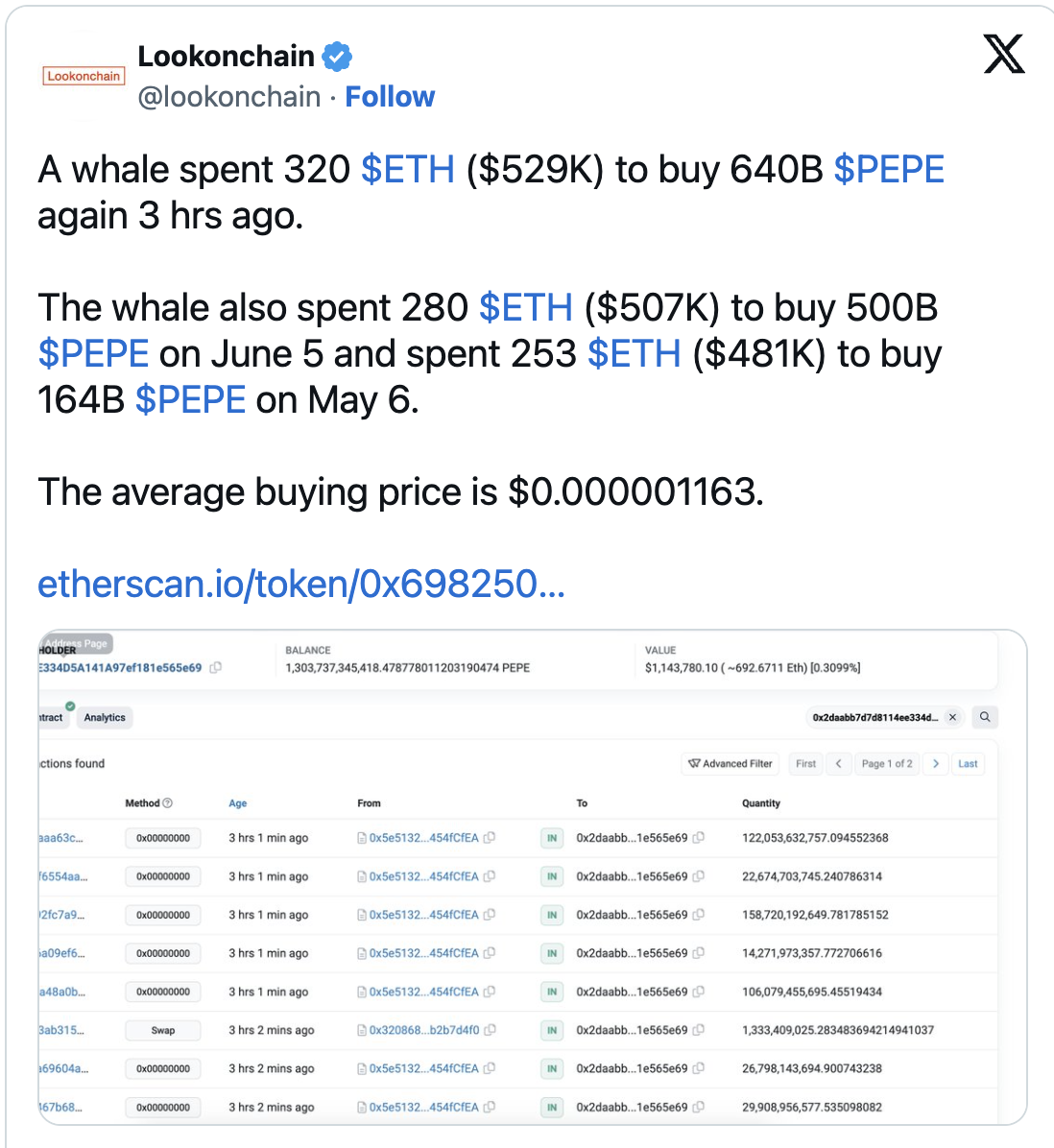

According to an X post shared by the on-chain data analysis platform Lookonchain, the same whale revealed that they purchased PEPE at an average price of $0.000001163. The same whale, who continued their previous transactions, made another move on August 25th. The whale spent 280 Ethereum ($507,000) to acquire 500 billion PEPE tokens on June 5, 2023. Additionally, on May 6th, the whale invested 253 Ethereum ($481,000) to purchase 164 billion PEPE tokens.

This particular whale, who seems to have acted quickly to take advantage of the opportunity presented by the decreased price of PEPE, likely triggered an increase in meme coin sales activity, which in turn prompted the whale to take action. The adjustments made in a multisig wallet managed by chaotic developers were the focus of attention.

What Happened During the PEPE Drop?

The changes made in this wallet, initially worth $10 million in PEPE value, raised suspicion as they decreased the required number of transaction signatures, reducing the necessity of five out of eight signatures to just two. Naturally, such changes in the critical financial structure of a project raise concerns about the potential “rug-pull,” where developers disappear with investors’ funds. As a result of these developments, the value of the once-popular meme coin dropped by over 20% in the last 24 hours.

As of the publication date, the transaction price of PEPE dropped to $0.0000009000, slightly above the lowest point of $0.0000008046 in the 24-hour period. During the same period, PEPE’s trading volume saw a significant increase of 276.51%, reaching a total of $283.05 million. In the past 24 hours, the price drop of PEPE further contributed to its lackluster performance in the previous 30 days, witnessing a drop of over 30% throughout the month.

Türkçe

Türkçe Español

Español