PEPE holders began losing hope earlier this year, especially after other meme tokens surged significantly. However, PEPE started losing market value, and other meme tokens like WIF took its place. The renewed interest in PEPE led to an increase in its market value.

Significant Comparison in PEPE

In fact, at the time of writing, the market value of this meme token was almost twice that of WIF. Despite the increase in market value and interest, the last 24 hours were not positive for PEPE. At the time of writing, PEPE was trading at $0,0000145 after a 5.76% drop. However, the overall outlook for the altcoin remained positive despite the same situation.

Since May 15, the price of the meme token has been on an upward trend. During the mentioned period, PEPE’s price showed numerous highs and lows on the charts. This could be an indicator of the upward trend. PEPE’s relative strength index (RSI) also fell to 43.75, indicating a decrease in bullish momentum in the market. Moreover, PEPE’s chaikin money flow (CMF) dropped to -0.09, which could be a sign of capital outflow.

Santiment Data on PEPE

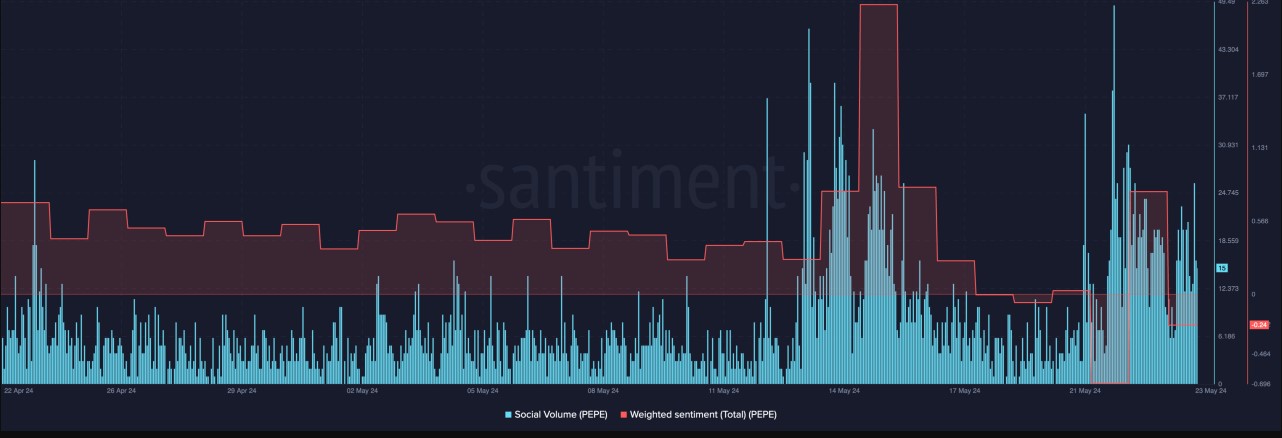

However, significant selling pressure may be required to push the meme token’s price down and reverse the bullish trend around the altcoin. Social activity around the meme token can play a crucial role in determining the token’s future price. Analysis of data from the cryptocurrency analytics company Santiment revealed that PEPE’s social volume has significantly increased over the past few weeks. This rising popularity could help the meme token maintain its upward momentum.

Additionally, there are several issues PEPE might face due to the general sentiment about the token. At the time of writing, the weighted sentiment had shifted from extremely high to extremely low within just a few days. Weighted sentiment can be a measure of the ratio of positive to negative comments. The fluctuating weighted sentiment could indicate the absence of a consistent narrative about PEPE on social media platforms. It is noted that the mood of users on the network shifted from a bullish trend to a bearish trend within a few days. This could be a sign of volatility in PEPE charts in the near future.

Türkçe

Türkçe Español

Español