Pepe (PEPE) seemed to be losing its power, as evidenced by a significant change in the behavior of a particular whale. New data revealed that a prominent whale in the Pepe community has parted ways with their assets and experienced losses in the process. This raises the question of how much this recent whale maneuver has influenced the overall direction of the token.

Whale and PEPE Coin Analysis

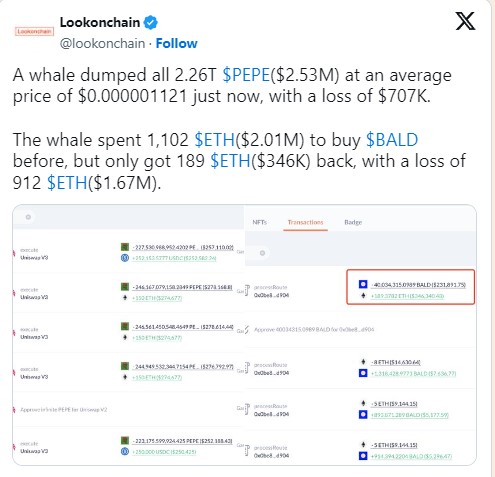

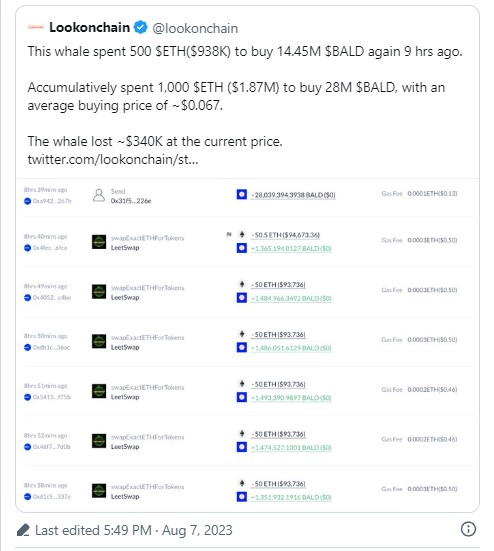

A major transaction orchestrated by a whale on August 7th caught attention. Information obtained from Lookonchain revealed the whale’s decision to divest their holdings in Pepe. However, what sparked curiosity were the noticeable losses incurred during the process. The data exposed a significant volume consisting of approximately 2.26 trillion PEPE tokens being exchanged for around $2.53 million.

Surprisingly, despite the significant amount obtained from the sale, the whale struggled with a loss exceeding $700,000. While the logic behind this maneuver remains uncertain, it is worth noting that this whale made another sale that resulted in a loss.

Pepe in the Daily Timeframe

As shown in the daily timeframe chart, the performance of the Pepe price trend was far from impressive. Following a modest 4% increase on August 1st, the trend steadily declined.

Furthermore, when the price fell below the neutral line of the Relative Strength Index (RSI), it struggled to rise above this line again. At the time of writing, the RSI was at the 30 level, indicating that any future price decline would push it into oversold territory.

The confirmation of the downward trend for PEPE was reinforced by the Moving Average Convergence Divergence (MACD) continuing to trend below zero. The lackluster nature of the price trend may motivate the whale to liquidate their holdings. However, other coin holders prefer a more patient and long-term perspective.

According to Santiment’s exchange flow data, there has been a higher volume of outflows rather than inflows in recent weeks and months. This indicates that many Pepe holders have opted to preserve their assets rather than sell. As of now, recorded inflows were approximately 158 billion, while outflows exceeded 425 billion.