PEPE related contract volumes have decreased. According to the cryptocurrency analytics company Coinglass, PEPE’s volume dropped by 5.10% in the last 24 hours to $764.63 million. The open interest (OI) in the popular meme token also fell to $158.02 million. OI is the value of the contract opened in the market. When OI increases, it can mean that market participants are increasing their net positions and new tokens are entering the market.

Sales Expectations in PEPE

When the mentioned situation occurs, buyers act aggressively and prices may rise further. However, the decrease in OI may mean that investors are increasingly closing their positions and withdrawing liquidity. In this case, sellers may act quickly, and PEPE’s decline in this regard may be related to the meme token’s price. Previously, the token’s price had reached impressively high levels, triggering investors to open positions and take advantage of price movements.

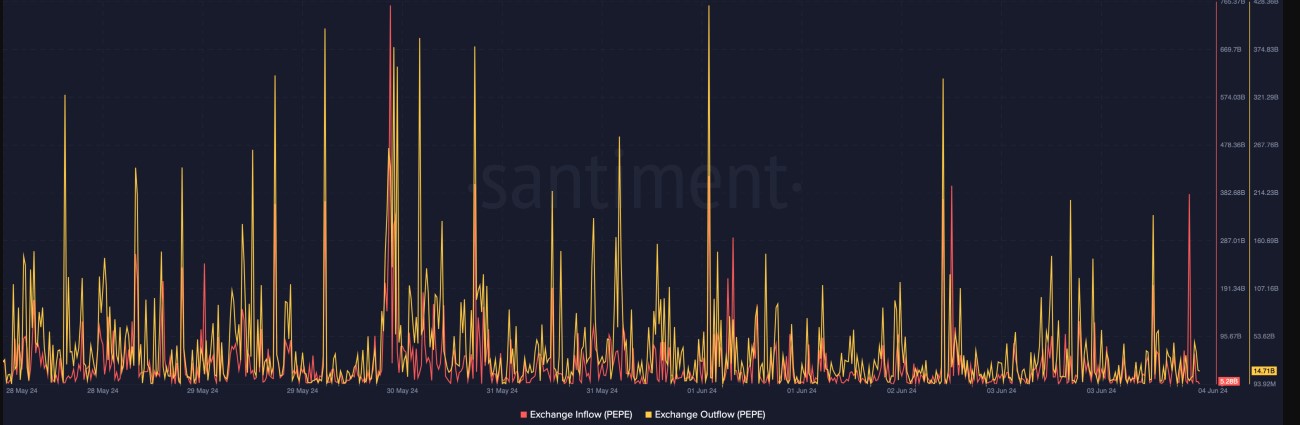

However, PEPE’s price fell by 8.78% in the last seven days to $0.000014. If the price continues to fall, interest in the token may continue to decrease. On the other hand, the token’s recovery could mean a significant increase in open contracts. So, will the price rise? According to data obtained from Santiment, PEPE’s exchange inflow was 5.28 billion. This figure is the number of tokens sent to exchanges for possible sales last week. Contrary to the assumption, the outflow from the exchange was 14.71 billion, which may indicate that more participants preferred to leave the token to make a profit.

Futures in PEPE

Another drop in PEPE’s price may occur, but this difference may change some things in terms of price. However, this situation may be valid if outflows continue to outpace inflows. If this happens in the next few days or weeks, PEPE’s price could return to $0.000017. Despite the potential for a rise, investors are not persistent about a possible recovery.

This can be seen in the Long/Short ratio. The Long/Short ratio is a measure of investors’ expectations. Values above 1 can indicate that the number of long positions is greater than short positions. On the other hand, a ratio below 1 indicates that investors are bearish. At the time of writing, the 4-hour long/short ratio falling to 0.69 strengthened the view that investors’ expectations were negative.

Türkçe

Türkçe Español

Español