PEPE is a meme coin in the cryptocurrency market that is just one year old. When it first launched, it created a lot of excitement. It experienced a meteoric rise, then said, “I am very tired and need to rest for a while.” This resting phase in November was followed by a tenfold increase, making both early investors and those who bought in November very happy. Now, I will tell you a cautionary tale of a whale. Lookonchain reported the story to us.

The Tragic Story of the PEPE Whale

If you have invested in a cryptocurrency, you need to manage the rises well. In this market, you might incur losses while trying to gain more. This is a reality we face. Adjust your moves accordingly to avoid saying “I wish” tomorrow.

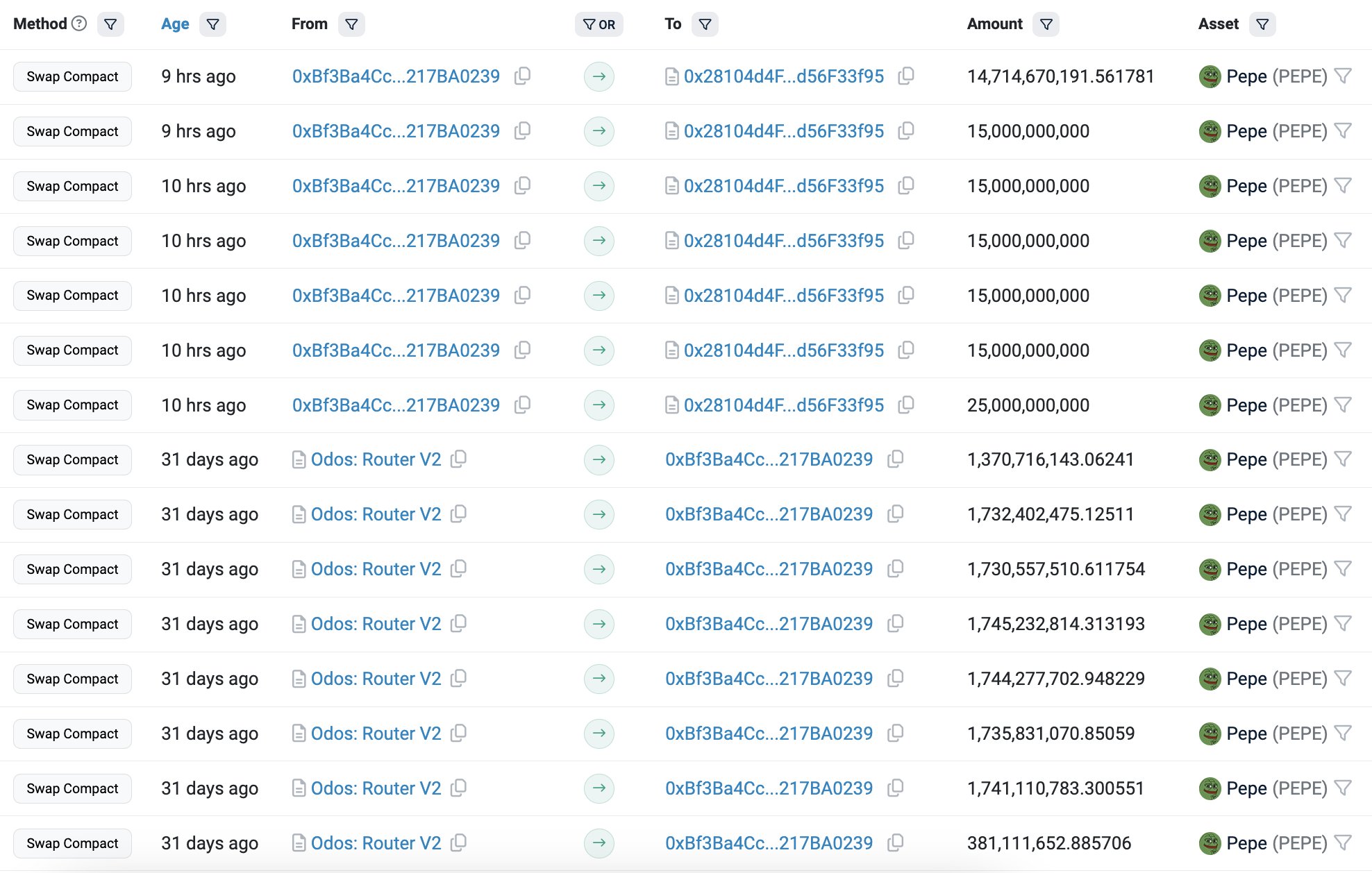

The story of a PEPE whale who didn’t sell in time and succumbed to the market has emerged. This whale sold approximately 115 billion PEPE coins at the breakeven price. In return, they received 366.5 ETH. The numerical value of the Ethereum received corresponds to around 1.27 million dollars.

When Was PEPE Purchased?

The interesting part is that PEPE was purchased on May 14 and May 15. Approximately 115 billion PEPE was bought at a price of $0.000011. The whale paid 1.27 million dollars for these PEPE coins.

Now we move to the regretful part of the story. On May 27, the PEPE price surpassed $0.000017. This meant a profit of over 50% from the whale’s purchase price. A figure of around 670 thousand dollars is indeed a nice income in this market.

The Whale is Probably Regretting

If the whale had sold, they might have been happy with the profit. However, the whale did not take advantage of this rise. They did not sell their PEPE. Subsequently, the PEPE price began to decline.

Eventually, the PEPE price fell below the whale’s breakeven point. The whale likely uttered “I wish” as they succumbed to this decline in the cryptocurrency market. They sold all their PEPE.

My advice to investors is, if you have a cryptocurrency and have made a profit, there is no need to be too greedy. Sell and take your profit. Remember, losing from profit is better than losing from the principal!

Türkçe

Türkçe Español

Español