Cryptocurrency discussions are ever-present, and the latest debate features renowned trader Peter Brandt. Brandt has harsh criticisms for Ethereum, labeling it an “insignificant currency” and arguing that this popular alternative cryptocurrency is not a serious competitor to Bitcoin.

Peter Brandt Targets Ethereum

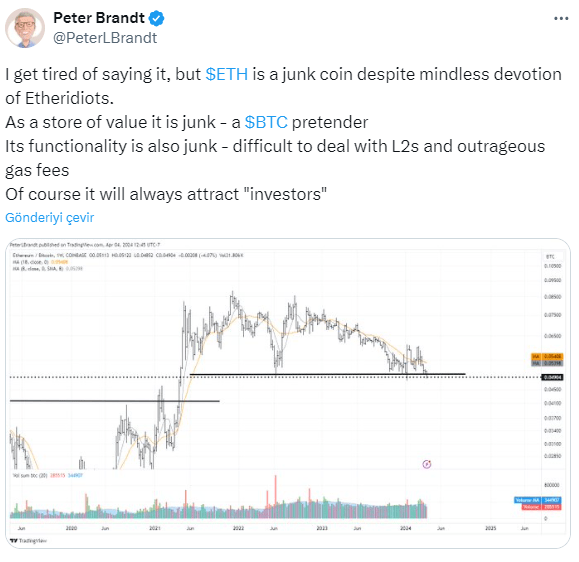

Known for his extensive experience in financial markets, Brandt targets Ethereum, claiming it lacks fundamental qualities necessary for long-term sustainability. In a recent social media post, he asserted Ethereum’s weakness as a store of value and pointed out issues such as Layer-2 solutions and high gas fees.

Brandt’s criticisms are supported by his claims that altcoin Ethereum’s performance has fallen behind Bitcoin, the flagship of cryptocurrencies. He emphasized Ethereum’s decline against Bitcoin since the end of 2021, noting that ETH has suffered a critical support loss at the 0.05 BTC level. This indicates Ethereum’s increasing weakness against Bitcoin.

Brandt: Reiterating My Doubts About Ethereum

Brandt announced in January that he would take a short-focused position on the altcoin Ethereum, citing its weak price performance as the reason. However, he admitted a month later that this strategy did not yield the expected results. Brandt’s statements reflect a wider belief that Ethereum is weaker compared to Bitcoin and that Bitcoin still dominates the cryptocurrency market.

Brandt’s criticisms once again highlight his belief that everything other than Bitcoin is “insignificant.” According to him, Bitcoin plays a unique role as the primary store of value with significant potential for appreciation, and the ability of other cryptocurrencies to assume this role is questionable.

Considering Ethereum’s technological innovation and broad use cases, Brandt’s criticisms seem likely to continue sparking debate and provoking thought. However, it is important to remember that, as always in the cryptocurrency market, facts and outcomes will reveal themselves over time. Brandt’s doubts about Ethereum are noteworthy as they suggest the market needs to be evaluated from a broader perspective.

Türkçe

Türkçe Español

Español