One of the experienced names in the cryptocurrency world, Peter Brandt, recently made an important prediction. This situation created a significant buzz in the cryptocurrency circles. In his post, the analyst pointed to the $90,000 level and stated that the price could exceed this level. More importantly, the price increase that started after the prediction caused investors to approach this statement with greater interest.

Will Bitcoin Rise?

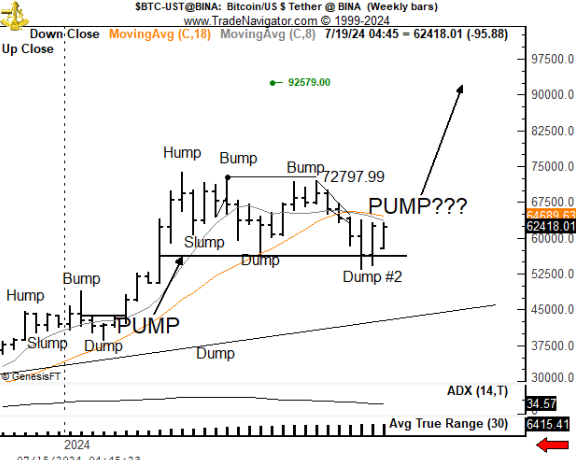

Peter Brandt made statements about possible movements in Bitcoin’s price actions. In the visual shared by Brandt, he drew attention to the possibility that BTC might be following a formation he defined as “Hump->Slump->Bump->Dump->Pump.”

On the other hand, he stated that the double top attempt that emerged on July 5th was nothing but a bear trap confirmed on July 13th. Additionally, Brandt mentioned that bears were now too late to turn back and the most likely scenario was a bullish outlook.

However, he also expressed that a close below the $56,000 level would invalidate the bullish outlook. According to the latest data, Bitcoin has seen an increase of over 6%. This rise did not go unnoticed by both investors and market followers, creating great excitement.

What Is the Current Bitcoin Price?

An important event occurred recently, and it was announced that trading in spot Ethereum ETFs would begin on Tuesday, July 23rd. Following the announcement, all eyes turned to the market. With the ongoing rise due to the Trump events, Bitcoin’s price moved once again and increased by over 6% in the last 24 hours.

Following this rise, the BTC price reached the $63,630 level. The market cap surpassed $1.250 trillion, while the trading volume increased by 70% with intense interest, reaching $36.1 billion.

Things also seemed to be going well for Ethereum, which was at the center of the events. Following the information that emerged, the Ethereum price surpassed $3,408 with a 7% increase in the last 24 hours. This price movement also had an impact on the market cap. The market cap rose to $410 billion, which had fallen below $400 billion in recent days.

Additionally, the trading volume saw a 63% increase, surpassing $16.5 billion.

Türkçe

Türkçe Español

Español