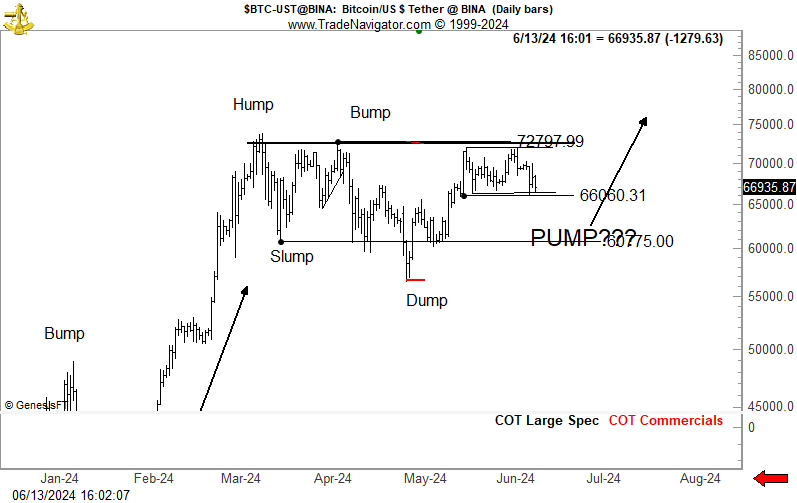

A new analysis warns that Bitcoin could still fall below $50,000 if remaining support weakens. Popular investor Peter Brandt made Bitcoin bulls think in a post on X on June 14. Bitcoin, after the recent failed price surge, has opinions divided at $67,000. After touching $70,000 earlier this week, the BTC/USD pair once again abandoned attempts to leave a stubborn trading range for weeks.

What Is Happening on the Bitcoin Front?

Instead, despite volatility from US inflation data, the market returned to a very familiar region. Now Brandt does not rule out the possibility of new long-term lows. Describing the BTC/USD pair as an interest chart, he shared the following statements:

“Sometimes the most obvious interpretations of a chart work, most of the time charts change.”

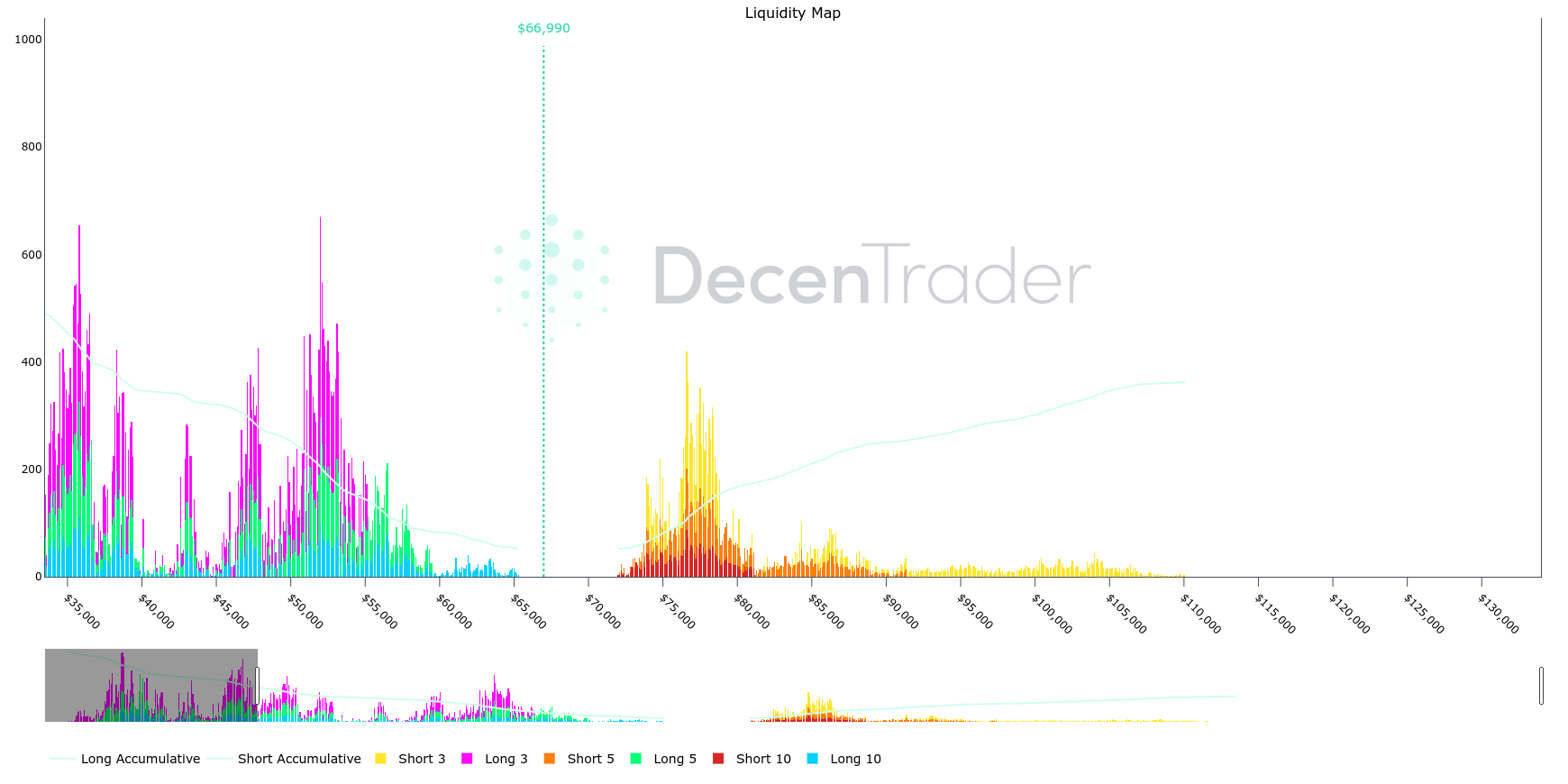

Bitcoin last traded below $50,000 in mid-February, a month before reaching its all-time high of $73,800. These high levels have since become a tough resistance; data from DecenTrader trade package shows the size of liquidity there and beyond. Popular trader Skew, in a part of his analysis on June 13, added that there is quite intense selling depth around $70,000 and above:

“The market will likely need a new narrative to bid over this.”

Notable Comments from Famous Names

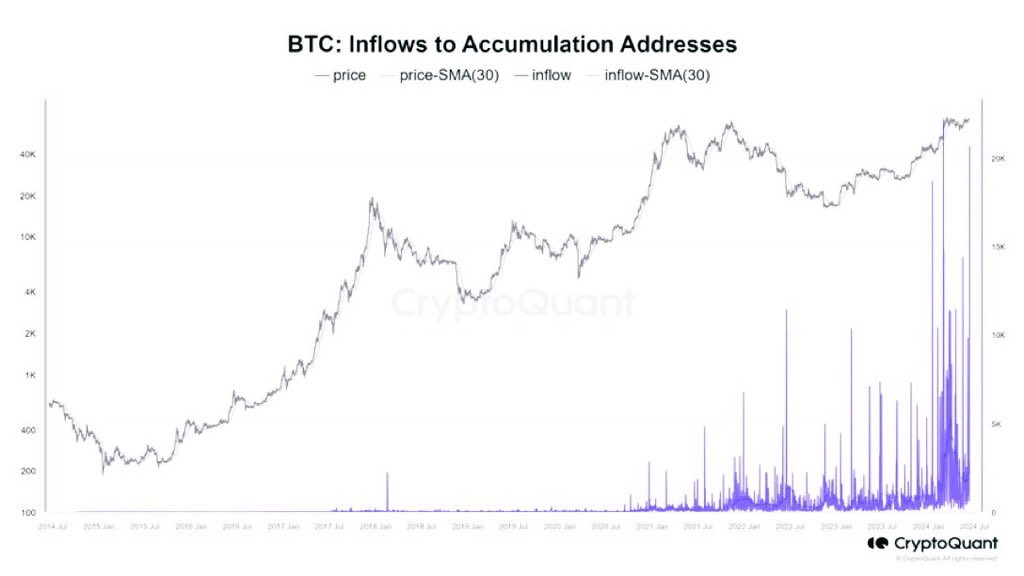

Not everyone accepted the downside as the most likely direction for Bitcoin’s price. Some market observers noted that Bitcoin whales significantly increased their Bitcoin risk at recent price levels. The number of whale holdings with at least 1,000 Bitcoins is near all-time highs this week.

Blockchain data source Woobull’s creator Willy Woo wrote in a part of his X response that this indicates a bullish signal and stated:

“In every past cycle, the FOMO phase of the bull market starts when they begin selling into the price rise.”

Crypto investor and YouTuber Quinten referred to data from blockchain data analysis platform CryptoQuant showing that whale purchases reached $1.3 billion.