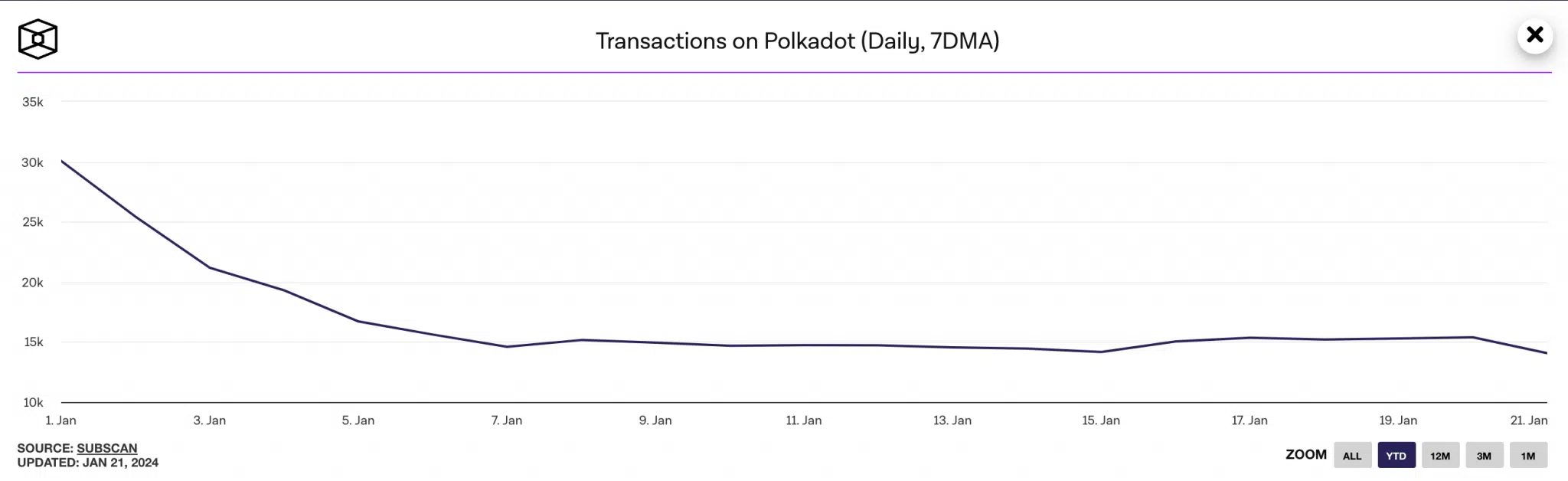

The assessment of activity on the Proof-of-Stake (PoS) blockchain network since the beginning of the year has shown a decline in demand, resulting in a double-digit decrease in the value of Polkadot (DOT).

Selling Pressure on DOT

The price movements of DOT observed on the 24-hour chart revealed a significant bearish presence. For instance, the Directional Movement Index (DMI) showed the positive direction index at 12.76, which was below the negative direction index at 25.94. When the indicated lines are positioned in this manner, it is accepted that the selling pressure has much more momentum than accumulation, meaning the downtrend is stronger than the uptrend.

Confirming the strength of the downtrend, DOT’s Average Directional Index (ADX) was seen rising at 26.19. An ADX of a token above 25 can indicate that the current market trend is strong. Additionally, looking at DOT’s Moving Average Convergence Divergence (MACD), the indicator moved below the trend line on December 31, 2023, and has remained positioned that way since then.

Polkadot Data from Coinglass

This intersection can be interpreted as a bearish crossover and a signal for investors to sell. The increase in selling pressure led to a 20% decrease in DOT’s price since the beginning of the year. The open interest in the cryptocurrency’s futures market has fallen since the beginning of the year. According to Coinglass data, DOT closed on January 21 with an open position of $221 million, which could indicate a 17% decrease compared to the $265 million recorded on January 1.

Despite falling prices and open positions, DOT futures investors continued to open leveraged positions betting on a price increase. Moreover, data obtained from Coinglass showed that since the beginning of the year, DOT has only exhibited positive funding rates on cryptocurrency exchanges. However, as the altcoin price continued to fall, long traders faced liquidations, with the highest level since the beginning of the year recorded at $8 million on January 3.