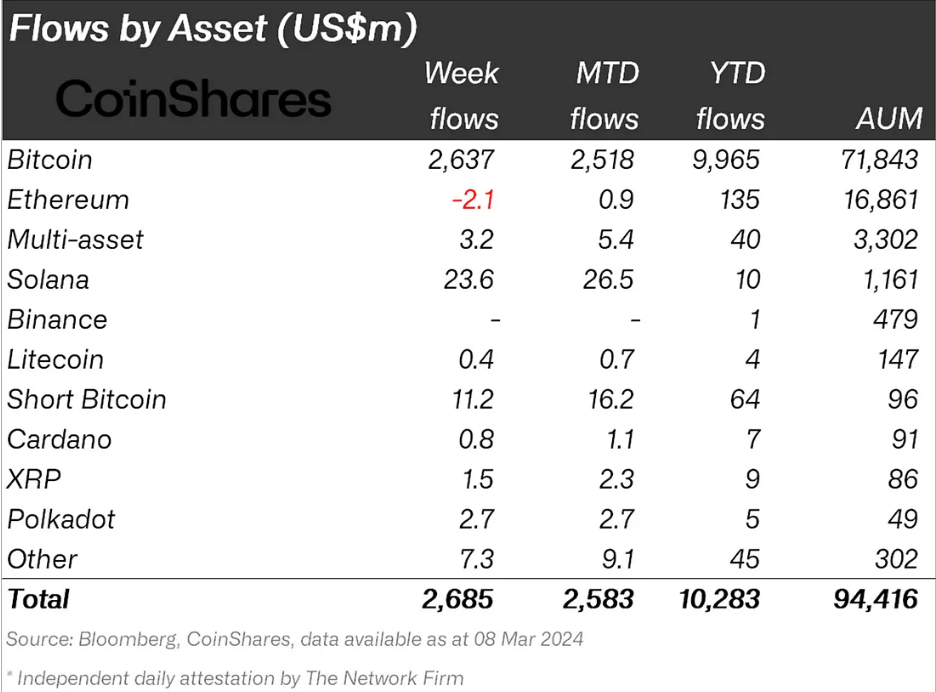

As the influence of institutions carries significant weight in this year’s bull market, corporate preferences for cryptocurrencies are becoming increasingly important. Polkadot has been showing impressive performance since the beginning of the year. Could this situation further increase the price of the cryptocurrency Polkadot (DOT)?

Polkadot (DOT) Achieves Notable Returns

DOT has yielded higher returns than competitors like Litecoin since the beginning of the year. Since the beginning of this month, Polkadot’s performance has also surpassed major cryptocurrencies like Ripple and Cardano. Although both continue to be institutional favorites, DOT has managed to outpace them.

This situation indicates that institutions may be observing a potential that they have not yet recognized. In addition, the belief that Polkadot’s price-to-sales (P/S) ratio is low supports this view. The Price-to-Sales (P/S) ratio evaluates a company by comparing its total sales revenue with its market value. This ratio helps assess a company’s valuation relative to its revenue generation.

While a low P/S ratio usually indicates better value, a high ratio can signal overvaluation. This is applicable to Polkadot (DOT) as well, as DOT’s P/S ratio is significantly below the historical average.

DOT Price Forecast: Is There Potential for Growth?

In recent weeks, a rounding bottom formation has been observed in Polkadot’s price. Since the beginning of the year, prices have completed this bullish formation by surpassing the neckline established at the beginning of the month.

This rounding bottom formation indicates a reversal of the downtrend. This “U” shaped pattern on the charts suggests that the previous downward trend is slowing down and giving way to buying interest.

Moreover, this formation is often considered a sign of the exhaustion of the downtrend before the price crosses above the neckline. Polkadot’s price has completed half of the expected 31.3% growth, reaching $10.61, and is approaching the $12 target price.

However, if market conditions do not support further rises or if DOT’s price cannot surpass the $11 level, the upward momentum may slow down. In that case, the price could retreat to $10. Furthermore, DOT could fall to $9.20 if it experiences more momentum loss.