The steady rise of active addresses and the momentum of Ethereum have been garnering interest for Polygon (MATIC). Does this indicate the beginning of a price surge, and if so, could we see it reach the $1.24 threshold?

Active Addresses on MATIC

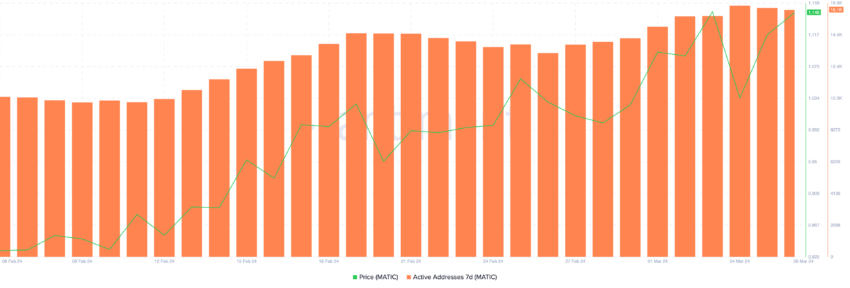

Active MATIC addresses have grown by nearly 60% in the last 30 days. According to historical data, there is a strong correlation between the growth in active addresses and price. On February 6th, there were 10,439 active addresses recorded. This number rose to 15,708 by March 3rd. The price also increased from $0.83 to $1.14 during the same period, marking a 37.35% growth. MATIC has not touched the price level of $1.14 since April 2023.

Despite the significant increase in active addresses and prices over the past month, things have come to a standstill. Based on past data, a pause in the growth of active addresses often precedes a period of price stability or a potential price correction. The indicated pattern could suggest that the MATIC price might similarly undergo a consolidation phase or experience a downward correction in the near future.

MATIC Price Analysis

According to historical data, the MATIC price closely mirrors the price movements of ETH, often showing a correlation coefficient exceeding 0.8. This connection intensified particularly over the past month. The correlation rose from a modest 0.5 on February 1st to a striking 0.95 on March 6th. Given Ethereum‘s current upward momentum, this close correlation could indicate promising expectations for MATIC.

However, this could also steer MATIC towards the anticipated price target of $1.24. On the other hand, when examining the growth rates of both ETH and MATIC this year, a clear disparity emerges. Additionally, Ethereum’s price has increased 4.5 times more than that of MATIC. Considering the traditionally strong correlations, it would seem reasonable to predict that MATIC has the potential to rise.