For years, the Proof-of-stake (PoS) network Polygon (MATIC) has maintained a strong position in the cryptocurrency market, and the past month has been particularly active, with a significant increase in user numbers.

Polygon (MATIC) Developments

According to data provided by Artemis, there were fluctuations in the daily active user count over the past year. The increase in momentum that started in the last week of 2023 seems to be gaining even more strength at the beginning of 2024.

The number of daily active addresses peaked on January 11, reaching 678,000, which represented a 63% increase within a month. Additionally, when considering the past year, the number of active users more than doubled.

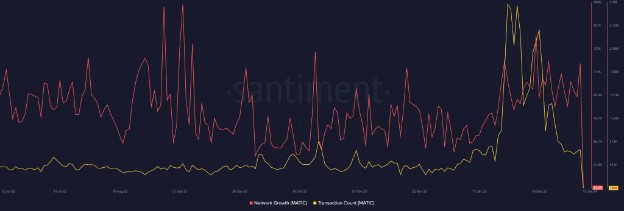

Despite the increase in user numbers, there has been a noticeable decline in block space demand since the beginning of 2024. Data from Santiment shows a 62% decrease in the number of transactions on the Proof-of-Stake network year-to-date (YTD).

On the other hand, the number of new addresses continued the positive momentum seen in 2023, indicating a healthy adoption of the network.

Developments in Polygon NFTs

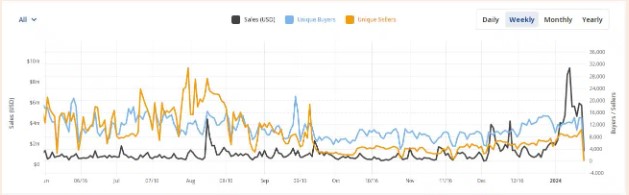

The surge in interest in inscriptions in December 2023 provided significant support for user participation, possibly initiating a second NFT era. In this context, most of the activities in the new year are emerging around NFTs.

According to data from CryptoSlam, it can be said that Polygon reached the third-highest NFT sales volume last week. During this period, the layer-2 (L2) chain witnessed a historic event as it surpassed the market leader Ethereum (ETH) in 24-hour NFT sales for the first time.

Current Status of Polygon (MATIC)

MATIC, the native token of the Polygon ecosystem, benefited from the rising cryptocurrency market along with spot Bitcoin (BTC) confirmations. Despite a subsequent decline, data from 21milyon.com indicates a 6% increase in MATIC at the time of writing.

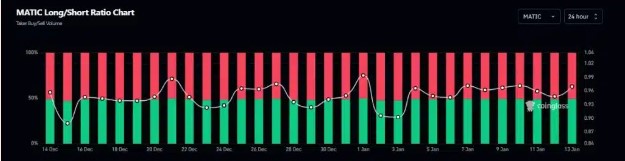

Additionally, data from Coinglass shows a decrease in Open Interest (OI) in MATIC futures. This suggests that short sellers have closed their positions and exited the market, which can lead to liquidity outflows and a potential price drop for the asset.

Despite ongoing short sales, the number of active short positions still appeared to outnumber long positions at the time of writing, with MATIC’s long/short ratio falling below 1. This could be interpreted as more investors maintaining their belief in the coin’s price decline.