Developments in the crypto market continue to attract attention. Accordingly, Polymarket is recording increased activity as investors show growing interest in current market conditions. Participants are making bold moves, trading thousands of dollars to predict market trends. While the platform’s impartiality in reflecting market sentiment is questioned, its role in promoting crypto adoption cannot be ignored.

What’s Happening on the Polymarket Front?

Dune Analytics reports that Polymarket has seen a significant increase in daily volume and active investors as participants try to predict market outcomes. These figures have been steadily rising since May. Narratives like the US elections continue to sustain this interest. However, the recent crypto market crash has also contributed to the increase in activities. Different dashboards on Polymarket show that participants are making predictions on multiple questions.

These include the likelihood of Bitcoin falling below $45,000 before September and Ethereum rising above $3,000 on August 9. At the time of writing, Bitcoin was trading at $53,625, while Ethereum remained below $2,400.

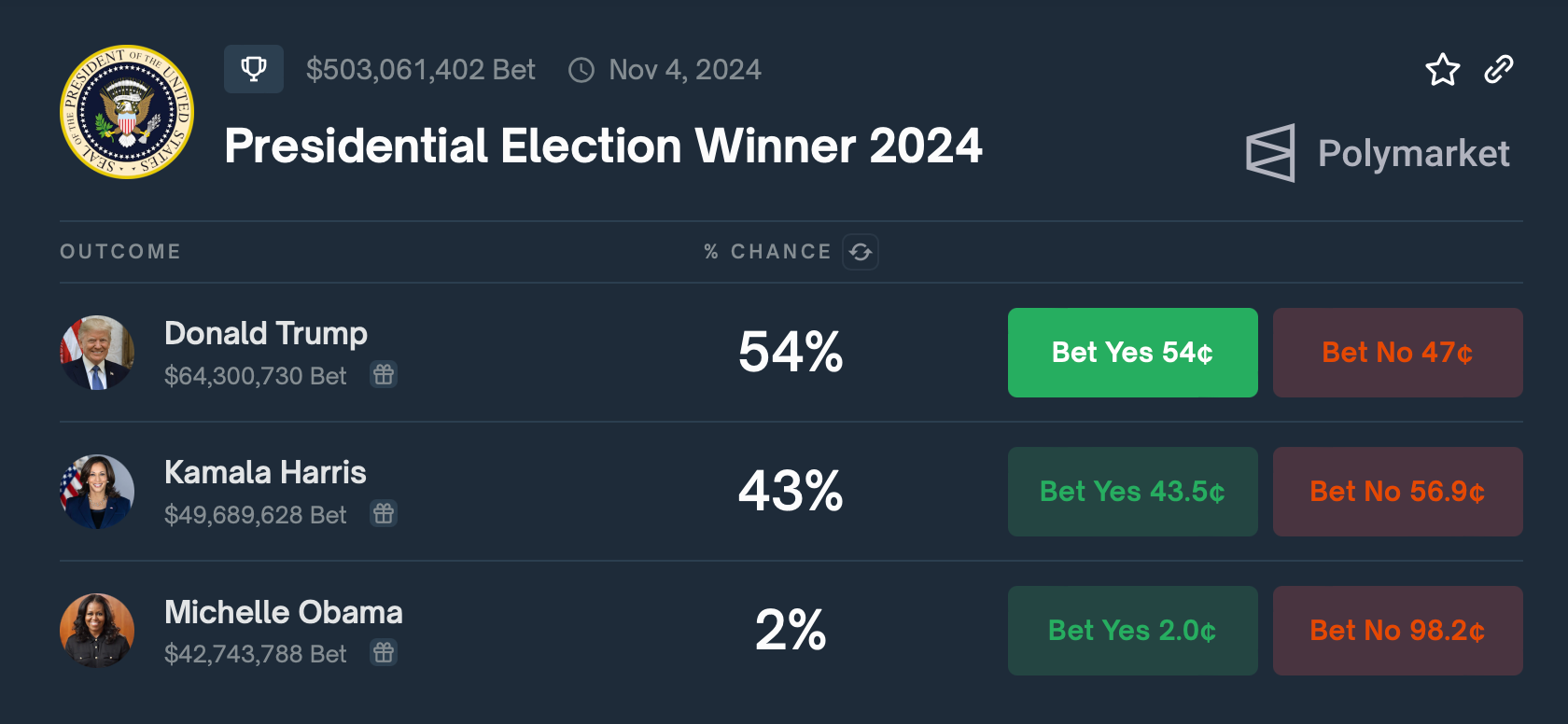

The US presidential race remains one of the most popular topics among Polymarket users. The crypto community is increasingly making predictions about potential outcomes. Republican candidate Donald Trump leads with a 54% success rate. In contrast, Kamala Harris stands at 43%, while former US First Lady Michelle Obama has a 2% rate.

Details on the Subject

Polymarket criteria also show investors’ interest in whether there will be an urgent rate cut in 2024. This interest emerged as markets condemned the recent downturn in the sector. Bitcoin investor Kyle Chasse shared the following statement on the subject:

“Jerome Powell should immediately hold a meeting and announce an urgent rate cut.”

Federal Reserve Chairman Jerome Powell recently indicated the possibility of a policy easing by late 2024 during a meeting. He acknowledged that a rate cut could be on the table in September. Whether an urgent rate cut will occur is still unknown. Besides urgent rate cuts, Polymarket participants are speculating about a possible recession in 2024. However, this process may soon end as US economic activity defies recession warnings.

Türkçe

Türkçe Español

Español