The year 2024 began with a strong start for the cryptocurrency markets, with investments reaching $151 million in the first week. However, Solana (SOL), despite having an impressive year in 2023, did not contribute much to the funds.

Positive Sentiment in Solana

A CoinShares report revealed that there were more outflows instead. According to experts’ analysis of the weekly report, outflows from Solana were valued at $5.3 million. There are several reasons for the shift in sentiment towards the altcoin. However, the most notable were the prices of Bitcoin (BTC) and SOL. Even though SOL’s price went above $100, it did not have a good week. According to CoinMarketCap data, the price of SOL fell below $90 in the first week of January. A 10.12% drop in its seven-day performance is cited as one of the reasons for this decline.

In the case of Bitcoin, there is a lot of optimism surrounding the token. As a result, inflows related to it accounted for $113 million of the total $151 million. Expectations for the approval of a spot ETF in the US are also said to be the main driver of the inflow. CoinShares’ Head of Research commented on the matter:

Despite no spot-based ETFs having been launched in the US yet, 55% of the inflows came from US exchanges; Germany and Switzerland followed with 21% and 17%, respectively.

The ETF Approval Process

Moreover, reports from various sources claim that the approval is almost complete. This was also confirmed by Gary Gensler’s post on January 8th. In the post, the SEC chairman encouraged investors to be cautious with cryptocurrency investments. Comments below the post indicated speculations that the crypto-skeptical regulator had agreed to greenlight the applicants. Details in the CoinShares report revealed that many participants did not share this view. The report also stated:

If many people truly believed that the launch of an ETF in the US would be a “buy the rumor, sell the news” event, we would definitely expect to see entries into short Bitcoin ETPs, instead, outflows occurred over the last 9 weeks reaching $7 million.

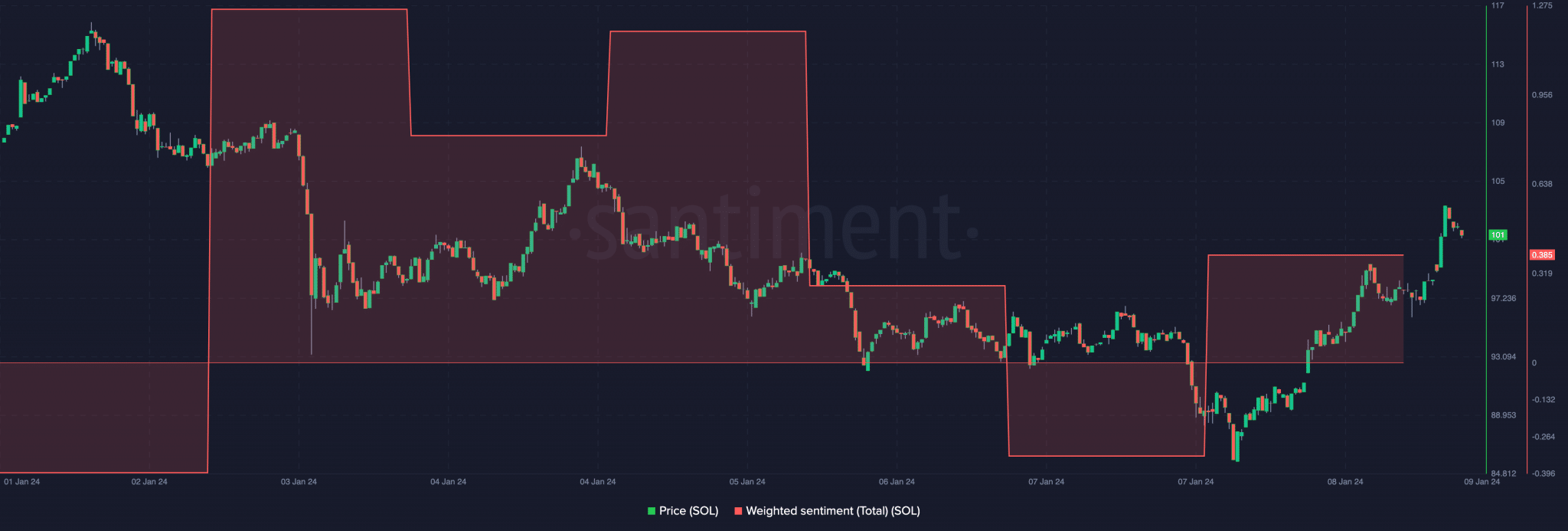

Nonetheless, sentiment towards Solana is changing compared to last week. According to Santiment, SOL’s weighted sentiment was -0.334 on January 6th. However, at the time of writing, the metric had climbed into positive territory. This recovery was a confirmation that positive comments about the project outweighed the negative ones over the past two days. If sentiments remain the same until the weekend, fund flows related to Solana could increase. However, the altcoin may have to contend with Ethereum (ETH). In contrast to Solana, Ethereum investment products experienced a total inflow of $29 million.