Bitcoin’s price volatility continues, with an upward movement recently reaching a peak of $38,999 on the Binance exchange. The increasing demand is attributed to the strengthening belief in the approval of a spot Bitcoin ETF, and this optimism could persist as January 10th approaches. But why is this ETF approval so significant?

Will Cryptocurrencies Surge?

Analysts at CryptoQuant believe a potential spot Bitcoin ETF approval could lead to a $1 trillion increase in Bitcoin’s market value. Galaxy Digital expects a 74% price surge in the first year following the launch of a spot BTC ETF. This is quite ambitious as it would mean seeing a new peak at around $70,000 based on current prices if it materializes.

The SEC now has to make a decision on approval or rejection, which will occur between January 5-10. Moreover, it is not incorrect to think that ETF approval would increase the institutional liquidity injected into the market.

Indeed, according to a report from CoinShares on Monday, institutional investor entries are on the rise. Investors who have invested through crypto trusts and ETPs have marked an entry of $1.5 billion in the last year. Last week alone, institutional entries amounted to $311 million for Bitcoin alone, indicating that the strong demand captures not just individual investors but everyone.

Bitcoin Chart Analysis

When we look at the BTC chart on a monthly basis, there is a clear similarity to the rapid rise experienced at the end of 2020. The king of cryptocurrencies is now aiming to reverse its losses from April 2022 and target $47,000. We are witnessing a recovery at a similar pace to the rapid decline experienced in the middle of last year. If the $44,800 levels can become support, the path to the dreamed six-figure Bitcoin price could be opened as well.

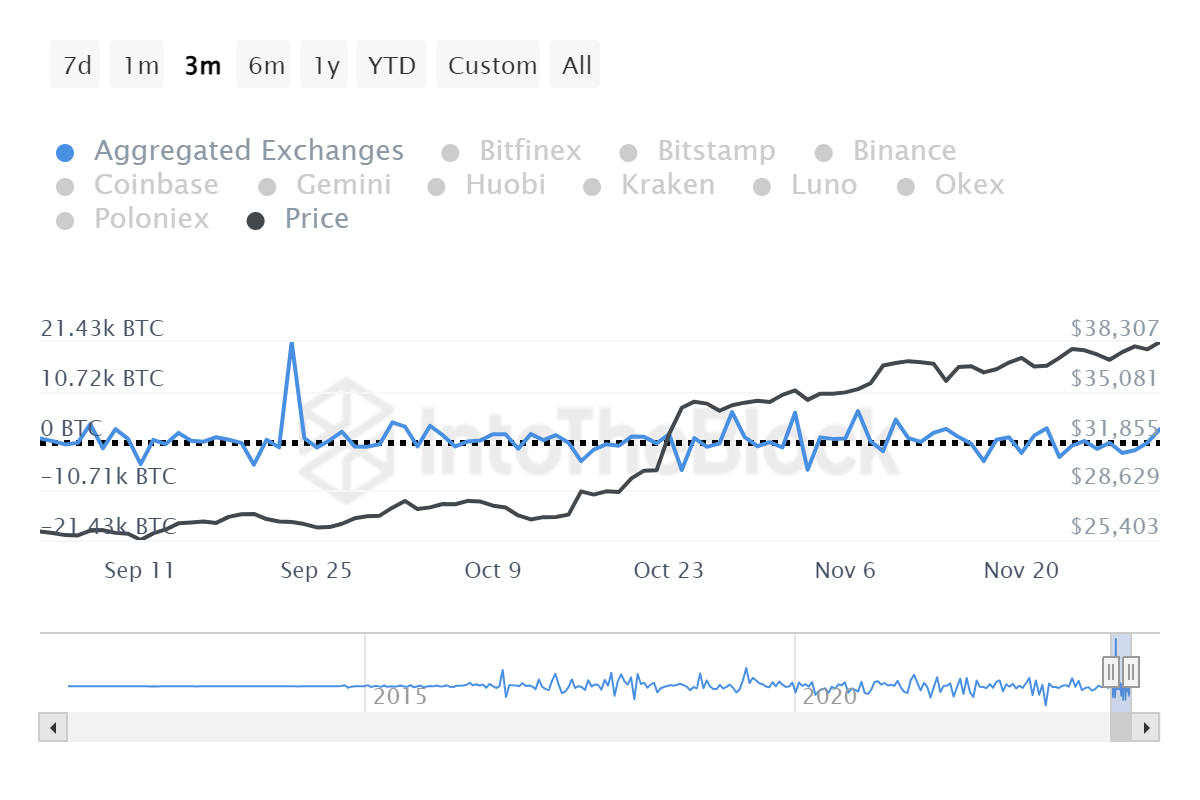

Net inflows to cryptocurrency exchanges are increasing as of December 1st. Although there was a net inflow of 2560 BTC yesterday, this number is consistent with levels seen on net inflow days throughout November. While inflows to exchanges continue, the price has continued to rise steadily.

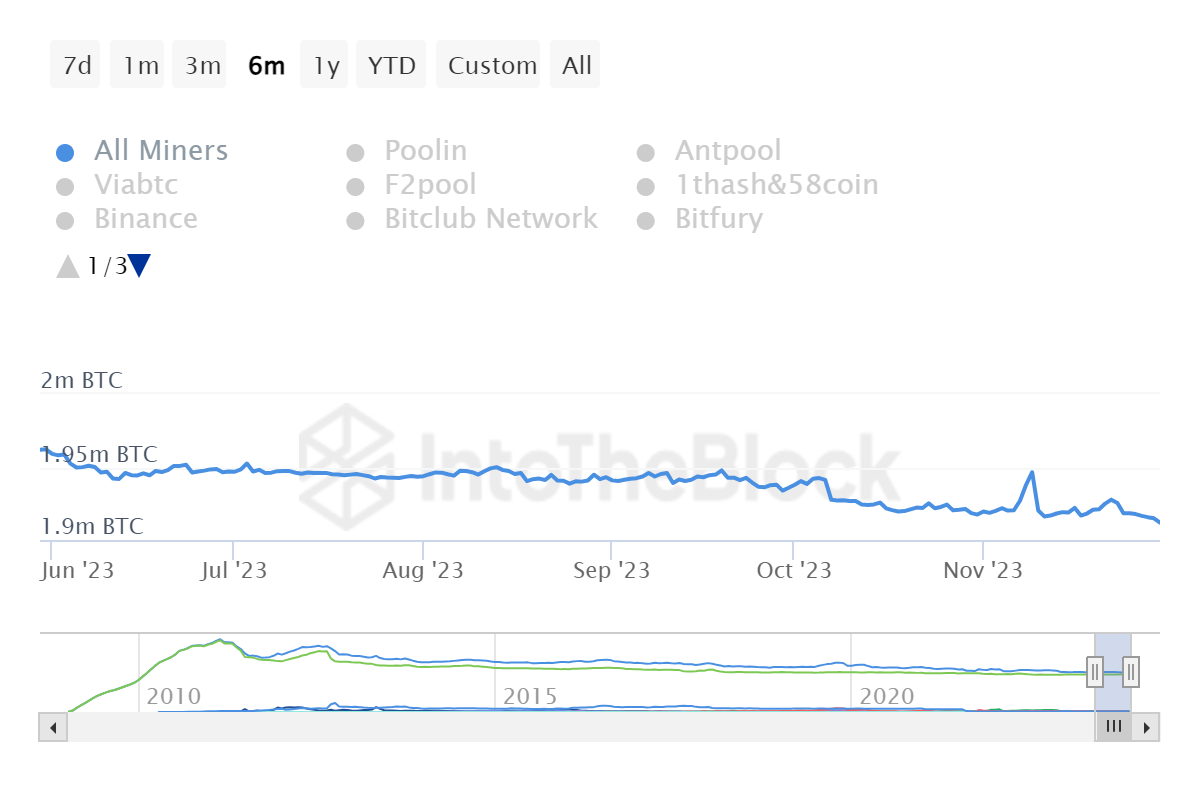

If you’re wondering who is selling while the BTC price is rising, you should take a look at miner reserves. Miner reserves have dropped to the lowest levels in six months, around 1.91M BTC. Increased hash power and intensifying competition are causing miners to set aside reserves for operational expenses.

- Spot Bitcoin ETF optimism fuels market.

- Institutional investors ramp up crypto entries.

- Miners hold reserves amid rising competition.

Türkçe

Türkçe Español

Español