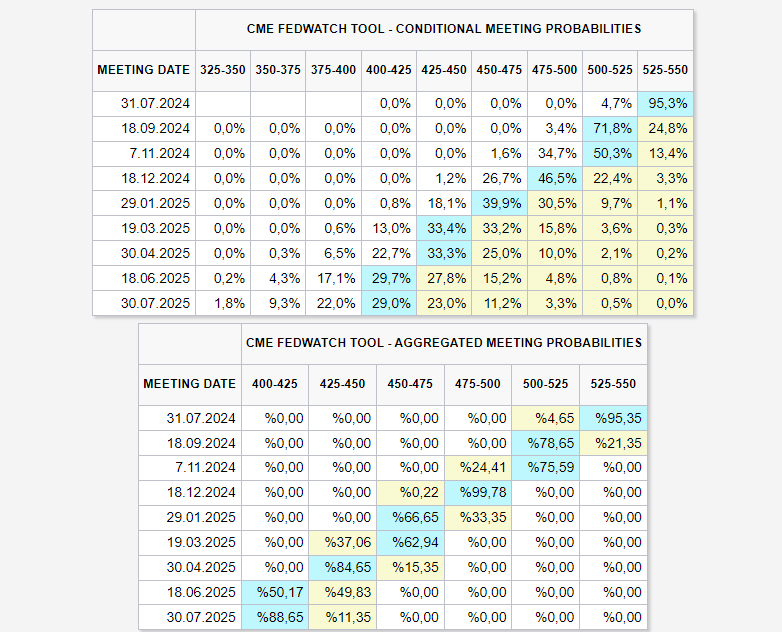

Bitcoin price is at $57,180 at the time of writing, and Fed Chairman Powell is making important statements. A few days ago, we mentioned the significance of Powell’s announcements on Tuesday and Wednesday in the week’s important developments. Statements about inflation and interest rate cuts help us understand the current situation.

Fed Chairman’s Statements and Crypto

Powell is commenting on the six-month monetary policy at the time of writing. More convincing data on the continuation of the decline in inflation will be sought for interest rate cuts. However, Powell also says that inflation is not the only issue and risk. The main points of his statements at the time of writing are as follows:

- The Fed will not consider a policy rate cut until it gains more confidence that inflation is sustainably moving towards 2%.

- High inflation is not the only risk we face.

- More good data will strengthen our confidence in inflation. We have made significant progress towards the 2% inflation target, and recent monthly data shows progress.

- First-quarter data did not support more confidence in the inflation path needed for a Fed rate cut.

- Reducing restrictions too late or too little could unnecessarily weaken the economy and the labor market.

- Reducing restrictions too early or too much risks reversing progress on inflation.

- Restrictive policy helps exert downward pressure on inflation.

- The US economy is expanding at a solid pace.

- Risks to achieving employment and inflation goals are becoming more balanced.

- Labor market conditions are cooling but remain strong and not overheated.

If this week’s inflation data meets expectations, we may see a rise in crypto with increased macroeconomic optimism following the recent statements.