QCP Analysts, who have been sharing updates on the markets for a long time, announced their latest predictions a short while ago today. The experts’ previous predictions were that there could be short-term negative movements after the ETF approval. They were right about this, and their comments on the spot ETH ETF were successful until the last BTC correction.

Will Spot ETH ETF Be Approved?

At the forefront of the experts’ focus is the approval of the spot ETH ETF. This issue is quite important as it could trigger a rise in ETH and altcoins similar to the months-long rise in BTC prices. In today’s market assessments, they wrote the following;

“We were eagerly awaiting the ETH spot ETF approvals as the next narrative for the rise. However, whether this will happen in 2024 is still a question mark. If BlackRock and Fidelity continue to postpone their deadlines around the end of May deadlines set by VanEck and Ark21, we think an approval is likely. They had done the same before the BTC approvals.

On the other hand, if BlackRock and Fidelity delay until the end of June at the latest (i.e., if there is no clustering), it could indicate that they have no intention of approving the ETH spot ETF this year.”

Bitcoin and Cryptocurrencies

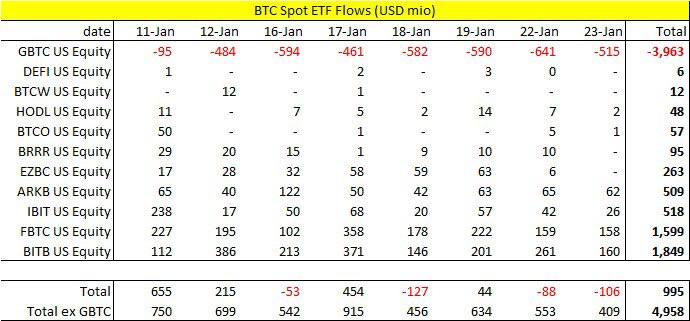

Addressing the recent decline, experts agree with our consistent emphasis that GBTC outflows triggered it. Investors panicked with massive GBTC outflows in addition to billions of dollars in spot market sales following the ETF approval.

“BTC retreated to around the 38,500 level due to significant daily outflows of 500 million – 600 million dollars from GBTC. GBTC still has a large reserve of about 21 billion dollars.

The break below 40,000 seems to have been triggered by headlines related to Mt.Gox confirming BTC addresses for creditor repayments. This represents another potential large supply of 142-200 thousand BTC.

In more positive news, the People’s Bank of China (PBoC) today announced a surprise 50bps cut in the Reserve Requirement Ratio (RRR). The Chinese Government also proposed a 278 billion dollar package yesterday to support the Chinese stock markets. Chinese stocks are up +%7-8 from their lows, which may have provided some support for risk assets today, including crypto.

We are also paying attention to the January 31 FOMC meeting, where we expect more clarity on the pace of balance sheet reduction, and the US Treasury’s Three-Month Bill Repayment Announcement (QRA).

If the US Treasury issues more short-term debt as we expect, it will mean a rise for risky assets and crypto. However, if they disappoint the market, bond yields will rise again and stocks will be sold off sharply. We think the likelihood of a rise is higher.”