Leading cryptocurrency investment firm QCP Capital has released its latest market analysis shedding light on recent trends and potential impacts for Bitcoin (BTC). The company notes that the bull market has not ended and maintains its upward trend expectations.

Spot ETF Outflows and FOMC Decision

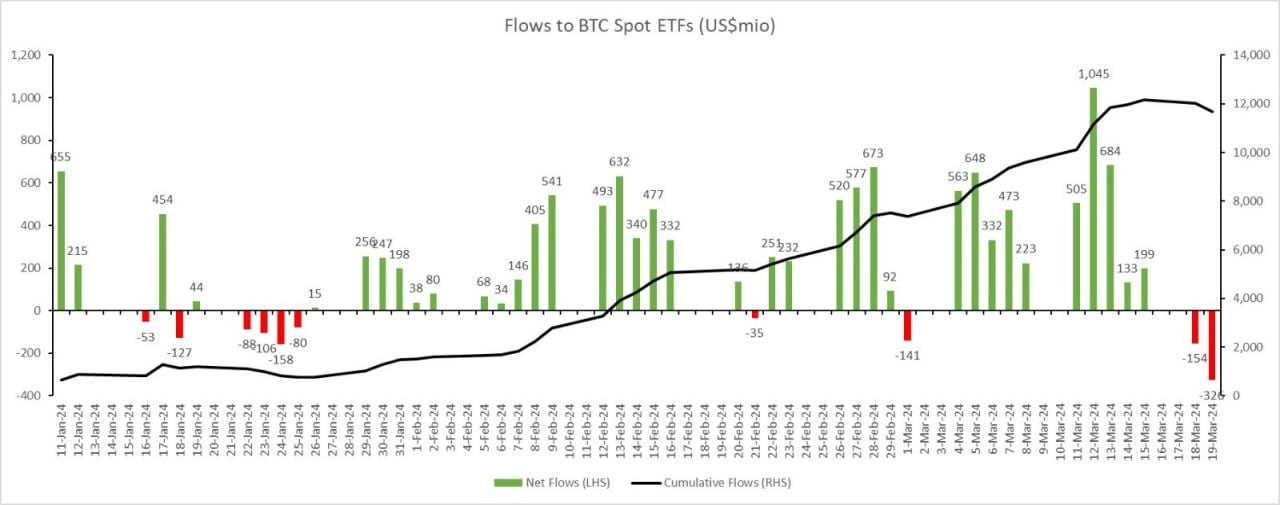

According to QCP Capital, entries into spot Bitcoin exchange-traded funds (ETFs) peaked on March 12, surpassing $1 billion, and have since decreased alongside the drop in spot prices. The firm highlighted the largest single-day net outflow to date on March 19, with a net $326.2 million leaving, contributing to BTC‘s temporary drop to $60,770 before climbing back above $63,000.

The company questions whether this marks the start of daily net outflows or if it’s part of position adjustments made before the Federal Open Market Committee (FOMC) decision, emphasizing the significance of today’s FOMC outcome. The FOMC decision, to be announced at 21:00 local time, will provide insights into the Fed’s stance on interest rates and inflation.

Markets have priced in three interest rate cuts for this year, according to QCP Capital, and recent inflationary pressures could lead the Fed to reconsider rate cuts. The firm expects BTC’s price to be potentially affected if the Fed adopts a more hawkish stance.

“The Bull Market Has Not Ended” Emphasis

Despite short-term uncertainties, QCP Capital emphasizes that the bull market has not ended and continues to hold a positive outlook for the cryptocurrency market’s annual growth. The company forecasts that a broad liquidity rotation will propel BTC to new highs following April’s fourth block reward halving.

However, the firm warns that the current excessive leverage in the market could lead to a harsh short-term correction. QCP Capital recommends strategies like the Enhanced Sharkfin, offering a return profile ranging from 6% to 200%, for investors looking to capitalize on such fluctuations.

The Enhanced Sharkfin strategy offers capital protection while reducing concerns about sharp corrections and provides gains if BTC surpasses previous high levels. This approach aligns with QCP Capital’s assessment of market dynamics, allowing investors to benefit from potential upward price movements while being protected against downward price risks.

Türkçe

Türkçe Español

Español