Singapore-based cryptocurrency investment firm QCP Capital made significant statements regarding the impact of recent geopolitical tensions in the Middle East on financial markets. As tensions rise between Israel and Iran, sharp movements have occurred in the cryptocurrency market. Nevertheless, there is a continued interest in risky assets, according to QCP Capital. The firm emphasized that these short-term fluctuations should not distract investors from the larger picture.

Impact of Geopolitical Tensions on the Cryptocurrency Market

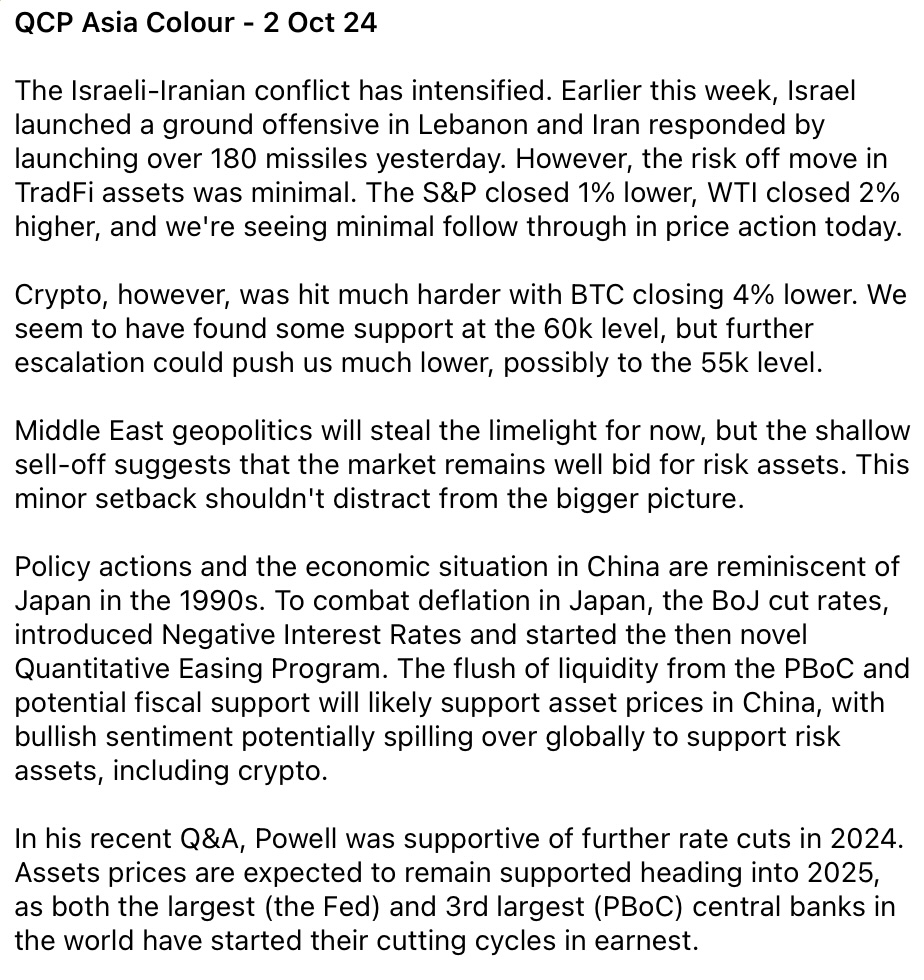

Last week, Israel launched a ground operation against Lebanon, prompting Iran to respond with over 180 missiles. However, the effects of this development on traditional financial assets remained quite limited. The S&P 500 index fell by 1%, while WTI crude oil prices rose by 2%. Today’s price movements did not result in significant changes following these events.

In contrast, the cryptocurrency market faced a much sharper impact. Bitcoin (BTC)  $91,967 experienced a 4% decline, finding support at the $60,000 level, but it is estimated that it could drop to $55,000 if tensions escalate further. QCP Capital noted that this wave of selling is shallow, with investors still showing demand for risky assets. It was stressed that investors need to focus on the long-term picture rather than short-term fluctuations.

$91,967 experienced a 4% decline, finding support at the $60,000 level, but it is estimated that it could drop to $55,000 if tensions escalate further. QCP Capital noted that this wave of selling is shallow, with investors still showing demand for risky assets. It was stressed that investors need to focus on the long-term picture rather than short-term fluctuations.

Factors Influencing China and the Global Economy

In addition to geopolitical developments, the situation in the Chinese economy also stands out as a significant factor. QCP Capital compared the policies of the People’s Bank of China (PBoC) to Japan’s struggle with deflation in the 1990s. During that time, the Bank of Japan lowered interest rates, adopted a negative interest rate policy, and initiated a monetary expansion program considered innovative at the time.

Similarly, the increase in liquidity in China and potential fiscal support measures could bolster asset prices in the country. This situation is expected to have a positive impact on global markets, leading to increased demand for risky assets, including cryptocurrencies.

Finally, QCP Capital recalled that Federal Reserve Chairman Jerome Powell supported expectations for interest rate cuts in 2024. With the world’s largest central banks expected to enter a cycle of interest rate cuts, asset prices are projected to remain strong until 2025. Changes in the interest rate policies of both the Fed and PBoC are anticipated to continue serving as significant support for global markets.