As we always emphasize, you should never underestimate the unpredictability of crypto. QCP was wrong in yesterday’s prediction. Analyst predictions in cryptocurrencies often mislead investors. So, what did the experts at QCP Capital who expected positive signals for FOMC and dreamed of crypto-favorable statements say today?

QCP Capital Crypto Commentary

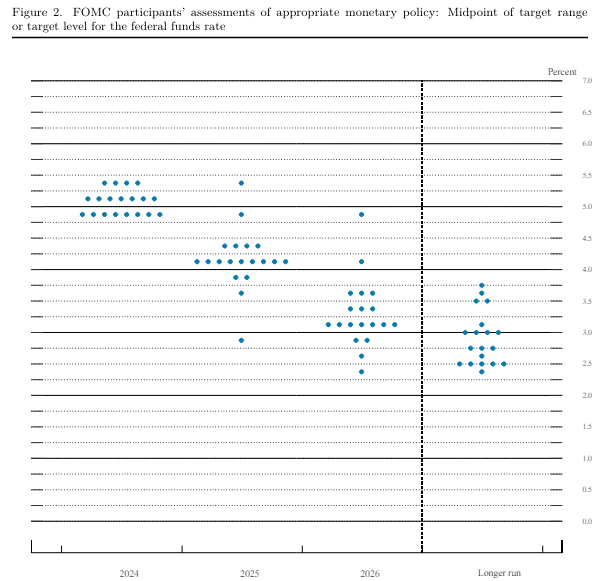

In their statements yesterday, QCP Capital experts did not expect such a change in the Fed’s 3-year interest rate forecasts. The improvement in inflation data not being a sufficient reason for Fed members to ease surprised many experts. Today, QCP Capital experts wrote the following;

“- Last night’s CPI figures ignited a boom in risk assets. US stocks reached an all-time high, while BTC rose to 70k before falling to 67.3k this morning.

– The market is pricing in 2 rate cuts in 2024. Interest rate futures indicate a 56% chance of a rate cut in September, with a second cut in December.

Our View;

– The Fed’s dot plot remains uncertain, making it difficult to predict whether officials will prefer one or two rate cuts this year. However, we expect a rate cut in September and a wait-and-see approach from the Fed in the November and December meetings.

– We maintain a structurally bullish outlook for the rest of the year due to the expected ETH ETF S-1 approval and potential rate cuts in September and year-end.”

Crypto Predictions for End of 2024

Gensler also said today that he hopes Spot ETH ETFs will start trading on exchanges before the end of summer. Yesterday’s CPI and today’s Producer Inflation came in below expectations for the US. Both data points could boost the Fed’s confidence in cutting rates in the upcoming period. After the poor inflation data in the early months of the year, the average rate cut expectation for this year among members dropped to 1, which is not surprising.

If there is an abnormal loosening in employment or if the decline in inflation continues for another 1-2 months, the likelihood of the Fed cutting rates in September and subsequent meeting months will also be confirmed. For now, markets continue to see the meeting as a sell signal due to reasons like the upward revision of 3-year interest rate forecasts and weakening 3-year optimism on inflation. This negativity may not last very long.