As the fluctuation in Bitcoin price continues, some altcoins have doubled or even tripled in value. This is quite normal. During the bull market, investors who are seeking higher profits tend to focus more on certain altcoins, leading to abnormal price movements. This is especially easier to happen when liquidity is low.

Sushiswap (SUSHI)

Even though there are periods of temporary price increases, well-timed good news can have a significant impact on prices. We have seen many altcoins announcing news that could create a lot of hype at the wrong time in the past 1.5 years. Sushiswap did not make this mistake. With the increase in DEX liquidity, the upward momentum has gained traction. It is possible for decentralized exchanges to attract unprecedented attention in the upcoming bull season due to the bad reputation of FTX exchange.

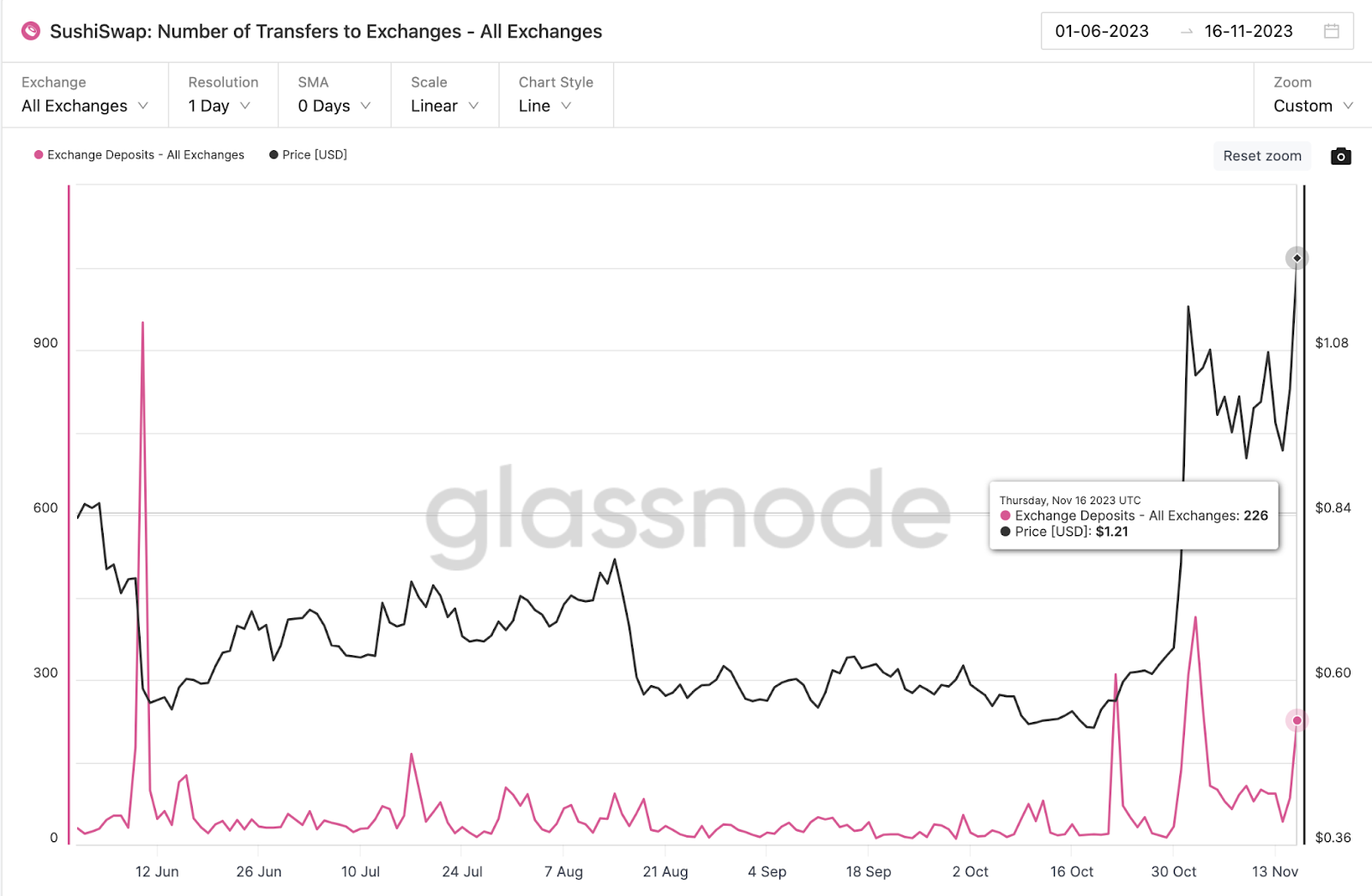

So, will the rise in SUSHI Coin price continue? The metric of exchange deposits shows an increase in outflows from cold wallets. The graph below, published by Glassnode, indicates that on November 16th, there was an increase in profit-taking transactions.

Past data shows that when SUSHI investors show a strong selling trend, prices usually decline in the following days. We have seen this after June 11th, August 17th, and November 2nd. A similar movement is possible in the next 24 hours.

SUSHI Coin Analysis

Order book data obtained by IntoTheBlock from 10 exchanges, including Binance and Coinbase, shows that there are 10.8 million SUSHI buy orders for 13.7 million tokens available for sale. The price could potentially reach the weak zone and this data supports the scenario of a decline.

After a 100% price increase in the last 30 days, a price correction is likely according to on-chain data. So, what is the technical situation? The upward movement starting from $0.53 stopped at the $1.3 level. Bulls resisting between $0.87 and $0.81 on the weekly chart may lose this area.

If the decline deepens, there is a potential bottom between $0.634 and $0.61. In the worst-case scenario where the Bitcoin price tests $30,900, we may see a drop to the $0.5 level. Investors may need to be cautious against increasing profit-taking transactions.