Bitcoin has been trading between $25,000 and $30,000 for a long time. In order for the crypto giant to break out of this consolidation, macroeconomic data and regulatory issues in the crypto market need to be resolved. Bitcoin experienced a 3.92% increase in September, but during the same period, the S&P 500 index experienced a 5.4% decrease. In addition to all these developments, crypto stocks experienced a larger correction than the S&P index. So, what are the factors behind the fall of crypto stocks while Bitcoin rises?

Why Are Crypto Companies Falling?

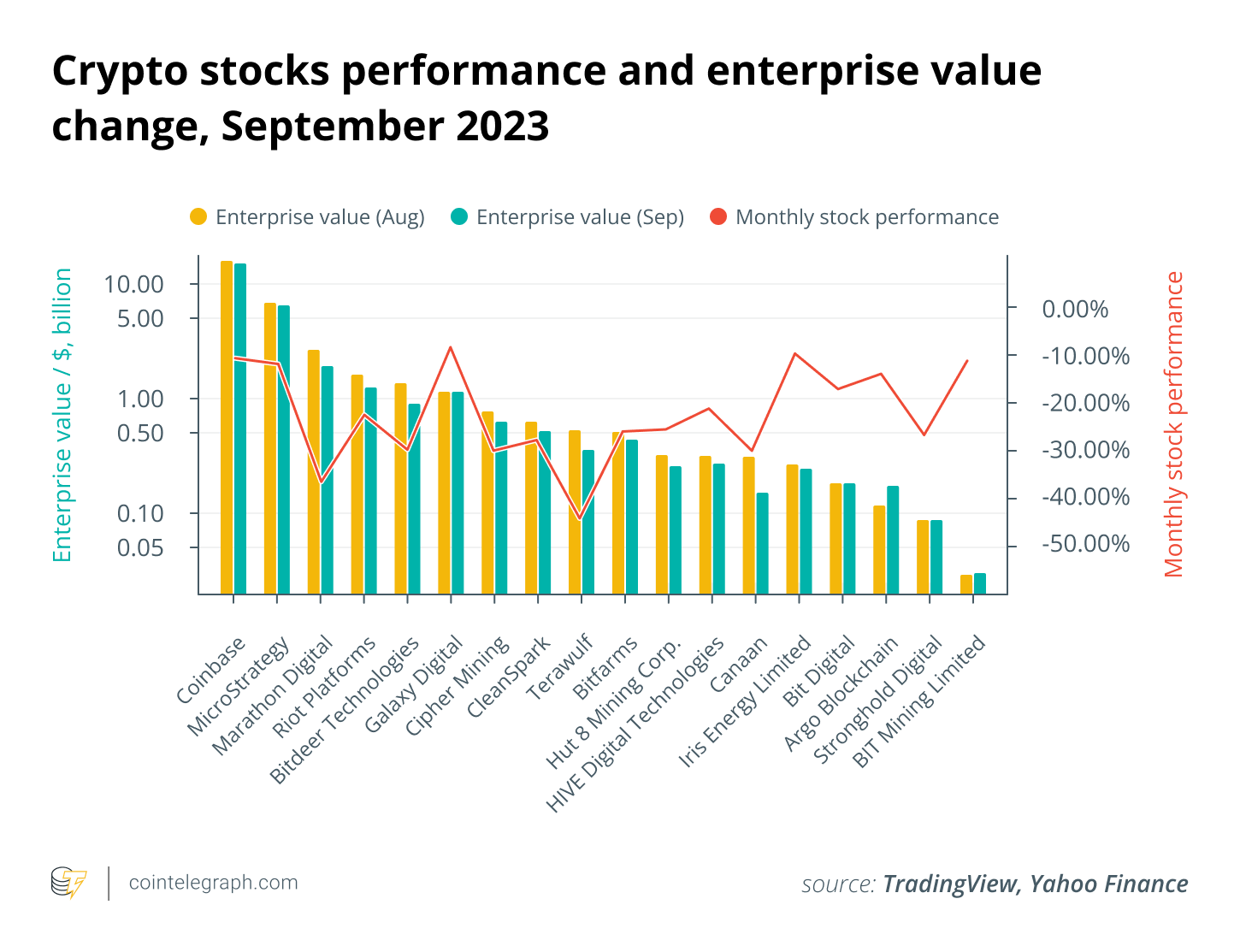

Most publicly traded crypto companies went through a challenging period in September. However, there was a correction in stock prices. With the developments in the markets, these stock prices faced corrections ranging from 10% to 40% and crypto stocks declined by an average of 22.4%. The leading sector in this regard was crypto mining stocks.

TeraWulf, Marathon Digital, and Iris Energy Limited, among other publicly traded crypto companies, experienced losses of nearly one-third. Miners who were affected by these significant corrections had a major rally in the first half of the year and gained over 300% at times.

However, stock prices started to decline in July and a significant portion of the past gains eroded. Some of the reasons for these corrections remained specific to the mining sector and are unlikely to have a broad impact on the crypto market.

Crises in Mining Companies

The major corrections in mining stocks came after a series of issues, triggered by the tightening in the mining economy. Mining revenues will be halved overnight with the halving event scheduled for April next year. Despite this negative situation, there has been no sign of slowing down in network hashrate, and it continues to reach all-time highs.

As a result, Bitcoin mining is becoming more and more competitive, and profit margins in this sector are narrowing. If mining companies exhaust their ability to generate new capital and Bitcoin does not experience a significant rise during this period, serious problems will arise for these companies after the halving event.

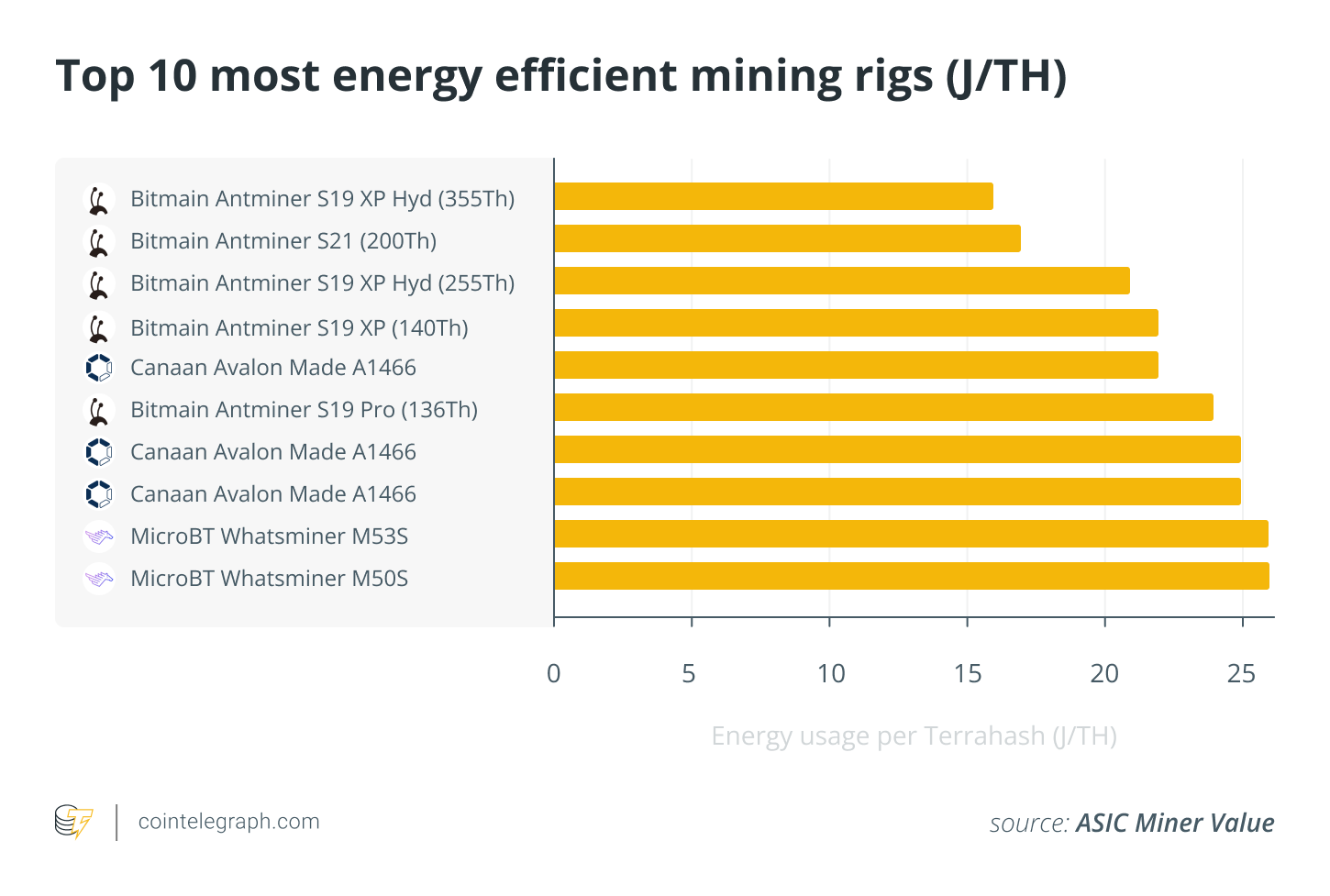

In September, the largest ASIC mining hardware producer, Bitmain, announced a new Antminer model that will further intensify this competition in the coming months. The new S21 machines will have a mining efficiency of 17.5 J/TH, providing more than 20% efficiency compared to the leading machine in the market. It is predicted that mining companies will want to have the new equipment due to the halving effect.

Türkçe

Türkçe Español

Español