Bitcoin momentum that caused its rise disappeared completely this week as the price of Bitcoin dropped by 3.6% in the last 30 days, erasing the 76% gain achieved since the beginning of the year. Although the Bitcoin price surged to $29,600 on August 14, it failed to reach $30,000 and remained below this key resistance level.

The decline in Bitcoin price and low volatility led some analysts to compare the current BTC market with the bull-preceding cycle of 2015-2017. Let’s take a closer look at the factors influencing the Bitcoin price today.

Market Structure Takes a Downturn

According to the Capriole Bitcoin Macro Index, Bitcoin’s market structure had been recovering since the beginning of 2023, but the recent price movement reversed the market structure, which is now believed to be contracting.

Despite the technical setback in Bitcoin price, independent market analyst Charles Edwards still considers the $30,000 level to be crucial:

“Although we are still in a technical downward trend from $30,000, the lack of downward follow-through in the Bitcoin price is somewhat encouraging. However, at least a daily close above $30,000 is required as technical confirmation of a failed breakdown. When this happens, we will consider it as a new uptrend.”

Long-Term Liquidations Draw Attention

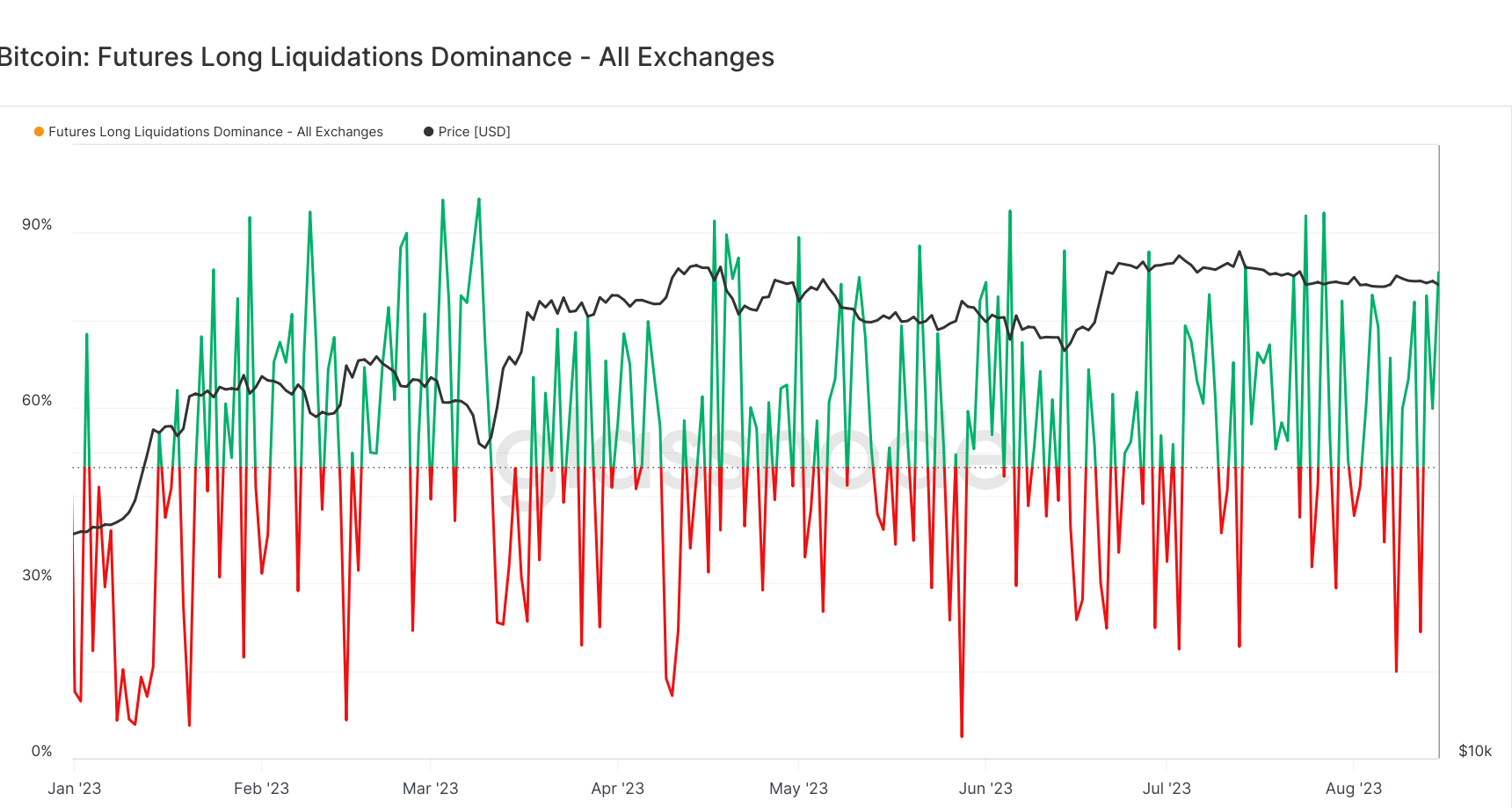

Since the beginning of 2023, there has been a continuous selling pressure in the futures market liquidations. The trend shifted on August 12, and on August 15, Bitcoin long liquidations dominated 83% of all BTC liquidations. When BTC is liquidated without buying pressure from long positions, it negatively affects the Bitcoin price. Bitcoin volume has also reached its lowest levels since the beginning of 2021.

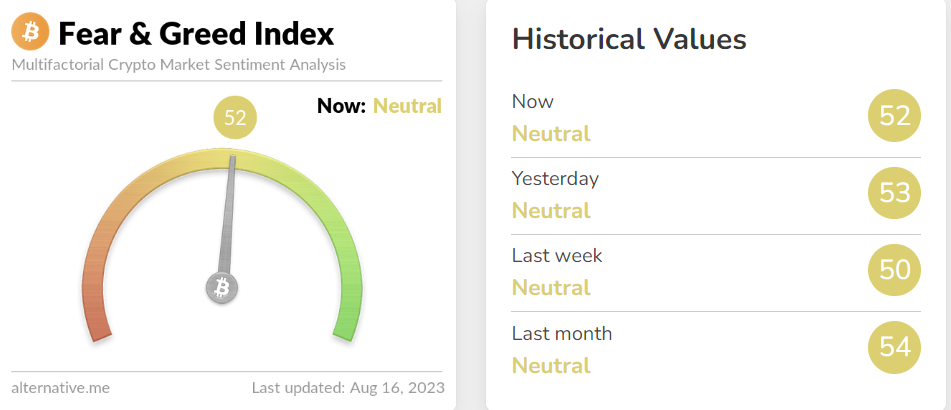

The lack of new volume has caused a decrease in the Fear and Greed Index, which is an important investor sentiment indicator, over the past 30 days, indicating a shift towards fear.

Short-term uncertainty in the crypto market does not seem to have changed the long-term perspective of institutional investors. Despite a hostile regulatory environment in the US, major institutions are pushing for Bitcoin financial instruments that could trigger a bull run. Grayscale has directly urged the SEC to approve all Bitcoin ETFs.

Despite the urgency of major financial firms, the SEC appears to continue delaying its approval of Bitcoin ETFs until 2024, which could negatively affect investor sentiment and price movements in the crypto market.

Bitcoin Adoption Will Drive the Rise

The Bitcoin price continues to be directly influenced by macroeconomic events, and it is likely to remain somewhat affected by further regulatory action and interest rate increases. The latest CPI data and the upcoming FOMC minutes to be released on August 16 may provide insight into whether the Federal Reserve will continue its aggressive interest rate policies.

Zachary Townsend, CEO of Meanwhile, provided insights into how macro events could affect the current Bitcoin price movement:

“The lower-than-expected CPI last week was somewhat surprising, especially considering the recent rise in energy prices due to summer travel and resulting demand. However, the fact that prices are still falling indicates to me that the Fed may become more concerned about economic growth and may move away from interest rate hikes, especially if signs of economic slowdown begin to emerge. We may see interest rate cuts earlier than expected. This will certainly be positive for Bitcoin and other risky assets.”

In the long term, market participants expect the Bitcoin price to recover, especially due to the increasing adoption of BTC by more financial institutions.

Bit coin