The king cryptocurrency unit reached $45,879, marking its first peak of 2024 and the best price in the last 21 months. Investors became confident months ago that the bear market had ended, and Bitcoin‘s price easily surpassed tough resistances. Surprise breakouts brought massive gains to bold investors. So, what was the reason for the rise in crypto?

Why Is Bitcoin (BTC) Rising?

Bitcoin (BTC), seeing its best price since April 2021, continues to rise due to several factors. Rumors that the US Securities and Exchange Commission would greenlight ETFs before the official approval process starting on January 4th excited investors. CME Bitcoin futures data clearly shows the strong bullish expectation of institutions.

As of today, the CME price is trading with a $1,300 premium. Since the BTC price has reached these figures for months, we could see prices around $47,000 in the short term. This interest from the CME side also reflects the expectation that the BTC price will approach $50,000 in the coming days and weeks.

The ongoing buying appetite at the current premium price is fueled by “the time has come” type of statements from spot Bitcoin ETF issuers.

Cryptocurrencies, BTC Commentary

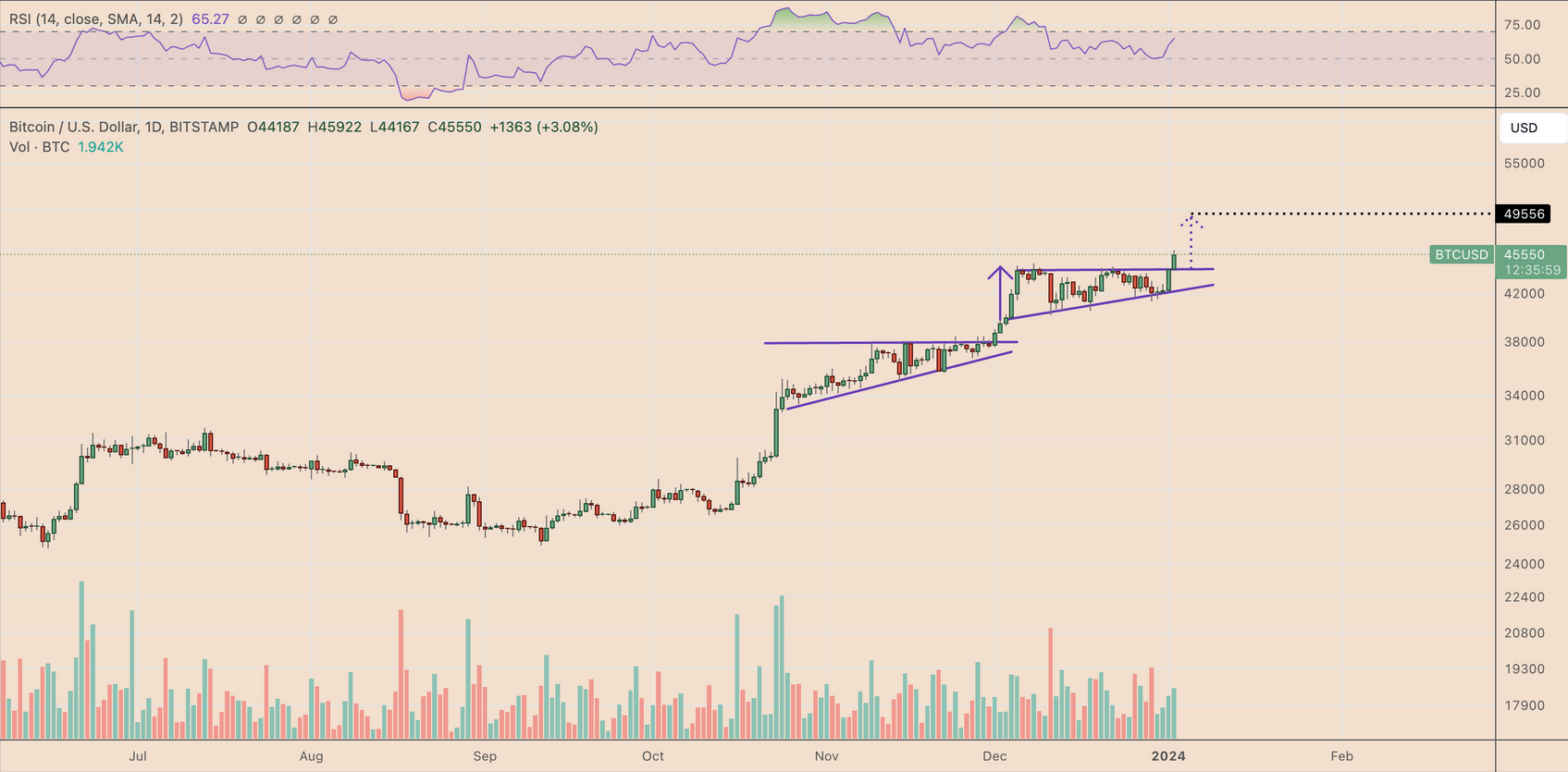

Net flow to exchanges turned negative again today for BTC. For spot exchanges, a lower net flow also emphasizes the buying pressure mentioned above. On the technical side, the BTC price is feeling the support of the rising triangle formation. As of January 2nd, BTC’s price entered the breakout phase of the rising triangle formation and is now targeting $50,000.

Considering the increased appetite of investors, the technical breakout, rising volumes, and potential issuers counting down to ETF approval, we should see the continuation of the rise in crypto.

If the BTC rally gains momentum, it will put some pressure on altcoins, but once it consolidates at higher levels, altcoins could again capture gains of over 100% monthly as they did in the past weeks.

There are two things that investors need to be on the lookout for. The first is last-minute announcements from the SEC regarding official approval, and the second is the increased volatility at the opening of Asian markets every morning.