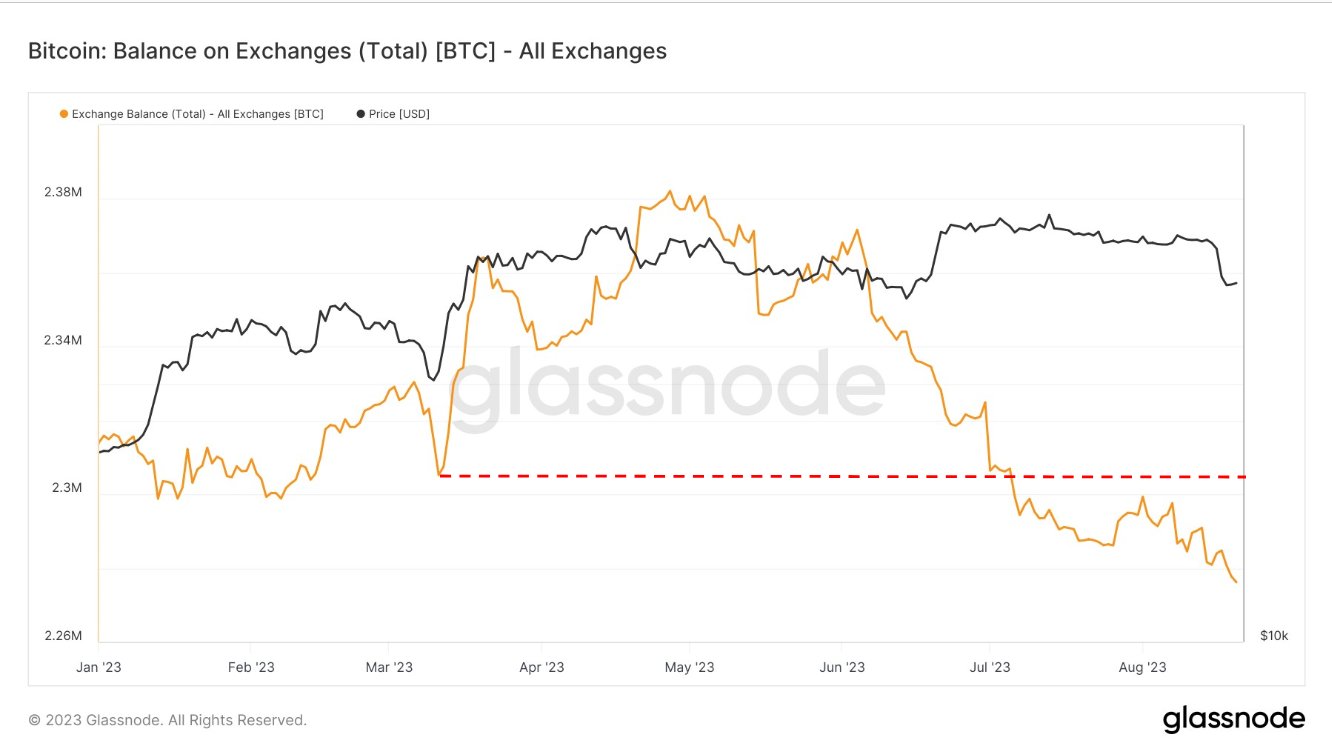

When the price of Bitcoin (BTC) shows a sudden and sharp decline, numerous theories emerge. Among the common events are government regulations, the possibility of exchanges manipulating prices, Bitcoin whales manipulating prices, and some conspiracies involving overleveraged investors and Tether (USDT).

Reasons for the Decrease in Cryptocurrencies!

Between August 15 and August 18, the price of Bitcoin experienced a significant 12% decrease. This event followed a familiar pattern that gave rise to various reasons put forward by analysts and experts. Due to the decentralized nature of cryptocurrencies and the lack of transparency between exchanges, confirming whether a particular asset affects price movements continues to be a challenging task.

Ceni, one of the founding partners of Ceni Capital, made a partially accurate prediction on August 11. Ceni predicted that the decision of the U.S. Securities and Exchange Commission (SEC) to delay the approval of the Ark Bitcoin ETF would result in a Bitcoin price below $29,000.

However, it is important to note that the prediction did not specify the timing of this event or the exact support level. As a result, the statistical basis of this hypothesis may become less certain. Nevertheless, Ceni claims that BlackRock could be a sign of Bitcoin’s collapse, and this claim guarantees a comprehensive investigation.

The idea that BlackRock could benefit from a lower Bitcoin price before launching a spot-based Bitcoin ETF is not as straightforward as it seems. While the concept of a lower Bitcoin price leading to increased profitability in ETF launch may be intuitive, there are several reasons why it may not align with BlackRock’s broader interests.

Possible Price Impact of BlackRock!

BlackRock has gained a reputation as a respected financial institution due to its commitment to market stability and investor confidence. A sudden and significant decrease in the value of Bitcoin could undermine the overall credibility of the cryptocurrency market, which BlackRock aims to avoid. Prioritizing the preservation of market legitimacy may outweigh the instant gains from a low Bitcoin price.

Secondly, obtaining regulatory approval, especially in the field of cryptocurrencies, could play a critical role in the launch of any financial product. The SEC carefully evaluates the potential for market manipulation and measures for investor protection. Engaging in activities that could be interpreted as price manipulation could jeopardize BlackRock’s chances of obtaining regulatory approvals for its ETF offerings.

Lastly, establishing investor confidence is of great importance when launching any investment product, especially a new product like the Bitcoin ETF. A sharp decrease in Bitcoin prices could undermine not only investor confidence in the asset class but also in the ETF. Therefore, BlackRock’s interest likely lies in launching the ETF during a positive period when investors have confidence in its future earning potential.