One of the main concerns for institutional investors is the implementation of comprehensive regulations in this field. Many financial institutions are unable to offer crypto services to their customers because the regulations have not yet come into effect. Moreover, this regulatory uncertainty puts extra pressure on the market, which was the reason why market makers fled from exchanges in May.

European Union Crypto Rules

The EU has made significant progress in terms of crypto regulations, surpassing many regions around the world. While the US is still trying to pass laws through committees, the EU has reached the final stages with MiCA. These regulations are crucial for protecting investors from risks in the crypto field. However, this protective shield has not been fully activated yet.

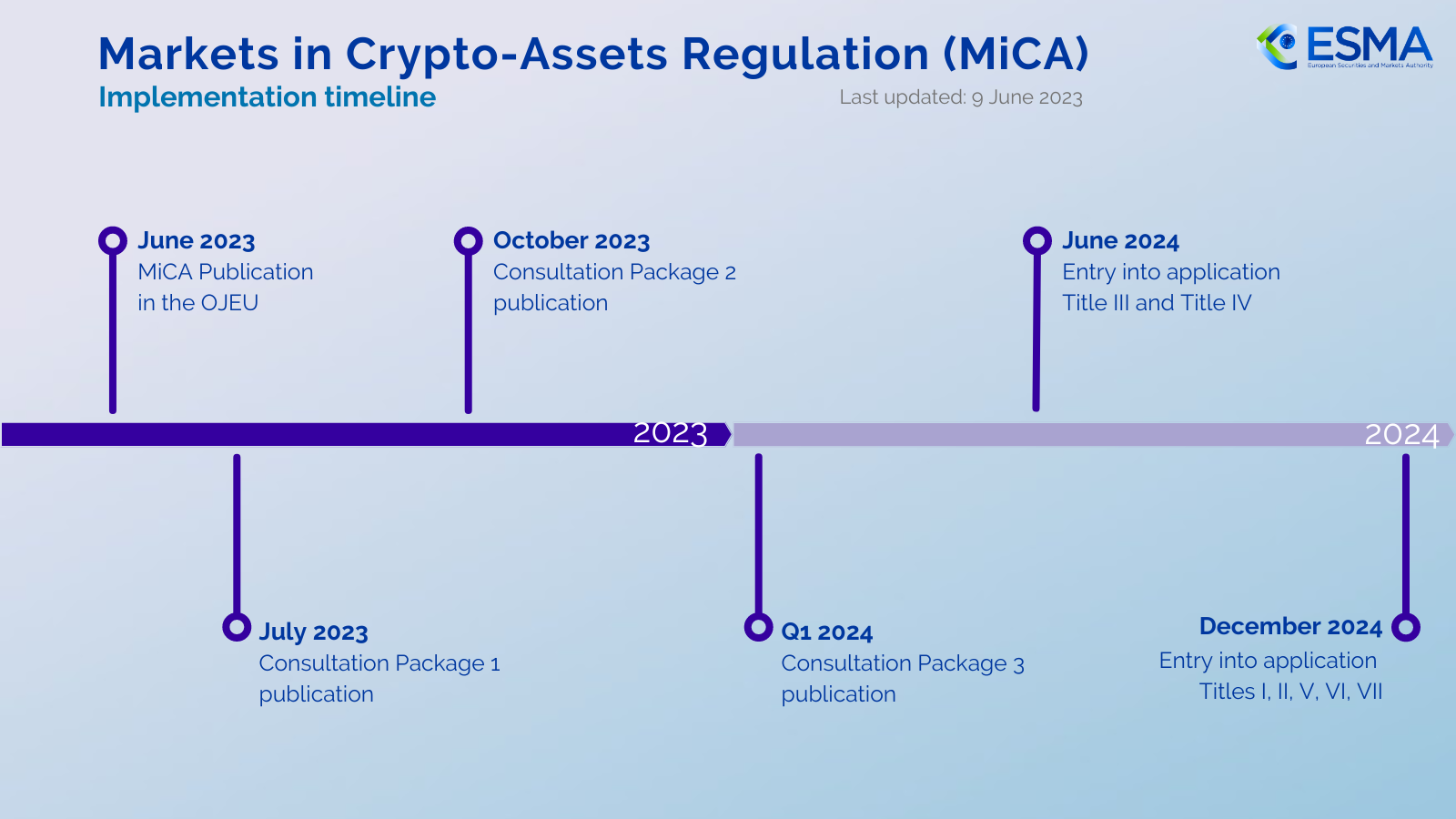

The European Securities and Markets Authority (ESMA), the securities regulator of Europe, has made an important announcement regarding the regulation known as the Markets in Crypto-Assets Regulation (MiCA). This announcement indicates that full protection will be activated at a later date than expected by investors.

When Will Crypto Regulations Take Effect?

ESMA stated that the rules, known as MiCA, which aim to protect investors, will not come into effect until at least December 2024. While making this announcement, investors were advised to be prepared to lose all the money they plan to invest in crypto.

“During this period, crypto asset holders and crypto asset service providers will not be able to benefit from any regulatory and supervisory safeguards at the EU level, such as the ability to lodge formal complaints against NCA [National Competent Authorities].”

It was also warned that complete protection will not be possible between December 2024 and 2026. After MiCA becomes applicable to crypto asset service providers towards the end of 2024, member states plan to provide an additional “transitional period” of 18 months that allows crypto service providers to operate without a license.

ESMA emphasizes that even when the rules are fully implemented, it will not guarantee a completely safe environment.

“ESMA reminds crypto asset holders and crypto asset service providers that MiCA does not address all the various risks associated with these products. Many crypto assets are inherently speculative.”

Türkçe

Türkçe Español

Español