Today, we can say that the wind of Render (RNDR) is blowing among artificial intelligence coins. Not only did RNDR perform better than its peers in its field today, but it also showed a more impressive rising trend than most other alternative cryptocurrencies.

Render Ecosystem to Launch a New Launchpad

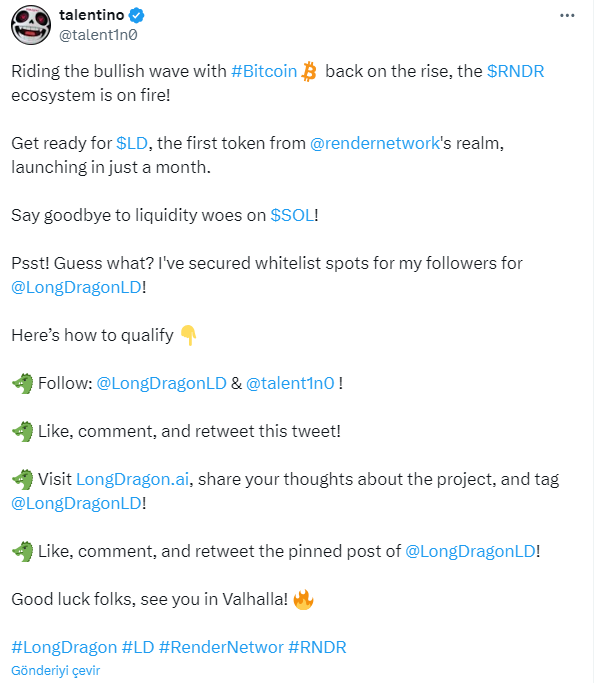

In the last 24 hours, the price of Render has increased by 10% and nearly 12% compared to last week. The ecosystem announced a new launchpad. Render is preparing the ground for the launch of the Long Dragon launchpad, which will simplify the participation process for emerging Web 3.0 projects.

The Long Dragon launchpad will meticulously evaluate projects and may even purchase a portion of their funding rounds. The platform has a user-friendly structure that will attract both Web 2.0 and Web 3.0 investors.

Render’s Long Dragon will offer the opportunity to stake with its native or booster token, LD. This will allow token holders and stakers to compete in the same market as whales and benefit from the advantages of scale. These advantages include higher yield opportunities, access to top-tier presales, the best airdrops, and market-making opportunities.

In addition to staking, other uses of the LD token include farming, governance, investment opportunities, and access to all features of the Long Dragon ecosystem. The token will also be used to encourage user participation in the ecosystem and reward them.

Render Price Rises Amid Launch Excitement

Render’s price has experienced a strong breakout by moving above the declining trend line over the past few weeks. This breakout was confirmed with a higher peak. Additionally, the Awesome Oscillator (AO), a lagging momentum indicator, has moved into the positive zone, signaling a potential rise. This breakout was further strengthened by the Relative Strength Index (RSI) entering the region above the average level of 50.

With the RSI showing rising momentum, the Render price is currently moving towards the $10.10 resistance level. However, surpassing this level could also mean crossing the $11.00 psychological resistance level. In this case, a price increase of over 10% could occur. If the price continues in this direction, the next resistance at $10.50 could be tested. A close above this level could accelerate the price to higher levels, potentially aiming above $13.00.

However, if profit-taking occurs, a pullback in the price could be observed. Dropping below the $8.00 level could be concerning for long-term investors and could lead to a declining trend formation. However, the bullish trend would only be invalidated with a close below $7.44.