As the cryptocurrency market continues its months-long decline, draining liquidity, investment companies are keeping a tight grip on their funds. In the bull season, billion-dollar valuations were commonplace, but now, even a few million dollars of funding from giant companies makes headlines. Amid the bear season, a $20 million investment announcement for three altcoins is not a negligible figure.

Reserve’s Investment Announcement

Reserve, a stablecoin protocol, has announced on June 20, it invested $20 million in the governance tokens of yield farming applications Curve (CRV), Convex (CVX), and Stake DAO (SDT). This investment aims to enhance the liquidity of the stablecoins named RTokens by Reserve. Furthermore, it will increase Reserve’s voting power within these applications’ governance systems.

Reserve is a stablecoin protocol allowing users to create their coins supported by any asset they desire. Electronic USD (eUSD), High-Yield USD (hyUSD), Reserve (RSV), Reserve Dollar (RSD), and ETH+ are examples of stablecoins created through Reserve.

Before this announcement, Reserve was the seventh-largest holder of Convex tokens following Mochi, Redacted, JPGd, Badger, Clever, and FRAX. The protocol has earned these tokens comprehensively using Convex to provide returns for its users.

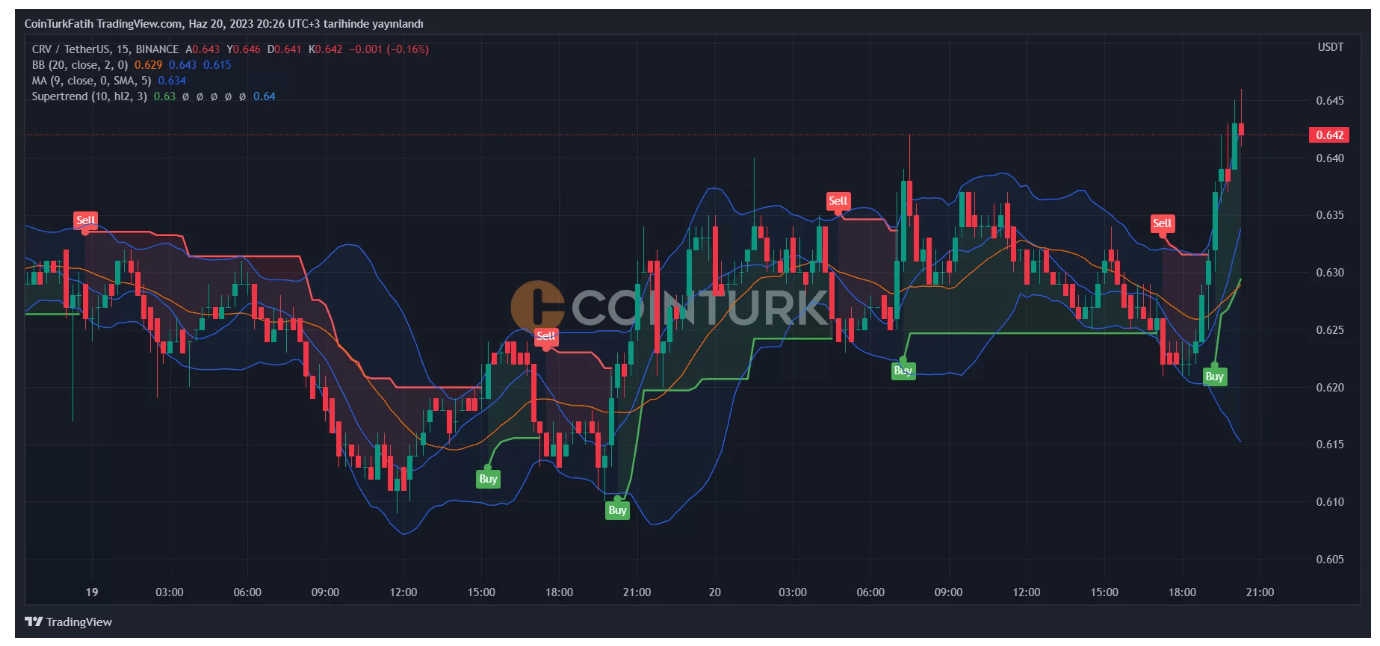

CRV Coin Review

Since CRV reached its lowest level in a year on June 15, the $20 million investment might be heartening news for CRV token holders. After the announcement, even though the candles have just started to turn green, it might initiate a real recovery in the coming days.

CRV price, which surpassed $6 in January 2022, made new lows in June and December 2022. Over-liquidation risks due to CRV collateralized loans triggered excessive sales in this popular altcoin several times. We saw similar FUD this month, and the CRV price dropped to $0.56.

In the short term, if the resistance in the range of $0.66-68 is overcome, we may see the price recover to $0.76. The price was finding buyers in this area before the downturn on June 10. As Bitcoin prepared to test the $27,500 level for the second time when this article was written, investors reducing altcoin risks due to the SEC lawsuit might have made the right move, as the rising BTCD suggests.

Türkçe

Türkçe Español

Español