Terra Classic (LUNA) and TerraUSD (USTC) have taken a significant hit in the past few years following the stablecoin’s depegging. This event sparked a catastrophic bear market whose effects are still visible. However, Binance, the world’s largest cryptocurrency exchange, recently made an announcement that provides hope for a trend reversal.

Terra’s Challenging Journey

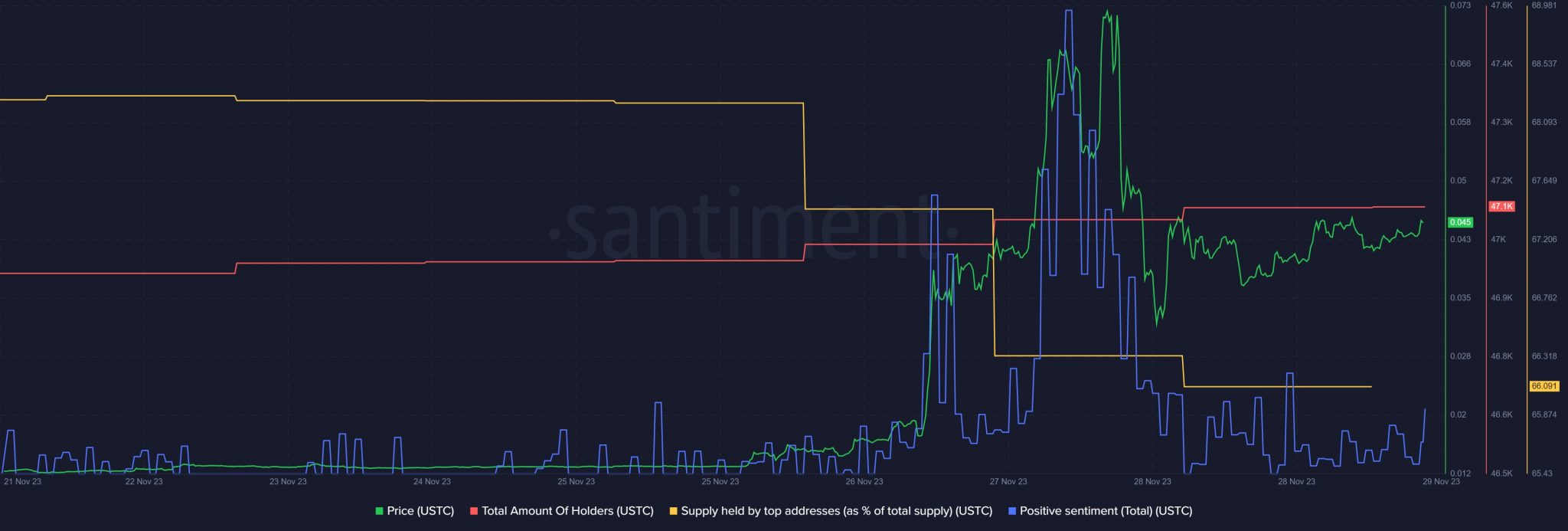

TerraUSD lost its peg to the dollar in May 2022, causing an explosion in the entire crypto market. Not only did the Terra ecosystem tokens plummet, but top tokens like Bitcoin and Ethereum were also hit hard. Since that period, the entire Terra ecosystem, including LUNC, has been struggling. However, things might look different for Terra in the coming months due to a significant announcement by Binance. Binance futures introduced the USD-M USTC perpetual contract with leverage of up to 50 times on November 27, 2023.

At the launch, the maximum funding rate for the USTC/USDT perpetual contract was either +2.00% or -2.00%. This helped Terra ecosystem tokens, including USTC and LUNC, gain momentum. According to CoinMarketCap, USTC had increased more than 36% in the last 24 hours. At the time of writing, it was valued at $0.05032 with a market capitalization of over $451 million.

LUNC Price Analysis

The positive sentiment towards the cryptocurrency resulted in increased confidence among general investors, clearly seen in the rise in total holder numbers. However, recent analyses revealed that whales might not have much confidence in USTC, as the supply held by top addresses has decreased in the near past.

Likewise, Terra Classic initiated a promising bull rally. LUNC also displayed a commendable performance with a double-digit price increase in the near past. LUNC surged over 23% in just the last 24 hours. At the time of writing, it was trading at $0.0001194 with a market capitalization of over $394 million, making it the 71st largest cryptocurrency.

- Binance’s new leverage contract offers hope.

- LUNC and USTC gain momentum after the announcement.

- Whales show mixed signals on confidence in USTC.

Türkçe

Türkçe Español

Español