Bitcoin miner Riot Platforms, according to its latest annual report, mentioned that the ongoing chip shortage, the need to continuously increase hash rate, and the deepening climate-friendly agenda in the United States could potentially affect its balance sheet. Riot, one of many Bitcoin mining companies preparing for the upcoming halving event, highlighted over 13 key risks to future Bitcoin mining profitability in its February 23 annual 10-K filing, which includes a section on risk factor disclosures.

Riot and Crypto Mining Challenges

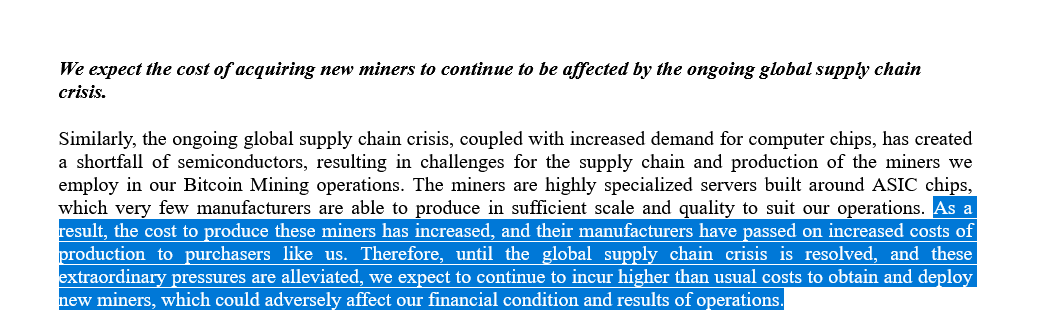

One of the risk factors Riot emphasized was the ongoing global chip crisis, as only a few manufacturers can produce the highly specialized ASIC chips they rely on. The Riot team stated in the report:

“The ongoing global supply chain crisis, combined with increasing demand for computer chips, has created a shortage in semiconductors.”

In December, Riot purchased 66,560 miners worth $291 million from manufacturer MicroBT. According to the company’s CEO Jason Les, this was recorded as the largest hash rate order in the company’s history. Riot expects to continue paying higher than normal costs to acquire and set up mining machines until the chip shortage crisis is resolved, as mentioned in its latest annual report.

Riot also noted that even with access to ASIC miners, they could still face design flaws. The company explained that in the past, they experienced software and firmware complications while trying to adapt their miners to work in cooled environments and that similar issues could arise in the future.

Meanwhile, Riot mentioned that the increasingly competitive sector poses a risk; this means the company must continue to increase its hash rate to maintain market share as the global hash rate rises. The team added:

“We believe that to compete in this highly competitive sector, we will need to continue acquiring new miners to increase our hash rate to replace losses due to normal wear and tear and other damages, as well as to keep up with the increasing global network hash rate.”

Noteworthy Comments from the Riot Team

Meanwhile, Riot also pointed out that Bitcoin faces significant scaling barriers that could prevent it from becoming a widely accepted payment method. According to the Riot team, demand for Bitcoin could stagnate or decrease, which could negatively affect Bitcoin’s price and thus weaken Riot’s balance sheet.

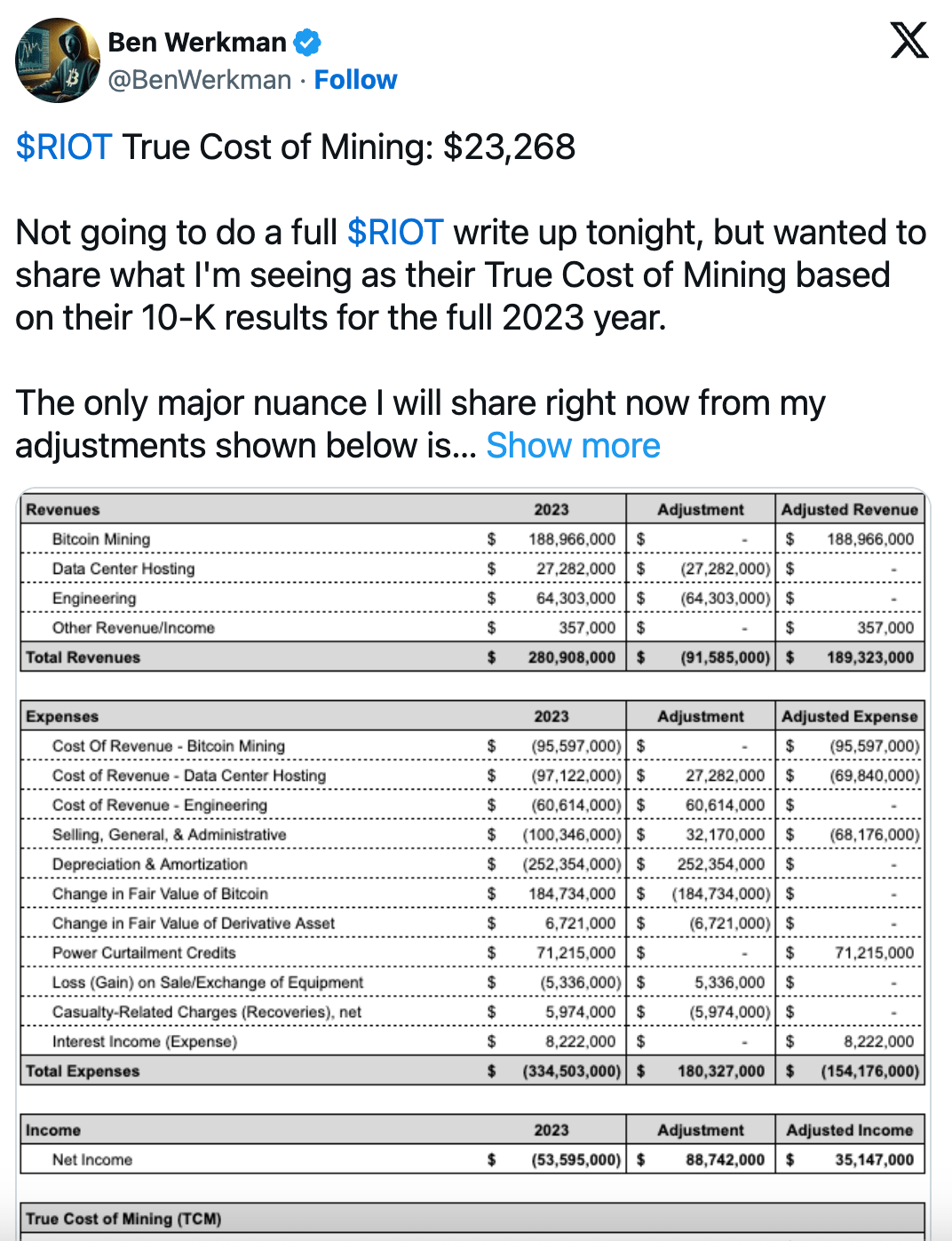

In addition, Riot increased its Bitcoin production by 19% in 2023, mining a total of 6,626 bitcoins valued at $341.4 million at current prices. The company’s average cost for Bitcoin mining in 2023 also decreased by 33%, dropping to $7,539.