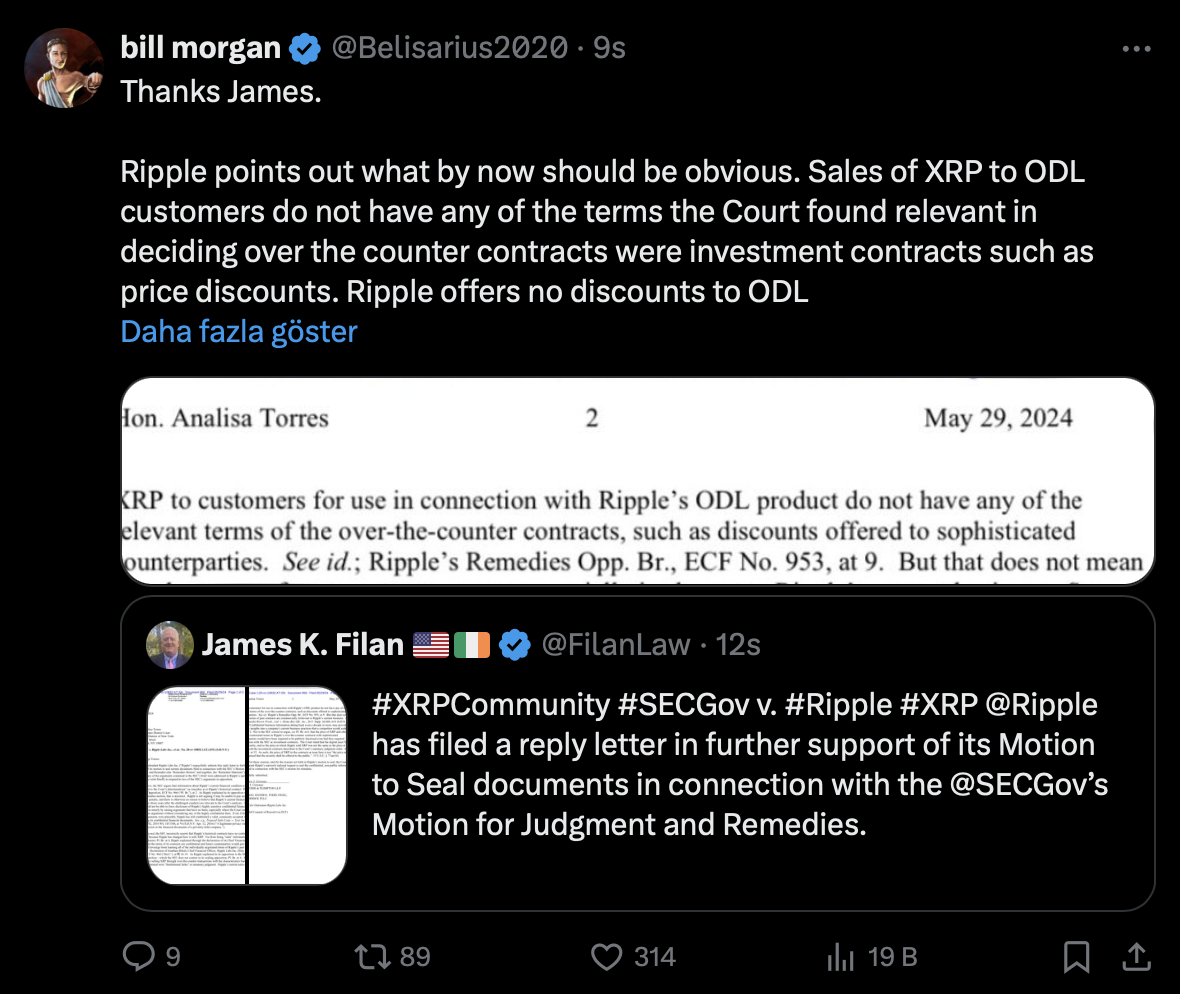

San Francisco-based Blockchain company Ripple recently submitted a response letter supporting the SEC’s request to seal documents related to jurisdiction and settlement proposals. This ongoing legal battle is closely watched due to its significant impact on Ripple, XRP, and the broader cryptocurrency market.

Ripple’s Current Token Sales Practice

Ripple emphasized in its filing that it no longer sells XRP tokens through over-the-counter (OTC) transactions. The company stated that current XRP sales are directed towards customers using Ripple’s On-Demand Liquidity (ODL) product. These sales do not include discount conditions, which were previously referenced by the court in determining such contracts as investment contracts.

Legal analyst Bill Morgan commented on Ripple’s statement, noting it as a significant rebuttal to the narrative that Ripple suppressed XRP’s price by selling large amounts at discounted rates to individual investors. Morgan highlighted that Ripple’s sales to ODL customers do not include any discounts, which should alleviate concerns about market manipulation. This clarification aims to dispel fears and doubts by explaining that ODL sales are structured differently from previous OTC transactions.

Impact of the Development on XRP’s Price

Despite these statements, XRP continues to underperform compared to Bitcoin (BTC) and the rest of the altcoin market. Ripple’s claim that ODL sales have a neutral effect on XRP’s price suggests that the company’s current sales practices do not contribute to the altcoin’s underperformance.

This underperformance may be due to various other market factors, but Ripple’s statements aim to distance its sales practice from contributing to negative price movements.

In its letter to the court, Ripple also argued that its current financial statements should not be relevant to the court’s analysis. While the company does not claim it cannot pay potential fines and penalties, it argues that disclosing sensitive financial details could harm its business without providing necessary context for the court’s decision. Ripple insists that these financial details should remain confidential to protect its commercial interests.

SEC, on the other hand, is pressing for comprehensive disclosure of Ripple’s XRP sales, revenues, and current assets. The US regulatory body argues that this information is crucial for the case, but Ripple contends that such a level of transparency is excessive given the current circumstances, claiming that disclosing such sensitive information could negatively impact its business operations and market position.