Since the end of 2020, Ripple continues its struggle with the SEC and it seems unlikely that the case will conclude before 2026. SEC lawsuits pose a threat to all cryptocurrencies by attempting to classify them as securities. What were the latest statements from Ripple’s CEO?

Statements from Ripple’s CEO

Ripple CEO Brad Garlinghouse recently joined Chris Vasquez on the World Class podcast. He commented on potential US actions against a stablecoin issuer. The Biden administration’s anti-crypto stance is hardening as the November elections approach.

“The US Government will go after Tether. It’s very clear to me. I see Tether as a very important part of the ecosystem, and I am confident in my assessment of its impact on the rest of the ecosystem.”

A Case Against Tether?

Tether has faced regulators multiple times before. Most recently, it resolved many issues following the conversion of its reserves into cash equivalents. However, reports that USDT is being used by terrorist organizations and individuals sanctioned by the US have stirred concerns recently. Similarly, last year, a strong political block claimed that crypto played a significant role in financing terrorist organizations.

In April, US Deputy Treasury Secretary Adewale Adeyemo testified before the Senate Banking Committee that sanctioned countries benefited from Tether.

“We have seen Russia increasingly turn to alternative payment mechanisms, including the stablecoin tether, to circumvent our sanctions and continue financing its war machine.”

Amid these concerns, Tether frequently facilitates law enforcement’s work in every crypto case, from freezing assets to identifying resources.

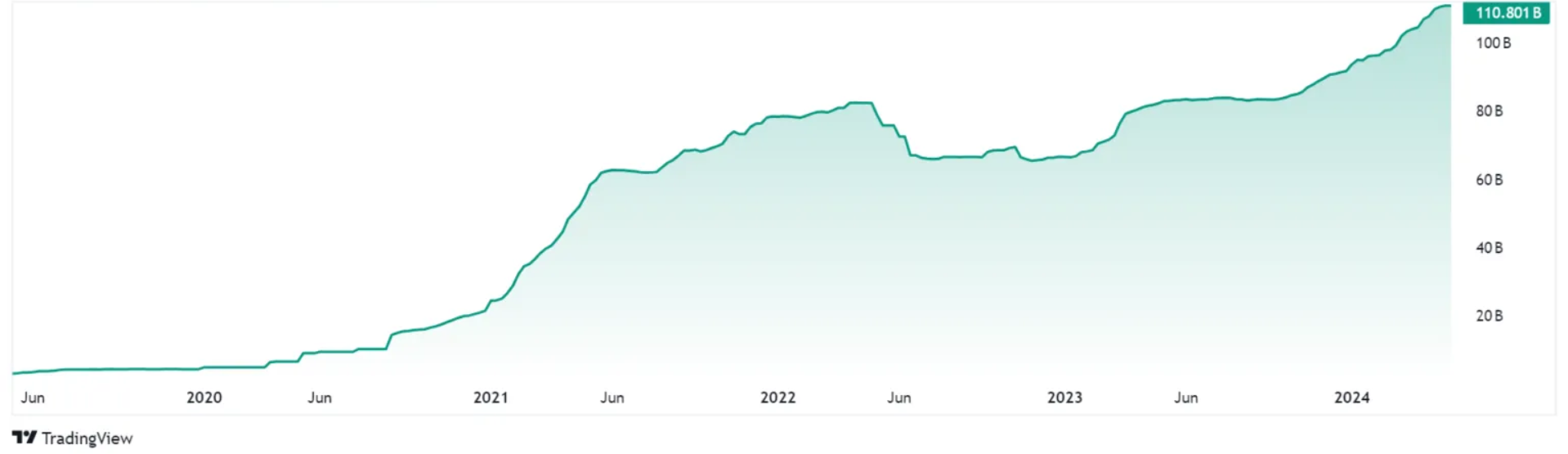

Tether’s USDT, with a circulating supply of approximately $110 billion, leads the market in value and generated over $4.5 billion in net profit in the first quarter.

Bitcoin price was at $61,100 at the time of writing, and the market has not yet been overwhelmed by more FUD for Tether.

Türkçe

Türkçe Español

Español