For years, Ripple has been fighting the SEC and still has not reached a conclusion in the lawsuit that began at the end of 2020. We know that the SEC and Ripple have allocated a massive amount of resources to this case, and the decision will affect not only XRP Coin but also the broader altcoin market. Just a moment ago, Ripple’s Chief Legal Officer lashed out at a senior SEC official. So, what did he say?

Comments from the SEC Official

The SEC’s Enforcement Division Director Gurbir Grewal made a 15-minute long statement targeting cryptocurrencies. His statement from yesterday drew criticism from many quarters. Where do we remember this name from? Of course, from his comments at the end of 2022, suggesting that “cryptocurrencies are facing tough legal challenges.” Grewal lived up to his threats, turning 2023 into a nightmare for crypto companies.

Grewal criticized crypto companies for trying to circumvent the institution through various backdoors instead of complying with the rules.

“Over the past decade, we have faced significant non-compliance and many creative attempts by market participants to avoid our jurisdiction; some go so far as to claim that we make up rules, regulate the industry with sanctions, and others recklessly overstep our authority. At the same time, we are accused of picking winners and losers, stifling innovation, and directing crypto businesses to more favorable foreign jurisdictions regardless of their location.”

The problem is that two of the five SEC members (Peirce and Uyeda) were accusing their institution of exactly these issues in an article we detailed weeks ago. So, the SEC needs to address these internal criticisms first.

Comments from the Ripple Executive

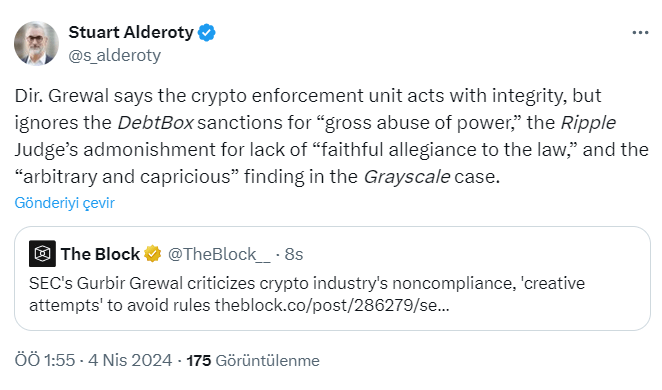

Those following the Ripple case know Stuart Alderoty well; he is the company’s Chief Legal Officer/Advisor and just now fiercely responded to the latest SEC statements. In his remarks, he addressed the SEC’s lawlessness and arbitrary actions.

“Director Grewal claims that the crypto enforcement unit acts with integrity, yet he ignores the sanctions for “gross misuse of authority” by DebtBox, the Ripple Judge’s warning about “not adhering to the law,” and the judiciary’s comments on the “arbitrary and capricious” stance in the Grayscale case.

Substantively, he refers to a part of the Ripple decision but overlooks the fact that the SEC lost or abandoned most of its claims in the case, including the Court’s rejection of the SEC’s claim that XRP itself is a security.

If this Agency truly wants to honestly repair the institutional harm it has caused to itself and the industry in its misguided war against crypto in recent years, it must lay down its arms and accept these truths.”

Türkçe

Türkçe Español

Español