Ripple (XRP) has been engaged in a tough battle with the SEC for months, which has led investors to be cautious about XRP. However, Ripple continues to find ways to attract attention, the latest being its partnership with the Bank for International Settlements (BIS). The newly announced partnership also highlighted the potential of the XRP rally, which was already showing signs of a small increase at the time of writing.

New Partnership from Ripple!

On August 20th, Ripple was announced as an official partner of the “cross-border payments interoperability and expansion task force,” a subgroup of the BIS Committee on Payments and Market Infrastructures. This happened just a few days after MasterCard CEO announced that the company would partner with several Blockchain/Web3/payments players, including Ripple, for its CBDC partnership program.

The aforementioned updates have made XRP a topic of discussion in the cryptocurrency space as social metrics have increased. According to LunarCrush, XRP’s social engagement and social dominance have increased by 42% and 63% respectively in the past seven days. Moreover, the sentiment around the token has also increased by about 60%. The rising sentiment indicated that investors were expecting an increase in the value of XRP. However, this sentiment has not yet been reflected in the token’s price chart.

Potential Effects on XRP!

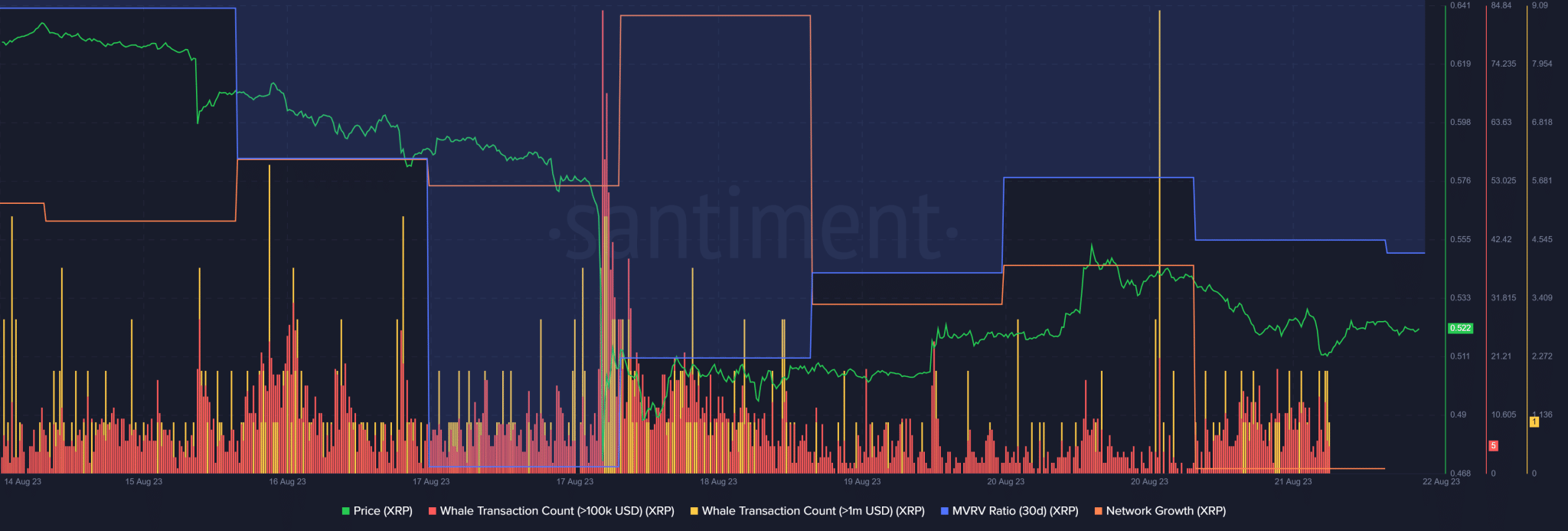

According to CoinMarketCap, XRP has experienced a decrease of more than 1% in the last 24 hours. At the time of writing, it was trading at $0.5201 and had a market value of over $27.4 billion. However, some metrics supported the possibility of an upward trend. Whale activity was particularly high around XRP. Additionally, the token’s MVRV Ratio has shown improvement in the past few days. However, network growth declined last week. Although the MACD indicated a downward trend, it also suggested that bulls could soon regain control.

XRP’s relative strength index (RSI) was near the oversold zone, which could increase buying pressure and therefore increase the token’s value. Additionally, the Chaikin Money Flow (CMF) moved away from the 0 neutral mark, showing a slight upward trend and further increasing the likelihood of a price movement to the north.

Türkçe

Türkçe Español

Español