Ripple’s Chief Technology Officer (CTO) David Schwartz, in a series of new tweets, is revealing surprising facts about the intricacies of the company’s XRP assets. Schwartz also sheds light on Ripple’s original plan for managing this digital asset.

The Structure of Ripple’s XRP Assets

Ripple’s XRP assets are divided into two different categories. These are XRP held in wallets and XRP locked in escrow accounts. The latter is being released into the market gradually each month. It is noteworthy that a significant portion of the released XRP has consistently been returned to escrow in past events.

Responding to a tweet by a user named “Mr. Huber” about Ripple’s XRP distribution, Schwartz explains the options the company faces in managing its XRP assets. According to him, Ripple is faced with a binary choice: either continue holding the current volume of XRP or initiate a reduction in XRP holdings. He emphasizes that there is no third option in this scenario.

Schwartz sheds light on Ripple’s original plan aimed at accelerating the reduction of its XRP holdings. However, considering the current landscape, he sincerely admits that he cannot envision any reasonable sequence of events that would make this initial plan feasible. Even in a hypothetical scenario where this could happen, Schwartz is skeptical about the tangible benefits such an approach would provide.

Exploring Strategies: From Giveaways to Partnerships

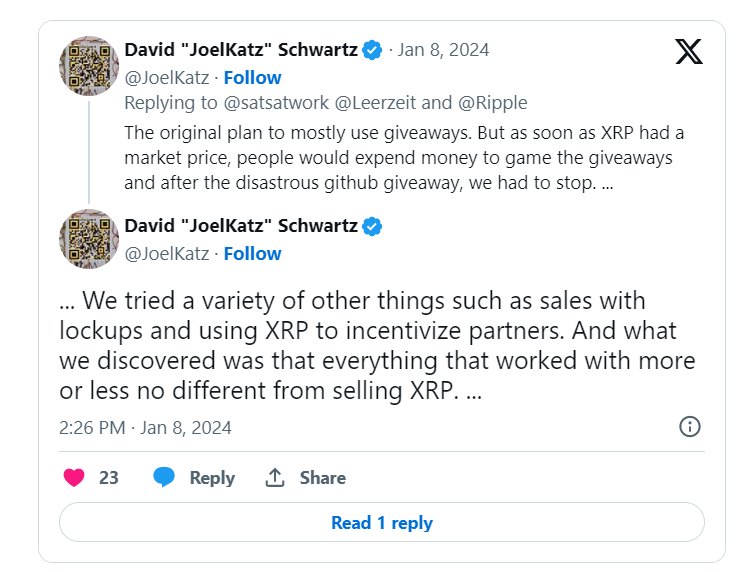

As Schwartz points out, the initial plan involved using giveaways to reduce the supply of XRP. However, with the emergence of a market price for XRP, individuals began using giveaways for personal gain, which led to difficulties with this approach. As a result, this method had to be stopped.

Ripple explored alternative strategies such as locked sales and using XRP as an incentive for partners. However, Schwartz notes that almost everything explored turned out to be equivalent to selling XRP.

A Decade-Long Journey: Ripple’s Progress

Schwartz offers a look at Ripple’s journey, acknowledging that the company is now more than a decade into what was initially conceptualized as a five-year plan. Despite being more than halfway through, Ripple’s approach and ability to adapt to market dynamics continue to be fundamental elements of its ongoing strategy.

In response to user questions about the possibility of burning the supply in escrow, Schwartz continues to exercise caution. According to him, burning the escrowed supply does not make sense. He also clearly rejects such an idea.

Türkçe

Türkçe Español

Español