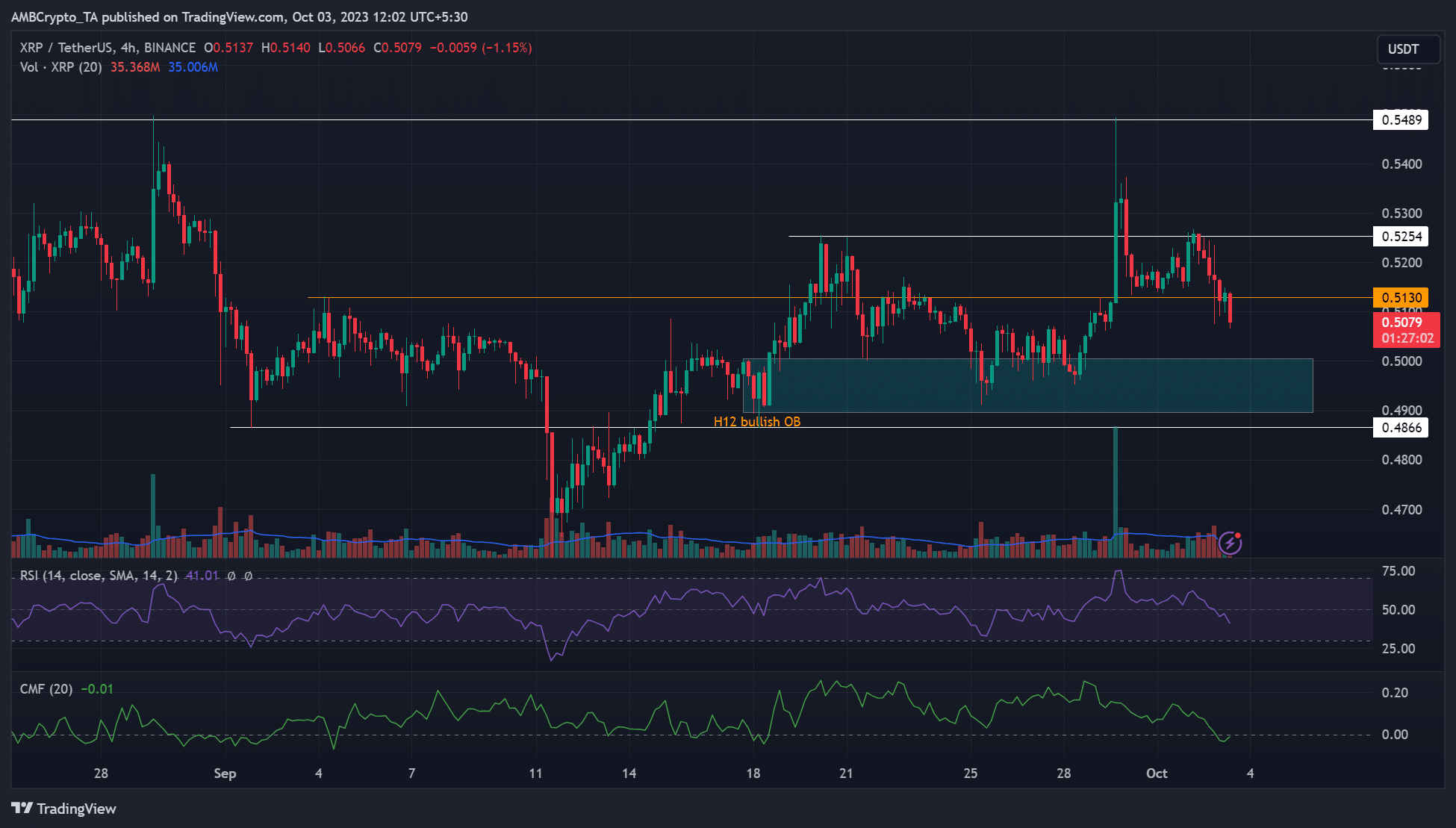

Ripple (XRP) sellers gained more market leverage at the end of September. Sellers pushed XRP below $0.513 from $0.548. The decline showed that sellers made more than 6% of their short sales gains according to the $0.507 value.

The Future of XRP Price!

To confirm whether a recovery or a pullback movement is likely, the focus is on whether BTC can defend the mid-range around $27.1k. In a previous XRP price analysis, it was predicted that a daily drop order of $0.54 could take the upward efforts out of the trend. The prediction was confirmed and allowed sellers to gain more advantage in lower time frames.

Cryptocurrency retreated extended on a 4-hour time frame broke the level of $0.5130. This move could encourage sellers to extend their gains to the H12 uptrend OB between $0.489 and $0.500 US dollars.

Therefore, if XRP cannot reclaim $0.513, short-term bulls may mark the H12 uptrend OB between $0.489 and $0.500 as a key level. If the pullback extends to the uptrend OB, the next target levels to follow in the short term could be $0.513 and $0.525.

XRP Technical Data

In addition, the RSI falling below the level of 50 highlighted the underlying long-term selling pressure seen in the past few days. Similarly, the CMF pulled southward and broke the zero threshold. This situation may indicate a significant amount of capital outflow during the same period.

The long-term price decline further weakened the XRP market and turned the accumulated swing index (ASI) negative, as shown. ASI follows the strength of price volatility, and a negative value may indicate a downward trend in long-term price movement as of the date of writing.

However, the recent movement of CVD, which showed no market advantage for either sellers or buyers. In addition, investors may follow the movement of BTC to reduce risk due to the quiet demand indicated by the reduced open interest rates.