Ripple’s (XRP) price appears to be reaching a point where the recent pessimistic sentiment is largely dissipating. It is anticipated that in the future, most XRP holders will prefer to keep their assets or try to initiate a buying spree to stave off a bear market.

XRP Investors Show Patience

A decline in XRP price was expected due to sales by Ripple, as it was moving within a bearish outlook.

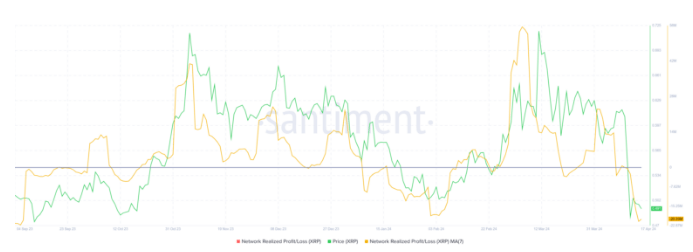

However, during this period, investors demonstrated resistance by refusing to sell their XRP holdings. The network’s realized profit/loss indicator shows that investors have largely incurred losses following the price drop.

Such situations typically lead to accumulation or HOLD scenarios. This occurs because investors prefer to avoid joining the network rather than accepting their losses.

This existing resistance situation is further highlighted by the Average Coin Age (MCA) indicator. This indicator reveals the average age of all coins in a cryptocurrency network, helping to understand the network’s activity level and its potential market movements.

An increase in this indicator suggests that investors are holding onto their assets, while a decrease reflects potential sales, i.e., XRP being moved between addresses. Such resistance could direct investors towards a bullish trend and potentially drive the price upwards.

XRP Price Outlook

The recent decline in XRP price was considered part of a descending triangle model associated with a bear market. As predicted by the model, a potential 25% price correction could have dropped the XRP token’s price to $0.42. However, contrary to this, the altcoin ended its decline at $0.47.

As of writing, the altcoin is trading at $0.4963, currently 13% above the expected bearish target. On the other hand, the XRP price is only 13% away from regaining the significant resistance/support level of $0.60.

XRP has fallen to the 7th position in market rankings following recent declines. The market cap at the time of writing was over $27 billion, while the 24-hour trading volume had decreased by 2.6%, amounting to $1.8 billion.

Türkçe

Türkçe Español

Español