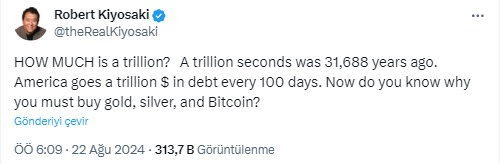

Bitcoin, altcoin, and silver purchase recommendations come with important warnings from a well-known figure. We are talking about Robert Kiyosaki. According to the famous name, the rapidly increasing US debt could be a harbinger of a financial collapse. Kiyosaki emphasized that the US borrows one trillion dollars every 100 days and advised investors to invest in valuable metals like Bitcoin, gold, and silver.

US National Debt is Rapidly Increasing

The US national debt continues to rise rapidly. Robert Kiyosaki, author of ‘Rich Dad Poor Dad,’ stated that the US borrowed an additional trillion dollars in just 100 days. Kiyosaki expressed that this situation could lead to a financial crisis and that investors should turn to safe havens like Bitcoin.

In March, Bank of America analysts warned that the US would borrow one trillion dollars every 100 days. Following the warning, Bitcoin’s value rose above $60,000, and its market value exceeded one trillion dollars again. Bank of America’s chief strategist Michael Hartnett emphasized that the rapid increase in US national debt would push the value of investment vehicles like gold and Bitcoin to the peak.

Other Experts Also Warn About Debt Increase

Kiyosaki is not alone in his concerns about this debt increase. Wharton Business School finance professor Joao Gomes also agrees. Gomes noted that the growing US debt could lead to a financial crisis as early as 2025 and that the next administration would be significantly affected by this situation. Additionally, Nassim Taleb, author of ‘The Black Swan,’ argues that the US economy is in a “death spiral” and that Congress’s constant raising of the debt ceiling is worsening the situation.

The American national debt has exceeded 35 trillion dollars according to the latest data. According to the Peter G. Peterson Foundation, the main reasons for this debt increase include an aging population, rising healthcare costs, and an inadequate tax system. It is particularly emphasized that the Covid-19 crisis has already put the US on an unsustainable financial path.

In light of these developments, the price of gold has reached an all-time high of $2,494, while Bitcoin is trading at $61,095. As the rapidly increasing US debt continues to shake financial markets, investors are forced to turn to safe havens.

Türkçe

Türkçe Español

Español