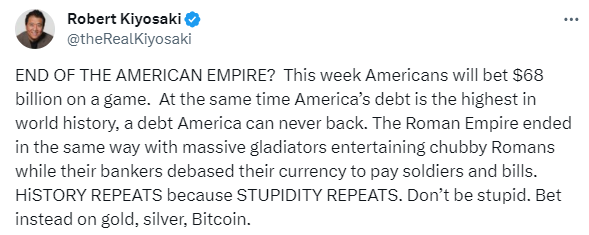

Famous investor and bestselling author of the personal finance book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, continues to voice his concerns about the trajectory of the American economy. He emphasizes the urgent need for strategic investments to protect against potential collapses. In a post on platform X, Kiyosaki’s views draw historical parallels, comparing the current state of the US to the fall of the Roman Empire.

Historical Echoes: America’s Twilight Years

Using the fall of the Roman Empire as a backdrop, Kiyosaki points to the historical tendency of great powers to face similar challenges during their twilight years. He observes the prevalence of extravagant displays and the increasing burden of debt in both scenarios in the US.

Kiyosaki suggests that similarities emerge when considering the currency devaluation witnessed during the fall of the Roman Empire to meet military and financial obligations.

America’s Debt Dilemma

Kiyosaki’s views gain significance as Americans prepare for the Super Bowl, where significant betting interest lies. This highlights the ironic spectacle of a nation grappling with unprecedented levels of debt indulging in lavish entertainment. The finance educator emphasizes that “history repeats itself when folly prevails.”

To guide investors towards more informed choices, Kiyosaki recommends against traditional investments and advocates focusing on tangible assets with enduring value. According to him, gold, silver, and Bitcoin (BTC) continue to be the best options for protection against economic uncertainty and currency devaluation.

Cautious Message for Bitcoin Investment

Kiyosaki’s cautionary message comes amid signs of positive recovery in the US economy, with slowing inflation and job creation exceeding analysts’ expectations. However, he rejects the idea that the economy is truly growing and claims that only ‘fools believe the economy is strong.’ Kiyosaki states:

“Fools really do believe the economy is strong. Don’t be deceived. The Magnificent Seven (Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla, and Meta) financed by US government dollars, are keeping the stock market afloat. Please be careful. The stock and bond markets are about to collapse.”

Meanwhile, Kiyosaki maintains his optimism about Bitcoin, highlighting its potential as an asset for protection against inflation, alongside silver and gold. He has previously expressed his bullish prediction for Bitcoin, suggesting that the cryptocurrency could surpass the $100,000 mark by the year 2024.

Türkçe

Türkçe Español

Español